Executive Summary

advertisement

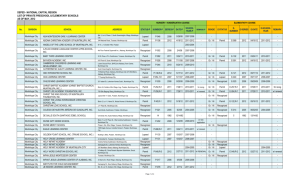

EXECUTIVE SUMMARY Introduction The City of Muntinlupa became an urbanized city by virtue of Republic Act No. 7926 dated March 1, 1995. Before its transformation to what is today a bustling city, it was a village now known as “Poblacion” which later was joined by other barrios to become the town of Muntinlupa. In 1901, Muntinlupa became one of the towns of the Province of Rizal. In 1918, Muntinlupa became an independent town by virtue of Executive Order 108 dated December 19, 1917. Muntinlupa’s mission is to pursue an integrated and sustainable development strategy, anchored on responsible stewardship, democratic institutions and efficient and effective management which will provide world class infrastructure and support services to promote a broad economic base, create a business-friendly environment, institutionalize community participation, provide quality social services, and ensure equity in the distribution of goods and services. During the CY 2013, the City of Muntinlupa has been ruled by two administrations due to the election in May, 2013. The City Mayor from January to June 30, 2013 was Mayor Aldrin San Pedro and the present Local Chief Executive is Mayor Jaime R. Fresnedi. A total of 3,178 personnel are employed by the City as of December 31, 2013 composed of the following: Elected Officials Permanent Casual/ Contractual/consultant Total 20 464 2,694 3,178 Major Accomplishments during the year include the construction of SAGIP and Red Cross Building located at Women’s Center, Filinvest, Alabang, costing P15,565,412.64, construction of Road Rip-rap and Fence at Laguerta, Tunasan, amounting to P17,430,545.50, construction of Cupang High School, in Cupang, in the total amount P21,971,886.57 and various asphalting and repair of roads. The enactment of City Ordinance No. 13-003 dated August 5, 2013 on tax amnesty effective August 1 to December 31, 2013, has increased the collections of Real Property and Special Education Taxes, net of discount by P109.78 million. The City’s increased collections of P72.33 million on business permits may also be due to the “One-StopShop” scheme in the processing of permits. i The financial condition and result of operation of the economic enterprises operated by the City are as follows: Economic Enterprises Muntinlupa City Public Market Ospital ng Muntinlupa Pamantasan ng Lungsod ng Muntinlupa Muntinlupa City Technical Institute Financial Condition Total Government Total Assets Liabilities Equity Total Income Total Expenses Net Income 22,812,322.05 65,090,707.80 5,193,322.85 17,618,999.20 Result of Operation 57,288,978.69 7,801,729.11 168,689,365.46 56,388,114.69 112,301,250.77 276,031,251.55 227,175,229.60 48,856,021.95 64,549,762.75 15,551,928.05 8,531,003.51 12,862.50 48,997,834.70 84,650,935.80 80,261,387.58 4,389,548.22 8,518,141.01 727,600.00 123,049.99 604,550.01 Highlights of Financial Operation For Calendar Year (CY) 2013, the appropriations of the City Government of Muntinlupa for the General and Special Education Funds totaled P 6.345 billion. Obligations charged against these appropriations amounted to P 2.475 billion. Fund Appropriation Obligation General Fund Current Appropriation Continuing Appropriation Sub-total P 2,992,500,000 3,037,022,945 6,029,522,945 P 2,236,645,428 2,236,645,428 Special Education Fund Current Appropriation Continuing Appropriation Subtotal Total 315,230,731 315,230,731 P 6,344,753,676 238,365,851 238,365,851 P 2,475,011,279 The operating income of P2.827 billion collected during the year was sourced from the following: Particulars Local Taxes Internal Revenue Allotment Permits and Licenses General Fund P 1,303,963,855 575,564,982 192,339,833 ii Special Education Fund P Total 318,705,426 - P 1,622,669,281 575,564,982 - 192,339,833 Service Income 57,503,475 Business Income 219,597,503 Other Income 157,902,358 Total Operating Income P 2,506,872,006 P 1,162,901 319,868,327 57,503,475 219,597,503 159,065,259 P 2,826,740,333 Scope of Audit The audit covered the accounts and operations of the City of Muntinlupa for the year ended December 31, 2013. The objectives of the audit are to: (a) verify the assurance that may be placed on management’s assertions on the financial statements; (b) recommend agency improvement opportunities; (c) determine compliance with existing rules and regulations; and (d) determine the extent of implementation of the prior year’s audit recommendations.. Audit Opinion on the Financial Statements The Auditor rendered a qualified opinion on the fairness of presentation of the financial statements due to errors and deficiencies that misstated the affected account balances, discussion of which are included in Part II of the report and summarized as follows: Obs. Nature of Errors No. 1 Unrecorded book reconciling items 4 Inclusion of the value of burned properties 6 Negative balances of receivables and payables accounts 11 Outright expense of supplies inventory Total Total Assets % of Errors to Total Assets Amount and % of error to Effect on the FS Account Balance Cash in Banks accounts 32,990,729 8.62% Property, Plant and 74,268,935 2.83% Equipment Receivables and 15,430,726 8.96% Payables 11,675,885 2.07% Inventory accounts 3,177,062 5.65% 137,543,337 4,297,411,041 3.20% Account/s Affected In addition, the following deficiencies were also noted and added to the unreliability of the affected account balances: Obs. Nature of Deficiency/ies Accounts Affected No. 2 Discrepancy between the GL balance of Cash in Cash in bank accounts Bank – LCCA and cashbook 3 Unliquidated Cash Advance Cash and Receivable accounts 4 Unvalidated existence of PPE due to failure to PPE accounts complete Physical Count Unreconciled PPE accounts with Inventory Report PPE accounts 5 Unreconciled balance and without details Asset accounts Liability accounts 7 Dormant accounts in Other Payables Other Payables 8 Unreliable set-up of RPT & SET Receivables Real Property Tax iii Amount Involved 42,953,970 (88,577,394) 1,026,549,793 179,068,542 392,985,211 9,584,172 47,678,903 718,391,117 9 Receivable Special Education Tax Receivables Due from Other Funds and Due to Other Funds Expense accounts Unadjusted balance in the reciprocal accounts 10 Improper charging of various expense account to Other MOE 11 Outright expense of supplies inventory Inventory accounts 12 Improper charging of MMDA share to Membership Dues and Membership Dues and Contributions to Contributions to Organizations account Organizations account 12 Overdeduction of the 5% MMDA share Expense account 398,781,355 6,804,033 54,966,189 3,177,062 83,340,000 2,943,376 For the above errors and deficiencies, we recommended that management: On the unrecorded book reconciling items: • • • • Management cause the revision of the stale checks and adjust the books to reflect the correct account balance considering the requirement in Section 59, Volume I of the NGAS. The City Accountant secure credit and debit advices/memos from the bank for recording purposes. The concerned officials of Ospital ng Muntinlupa submit the DVs, missing payroll and supporting documents to the City Accounting Office. Treasurer’s Office coordinate and work closely with Accounting Office to ensure that all financial transactions are promptly and properly recorded and reported in the financial statements. On the PPE accounts: • • • • Complete the additional requirements for their Request for Relief from Accountability for the properties destroyed by fire. Conduct a complete physical inventory of the City’s property. Require the disposal team to take charge of the property/assets subject for disposal and prepare the Inventory and Inspection Report of Unserviceable Property (IIRUP) for semi-expendable materials and equipment and non expendable supplies and recommend the most appropriate mode of disposal given the condition of the assets. Require the Procurement Officer to maintain equipment and real property cards and post/record existing City’s unrecorded property as well as subsequent acquisitions. On the negative subsidiary ledger balances: • City Accountant analyze the accounts with negative balances and effect the necessary adjustments to establish the correct and accurate balances of the Receivable and Payable accounts at year-end. iv On the outright expense of supplies inventory and maintenance of subsidiary ledger cards: • • • The Accounting Office to record the purchase of office supplies, materials and other supplies as inventory following the perpetual inventory method. The Accounting Office to maintain SL for supplies and material and record acquisition and issuances thereof. The SLs be maintained for each inventory item/account. Head of the Procurement Office maintain the stock cards pursuant to Section 114, Volume I of the NGAS Manual, consolidate approved Requisition Slip (RIS) and prepare/submit the SSMI to the Head of Accounting Office for monitoring and recording purposes. Reconcile their records regularly. On the discrepancy between the GL balance of Cash in Bank – LCCA and cashbook: • • City Treasurer instruct the City Cashier to exert effort to reconcile the cashbooks with accounting records as well as the BRS at the end of each month in order to present the correct Cash in Bank balance of the City Government which is vital in decision making. City Treasurer request to City Personnel Office to assign additional employees to his office to facilitate the said reconciliation. On the unliquidated cash advance: • • All concerned accountable officers and employees be required to immediately settle their outstanding cash advances. Management undertake full and comprehensive evaluation of these outstanding cash advances by applying all possible remedies to enforce liquidation and settlement and substantiate any possible resolution in accordance with existing laws, rules and regulations. On the unreconciled balance and without details: • • • The City Accountant analyze the pertinent accounts marked “for reconciliation” and make the necessary verification against previous financial reports and schedules. Coordinate with the City Legal Officer and exhaust all possible legal means to collect the receivables from employees/debtors of the City. Render a report on payables without valid claims and cause reversion to the Government Equity. On the dormant accounts in Other Payables: • City Accountant review and analyze the composition of the Other Payables account, exert effort to produce the documents to support the dormant accounts, and if proven to be without valid claims, prepare the corresponding adjusting entries, as appropriate. v On the unreliable set-up of RPT and SET Receivables: • City Treasurer should coordinate with the City Assessor to come up with a certified list of taxpayers and the amounts of tax due and collectible for the subsequent year and furnish the same to the City Accountant as basis in setting up the RPT/SET Receivables and Deferred RPT/SET Income. On the reciprocal accounts: • Accounting Office periodically review and analyze all prior and current year’s transactions involving reciprocal accounts and effect adjustments in the respective books of accounts. On the Other MOE account: • • Chief Accountant ensure that the updated description of accounts under the NGAS be strictly implemented. Any correction/adjustment in the records of the Accounting Office which will require the corresponding adjustment in the appropriate Registry of Appropriation, Allotment and Obligation (RAAO) shall be coordinated with the City Budget Officer. On the over-deduction and improper charging of MMDA share: • • Stop the use of Membership Dues and Contributions to Organizations account and instead, record the contributions to MMDA to its proper expense account, Subsidy to NGAs. Make representation with MMDA for reconciliation of their records to recover the over-remittance made. Other Significant Observations and Recommendations 1. Delayed submission of reports and transaction documents – up to 277 days (Observation No. 13, page 55) We have recommended that the City Treasurer, City Accountant and other concerned officials submit transaction documents within the prescribed period as provided under Sections 6.03 COA Circular No. 95-006 and Section 70, Volume I of the NGAS Manual for LGUs. Likewise, we request for the immediate submission of the unsubmitted documents to the Office of the Auditor. 2. Documents required to complete technical review of contracts not submitted P88.300 million (Observation No. 14, page 57) We have recommended that the City Mayor instruct the concerned City Engineer to comply with the submission of the required documents pursuant to Section 4(6) of PD vi 1445 and in order to complete the technical review and evaluation of the identified projects. 3. Disbursement vouchers not submitted for audit - P26.089 million (Observation No. 15, page 58) We have recommended that the City Mayor require the Head of the Accounting Office to cause the submission of the above paid vouchers and to strictly comply with the provisions of COA Circular Nos. 2009-006 and 95-006 dated September 15, 2009 and May 18, 1995, respectively and Section 100 of Presidential Decree No. 1445. 4. Non-preparation of the Local Disaster Risk Reduction Management Fund Investment Plan (LDRRMFIP), inadequate supporting documents for expenditures charged to the Local Disaster Risk Reduction Management Fund (LDRRMF) –P3.882 million and non-classification of the unexpended balance of the LDRRMF under the Trust Liability – DRRM in the Trust Fund book – P61.204 million (Observation No. 16, page 60) We have recommended that Management concerned strictly follow the guidelines outlined under COA Cir. No. 2012-002 dated September 12, 2012 on the accounting and reporting of its Local LDRRMF. 5. The amount appropriated for Gender and Development (GAD) for the year 2013 was deficient by P2.000 million. Likewise, the agency failed to submit the GAD accomplishment and utilization report for CY 2013. (Observation No. 17, page 63) We have recommended that management: • Strictly comply with the 5% mandatory appropriation for GAD, wherein the basis of computation is the total appropriation for the year. • Require the GAD Focal Point to prepare the GAD accomplishment report in order to monitor the implementation of the GAD Plan and GAD related program/activities and projects. • Require the City Accountant to submit GAD utilization report and the nature for which GAD fund was expended. 6. The releases of the barangay shares from Real Property Tax (RPT) collections of P121.435 million for the first, second and third quarters of 2013 were delayed by 3 to 151 days while the barangay shares in 2013, 2012 and 2011 in the total amount of P4.655 million were still not released as of December 31, 2013. Moreover, accounting records showed four barangays with unreconciled amount totaling to a negative P.207 million. (Observation No. 18, page 64) vii We have recommended that the City release the barangay shares from the RPT collections within the prescribed period as provided under Section 271(d) of RA 7160. Likewise, we recommended that the City Accountant adjust /reconcile the shares of the four barangays with a total negative balance of P207,086.28 and record the cost of electric bills of barangay streetlights deducted from the barangay shares to establish the correct balance of the Due to LGUs account (418). 7. Payments for the garbage collection and disposal services were processed and paid despite the lack and insufficiency of documents in violation of Section 4(6) of P.D. 1445, thus, the validity and regularity of the transaction could not be ascertained. (Observation No. 19, page 66) We have recommended that management submit bidding documents and additional documentary requirements provided under COA Circular No. 2012-001 dated June 14, 2012 to avoid suspensions of the transactions. Also, include the detailed breakdown of the ABC and contract amount to determine the reasonableness of the contract price. 8. Non-revision of the Schedule of Fair Market Value for real property (Observation No. 20, page 68) We have recommended that the – a. City Assessor undertake the general revision of real property assessments once every three years pursuant to Section 212, 219 and 220 of RA 7160 and recent directive from Department of Finance and Department of Interior and Local Government to ensure that the bases for the collection of RPT and SET are current and realistic that may afford the City of additional income to finance its various programs, projects and activities. b. City Council facilitate the enactment of an ordinance of the SFMVs of real property that will serve as a basis in the general revision of real property assessment and classification. 9. Forgone income from business permits and licenses - P1.658 million (Observation No. 21, page 71) We have recommended that the personnel tasked in the assessment of business taxes and licenses verify the accuracy of the gross receipts being declared by the contractor/supplier of the City. Likewise, conduct the review and examination of books of accounts and records of businesses operating in the City as provided for under Section 171 of R.A. 7160 and authorized under Section 172, Title VI of the City’s Revenue Code. We also enjoined the Chief, Business Permit and Licensing Office (BPLO) to conduct thorough tax mapping of all businesses operating in the City to come up with correct viii business taxes due and demandable that could have finance more City Projects. For those contractors/suppliers of the City Government, the Chief, BPLO should request from the City Accountant/City Treasurer the amount of payments made by the City to them as basis in the assessment of their business taxes. 10. The duties and responsibilities of the consultants were not indicated in the contract of services and their accomplishment reports were not submitted. Moreover, payments to consultants were recorded in the books as Salaries and Wages – Contractual (Code 706) instead of Consultancy Services (Code 793). (Observation No. 22, page 73) We have recommended that the City indicate the duties and responsibilities of the consultants in the contract of service as required under the CSC Resolution. Likewise, require the submission of accomplishment reports for proper evaluation and record the payment under Consultancy Services. 11. Audit of Salaries and Wages – Contractual (Code 706) account disclosed: (a) Personnel hired under Contract of Services/contractual employees were appointed/ designated as department heads and to other various career positions contrary to Section 15, Rule XIII, of the CSC Revised Omnibus Rules on Appointments; and (b) Payments of salaries and wages under contractual/ or contract of services amounting to P20.663 million were recorded under the Consultancy Services (Code 793) account instead of Salaries and Wages – Contractual (Code 706), while, some payrolls were paid without the certification and approval of the authorized City officials. (Observation No. 23, page 74) We have recommended that the City Accountant review thoroughly the recording of transactions to avoid error/or misclassifications of accounts resulting in the misstatements of the account balances in the financial statements. Moreover, entries in the Journal Entry Vouchers should be correctly recorded and posted to the appropriate GLs and subsidiary ledgers. Likewise, ensure that all claims are supported with complete documentations. 12. Transportation allowances were granted to City Officials in spite of the assignment of motor vehicles for their use in the performance of their official functions. (Observation No. 24, page 76) We have recommended that Management stop the granting of transportation allowances to City government officials and employees who are assigned government vehicles in compliance with the provisions of Local Budget Circular No. 79, 102 and COA Circular No. 2000-005 dated April 1, 2005 January 17, 2013 and October 4, 2000, respectively. Require the said City government officials and employees to refund the transportation allowances granted to them during the year. The City Accountant should ensure that Transportation Allowance is not given to those who were issued government vehicles. ix 13. Honoraria totaling P4.431 million were granted to officers and members of various special committees the function of which were inherent to the regular functions of the City. (Observation No. 25, page 78) We reiterated our previous recommendation that payment of honoraria to officers and members of the committees performing functions inherent to their regular duties and responsibilities be stopped. The officers and members of said committees should be required to refund the honoraria paid to them. 14. Payments to service providers not subjected to withholding tax – P117.358 million (Observation No. 26, page 80) We have recommended that the Accounting Office ensures that the required and appropriate withholding taxes are deducted before making payments to service providers and utility companies in accordance with the above-mentioned provisions and the same are remitted to the BIR within the prescribed period. 15. Audit suspensions and disallowances amounting to P72.490 million and P1.853 million, respectively, remained unsettled as of year-end. (Observation No. 27, page 81) We recommended that management enforce the immediate settlement of suspensions and disallowances in accordance with Section 7.1.1 of COA Circular No. 2009-006. Henceforth, ensure that government auditing rules and regulations are strictly complied with before effecting payment to minimize suspensions and disallowances in audit. Status of Implementation of Prior Years’ Audit Recommendations Of the 22 audit recommendations contained in the 2012 Annual Audit Report, two were fully implemented, 16 were partially implemented and four were not implemented. x