Myanmar's Garment Industry is rapidly gaining Dynamic

advertisement

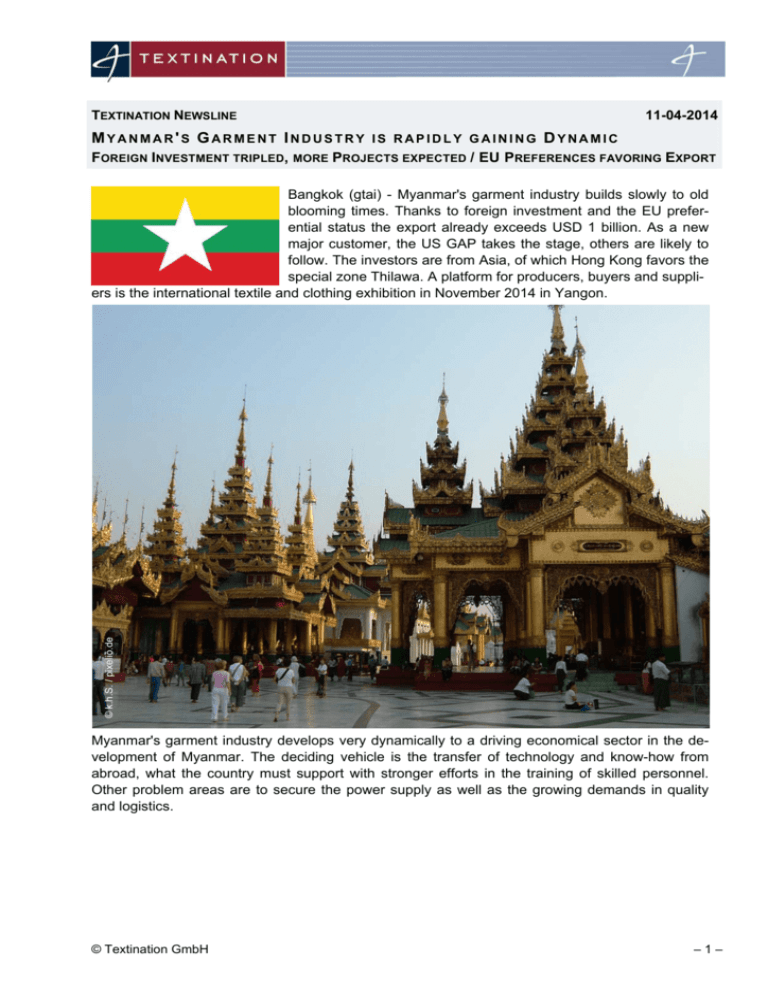

TEXTINATION NEWSLINE 11-04-2014 MYANMAR'S GARMENT INDUSTRY IS RAPIDLY GAINING DYNAMIC FOREIGN INVESTMENT TRIPLED, MORE PROJECTS EXPECTED / EU PREFERENCES FAVORING EXPORT © k.h.S. / pixelio.de Bangkok (gtai) - Myanmar's garment industry builds slowly to old blooming times. Thanks to foreign investment and the EU preferential status the export already exceeds USD 1 billion. As a new major customer, the US GAP takes the stage, others are likely to follow. The investors are from Asia, of which Hong Kong favors the special zone Thilawa. A platform for producers, buyers and suppliers is the international textile and clothing exhibition in November 2014 in Yangon. Myanmar's garment industry develops very dynamically to a driving economical sector in the development of Myanmar. The deciding vehicle is the transfer of technology and know-how from abroad, what the country must support with stronger efforts in the training of skilled personnel. Other problem areas are to secure the power supply as well as the growing demands in quality and logistics. © Textination GmbH –1– But the concept seems to work. Foreign direct investment tripled in fiscal year 2013/14 (April / March) to USD 4.2 billion with 123 projects. According to the Investment Agency DICA these were mainly manufacturing companies and mostly in the clothing industry. The Myanmar Garment Manufacturers Association (MGMA) predicts a foreign involvement of USD 1.5 billion by 2015. The Myanmar Investment Commission announced for the second half of 2014 the approval of six new factories with investments of USD 10 million each. In the last eight months of 2012 19 foreign companies have been established, including Costic International, Honeys Garment Industry, Nadia Pacific Apparel, Manufacturer GFT Enterprise, JS filter, Euro Gate Sports Goods, THY Garment, Shinsung Tongsang Inter, Korea Link Industrial and Mac Do. More newcomers are Jiangsu Garments Group, Dong Fang Star Garment Factory, Manufacturing SDI, Solamoda Garments Group, Kamtex, Richest Time, Sinobest Brothers, Archid Garment, Slita and North Star Manufacturing. Dynamic export in the billions Analog the clothing industry provides the largest contribution in the export statistics of the manufacturing sector. According to the customs department the export improved by 27% to USD 885 million in the fiscal year 2013/14, representing a share of almost 8%. According to the International Trade Center (based on Comtrade) the value of exports exceeded already USD 1 billion and has thus tripled since 2010. Also the MGMA estimates the export value to http://myanmargarments.org/media-room/export-data/ USD 1.1 billion. The Swiss strategy consulting company Impact Economy believes in an export value of over USD 6 billion in a few years as possible. The main export countries are Japan and Korea (Rep.), while the PR of China follows dynamically. As future rich new markets Brazil, Argentina, South Africa and Turkey are seen. Germany has imported goods with EUR 56 million from Myanmar in 2013 (+ 25%), EUR 47 million (+ 20%) of it accounted for clothing. For the EU as a whole an import value of EUR 131 million (+ 17%), was reached, also here clothing was the largest import group with a share of 59%. © Textination GmbH –2– © wolfish. / pixelio.de An important reason for the new export dynamic in the direction to Europe lies in the inclusion of Myanmar in the Generalized Scheme of Preferences (GSP) of the EU since 2013. The GSP frees Myanmar as a Least Developed Country (LDC) from customs duties and other import taxes. And these tax incentives make the location for investors from Asian countries so interesting - mainly from Korea (Rep.), SVR Hong Kong, PR of China, Japan and Thailand. Large cost advantage, low added value Thailand's market research institute Kasikorn Research sees the attractiveness of the location Myanmar especially in the low labor cost. In particular in comparison to other cheap production countries, such as Vietnam, Laos or Cambodia, there is a significant labor cost advantage. The main problems KResearch sees in the incomplete value chain as well as in the shortage of skilled workers. Potential investors when deciding should take the strengths and weaknesses profile of the industry and the associated opportunities and risks into account (SWOT analysis): Strengths Weaknesses Great work potential Shortage of power supply Low wage level High energy cost Relatively good level of education Expensive and ineffective logistic International competitiveness Low training capacity Lack of bank financing Opportunities Threats Generalized Scheme of Preferences (GSP) of the EU. Problems when operating larger order volumes. Improvement of the infrastructure Conservation of competitive prices in the long run are difficult Ongoing government reform policy Compliance with international quality standards Development of Human Ressources On time delivery Increasing attractiveness for foreign investors Technologically Myanmar's garment industry is limited to the functions of cutting, skilled sewing and packing (CMP - "cutting, making, packaging"), while the larger part of the added value is made in the neighboring countries. The sector was founded in the early 1990s and produced in addition to clothing products various other articles such as shoes, hats, socks, rubber boots or hair nets. © Textination GmbH –3– With the onset of the US economic sanctions in 2003 the industry shrank from 400 to around 130 companies, the employment dropped from 400,000 to 100,000 people. About the current situation quite different information exists. The professional association MGMA is counting about 200 member companies with approximately 20,000 employees, as it is published on the website of this year's trade show. Nationally, according to Impact Economy approximately 350 companies exist. Taking into account all small and micro enterprises, the sector employs approximately 150,000 people. http://myanmargarments.org/media-room/factory-zones/ A new "cluster" grows in the together with Japan established special economic zone Thilawa. Here the Hong Kong Apparel Society secured with 200 ha half of the terrain, where a dozen Hong Kong clothing manufacturers will create about 30,000 jobs until the end of 2015, with an investment of at least USD 3 million each. The land lease will be annual USD 52 million for a contract period of 50 years. Nationwide a total of 30 clothing manufacturers from Hong Kong are said to be engaged, mainly thanks to the wage advantage of USD 100 to 120 a month compared to up to USD 600 $ in Guangdong. © Dachkammer. / pixelio.de Countrywide settlement proceeds Regionally the settlement is concentrated in greater Yangon, mainly due to the logistic advantages of the nearby harbor infrastructure. MGMA considers the employment density here as already overflowing, therefor new allocations are preferred in other regions - especially since 90% of the workers are coming from such areas and the land leases have strongly increased. In this context 50 new businesses are planned in Pathein, Ayeyarwady Region.The first factory was taken into operation by the Delta Industrial Group in May 2013. The market entry of large customers such as recently GAP should continue to drive the sector. As the first American wholesale group GAP will let produce vests and jackets for the brands "Old Navy" and "Banana Republic" from mid-year 2014 at two South Korean companies. The investment amount is not known, but the volume of orders should create 700 direct and 4,000 indirect jobs. First order samples also the Swedish outfitter Hennes & Mauritz will let produce in four factories; as other interested parties like Tesco, Guess or Dewhirst (UK).have announced their interest. © Textination GmbH –4– Responsible for the professional qualification is the Myanmar Garment Human Resource Development Centre. The MGHRDC was founded in 2009 and has trained by its own account more than 1,000 workers. The center will be expanded, while the training standard should be raised gradually to the upscale quality requirements of the new foreign investors. The EU has initiated a SMART program with over EUR 2 million, which should support the small and medium enterprises in competitiveness, training and sustainable production in cooperation with local organizations. © Martin Berk. / pixelio.de Shortage of skilled personnel and power outages are scotch blocks According to a leading German manufacturer of branded shirts in Yangon mainly the poor electricity infrastructure with several power outages a day, causes a significant additional cost burden. As the only alternative the manufacturers use diesel engines equipment, but the monthly operating costs quickly add up to several thousand dollars. It is a fact for the entire country that the current demand exceeds the production by over a third and will increase annually by 15%. Yangon alone claims 720 MW, almost half of the total capacity of 1,500 MW. © k.h.S. / pixelio.de In general, the clothing industry plays a prominent role in the industrial policy approach of the government. Industry Minister Soe Thane sets the focus for the modernization of the manufacturing sector especially on labor-intensive products, such as food, shoes, toys and clothing. The industry profile is currently composed of 41 industrial zones, including 19 in the room Yangon and six in Mandalay, the remaining 16 zones are spread across nine other locations. The main emphasis is on processing of agricultural and fishery products, the timber industry, simple electrical products and the manufacturing of clothing. Interesting trade fair event As a premiere the four-day "Myanmar International Textile and Garment Industry Exhibition" was formed in December 2012 in the Tatmadaw Hall in Yangon. Represented were manufacturers, distributors and suppliers of machinery, equipment and parts. In total more than 100 exhibitors from 17 countries - including the People's Republic of China, Hong Kong (SVR), India, Indonesia, Korea (Rep.), Singapore, Switzerland and Germany, came to show their products. As partner for the organization, the industry association MGMA chose the Yorkers Trade & Marketing Services Company from Hong Kong. The next exhibition will be held in November 2014. Internet addresses: Catalina Research Myanmar Garment Manufacturers Association (MGMA) No. 29, 6th Floor, Min Ye Kyaw Swar Road, Lanmadaw, UMFCCI Tower, Yangon E-mail: garment.mgma@gmail.com Myanmar Textile Garment Directory 2011 © Textination GmbH –5– Internet : http://www.myanmartextile-directory.com 2014 Myanmar International Textile and Garment Industry Exhibition Tatmadaw Exhibition Hall, Yangon Termin: 20.-23.11.14 Internet: http://www.myanmar-expo.com/MTG/ © http://www.afza.gov.ae Source: Waldemar Duscha, Germany Trade & Invest www.gtai.de Translation: Textination-Team © Textination GmbH –6–