Enrollment Guide

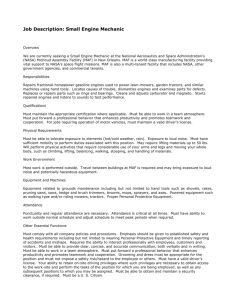

advertisement