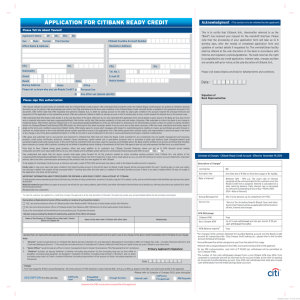

offer for Citibank payroll account

advertisement

Welcome offer of Citibank payroll account From now until April 30, 2012, sign up for our payroll account, with registration of banking e-statement service log-on to Citibank online banking and have 3 consecutive monthly payroll deposits you can enjoy the following welcome offersi. Open payroll account to enjoy up to HK$2,000 rewards Monthly Salary* HK$10,000 - <HK$30,000 Citibanking iii HK$30,000 or above Citigoldiv HK$30,000 or above with new funds amount of >HK$50,000 Offerii Welcome offer Rewards HK$150 credit card spending HK$550 cash coupons HK$800 + credit card spending = HK$950 HK$400 HK$300 HK$1,500 cash coupons credit card spending HK$1,800 * Rewards are calculated according to the actual monthly payroll deposit Referral Program : Up to HK$1,000 credit card spending Each successful referral Rewards Citibanking HK$100 credit card spending Citigold HK$1,000 credit card spending Customer Referral Ambassador Program : Up to HK$2,000 credit card spending No. of successful Citibanking referral Rewards 3 or above HK$450 credit card spending 5 or above HK$750 credit card spending 10 or above HK$2,000 credit card spending Successfully apply for the following products/services to enjoy: Products / Services Extra Privileges MPF Preserved Assets Consolidation HK & US stock accounts • One-off management fees rebate • Management fees as low as 0.99% p.a. • Trade HK & US stocks with no commission (first 2 months) Remarks: Investment shall not be regarded as a substitute for time deposit • As low as 0.2% brokerage fee for HK stock trading after first 2 months Citibank Rewards Card • Up to 200,000 Rewards Pointsv Citibank Ready Credit • HK$100 Cash Coupon (equivalent to HK$800 cash coupons) • Offers preferential mortgage rate with attractive cash rebate • Fulfills the need of new home purchase, mortgage transfer or cash out refinancing • No handling or valuation fee Service Fee Waiver Account Opening / Enquiry Hotline • No min balance requirements • Free gift check issuance, standing instructions, Online TT 2860 0266 www.citibank.com.hk OFSCTB-0030312 Mortgage Remark: i. Rewards are not applicable to existing banking clients of Citibank(Hong Kong)Limited(“The Bank”) or client who had banking relationship with the bank in the past 12 months. ii. Open a Step-Up Interest Account and register email address and enroll in banking e-statement simultaneously, Citibanking client can get HK$150 cash coupons; Citigold client can get HK$300 coupons (“instant gift”). Citibank reserves the right to reclaim the full cash value of the instant gift in the event that an account is closed within 3 months after account opening. Clients are required to submit relevant documents including a copy of their HKID card and valid address proof (e.g. latest banking statement in order to be eligible for the gift. iii To be eligible for up to HK$800 credit card spending, client should have monthly payroll through autopay/standing instruction to enjoy the above offer. If client has check deposit, Citibanking client is eligible to enjoy up to HK$400 credit card spending. iv. To be eligible for HK$1,500 credit card spending, cilents are required to join Citigold, bring in new funds of HK$500,000 and with monthly payroll through autopay/standing instruction with HK$30,000 or above. To be eligible for HK$1,000 credit card spending, clients are required to join Citigold, bring in new funds of HK$500,000 and with monthly payroll through check deposit with HK$30,000 or above. Upon completion of this offer for 1st year, the “Average Daily Combined Balance” of HK$1,000,000 for Citigold account will be applied. v. All welcome offers are only applicable for New Citibank Credit Card Clients. New Citibank Credit Card Clients are defined as Clients who do not currently hold and/or in the past 12 months have not been successfully approved for or have not cancelled any Principal Citibank Credit Card, Citibank Cobrand Card, Citibank Private Label Card issued by the bank or Diners Club Card issued by Diners Club International (HK) Limited (“Diners”). Spending requirements apply and successful enrollment of e-statement delivery service is required. For details, please refer to relevant marketing materials. vi. The overleaf banking welcome offers are not applicable for U.S. persons, except deposit interest rate. vii. Terms and Conditions apply, refer to below for details. Terms and Conditions: 1. The promotion offer is valid from April 1 to April 30, 2012, both dates inclusive (”the Promotional Period”). 2. To enjoy the promotion offer under the promotional period, client must successfully open and use the Step-Up Interest Account for payroll deposit, and as the primary account holder during the promotional period and fulfill all other criteria below mentioned (“Eligible Client”). 3. Citibanking client can enjoy minimum balance fee waiver as long as using Step-Up Interest Account for monthly payroll. Citigold client must maintain “Average Daily Combined Balance” of HK$500,000 or above (with HK$30,000 or above monthly payroll). This offer is only applicable for the first year upon account opening and client needs to maintain Citigold minimum balance requirement afterwards. Service charges for certain products apply, please refer to the latest Service Fees booklet^. 4. Up to 0.8%p.a. preferential deposit interest rate will only apply to Step-Up Interest Account. All deposit rates are for reference only and are not guaranteed. Deposit rates will be subject to change from time to time without prior notice. For details, terms and conditions of Step-Up Interest Account, please refer to the leaflet of Step-Up Interest Account^. 5. Welcome offer for Citibank payroll account client: a) Client must enroll banking e-statement during account opening; and b) Client must have first log-on to Citibank online banking within one month after account opening; and c) Client must have 3 consecutive monthly payroll deposit through autopay/standing instruction/check deposit in 5 months upon account opening month, with monthly salary of HK$10,000 or above for autopay/standing instruction (as per client’s declared basic salary) OR HK$30,000 or above for check deposit (as per client’s declared basic salary) in the Step-Up Interest Account. d) Rewards correspond to the relevant salary tiers and payroll deposit method: Monthly Salary Citibanking Citigold Autopay or Standing Instruction HK$10,000 or above HK$400 Credit Card Spending HK$30,000 or above HK$800 Credit Card Spending HK$30,000 or above* HK$1,500 Credit Card Spending * To be eligible for HK$1,500 credit card spending, cilents are required to join Citigold, bring in new funds of HK$500,000 and with payroll of HK$30,000 or above. Upon completion of this offer for 1st year, the “Average Daily Combined Balance” of HK$1,000,000 for Citigold account will be applied. e) If client has check deposit with HK$10,000 or above, Citibanking client is eligible to enjoy HK$200 credit card spending; If client has check deposit with HK$30,000 or above, Citibanking client is eligible to enjoy HK$400 credit card spending. Citigold client are required to join Citigold, bring in new funds of HK$500,000 and with payroll of HK$30,000 or above to enjoy HK$1,000 credit card spending. f) Rewards are calculated according to the actual monthly payroll deposited. Clients need to submit valid employment proof as stated in the leaflet. If the actual payroll deposited amount does not equal the client’s declared basic salary or the actual monthly payroll deposited has differences (Example: the actual monthly payroll amount after deducting MPF is lower than declared basic salary), rewards are determined according to the client’s declared salary or the actual payroll deposited, whichever is lower. Payroll deposit refers to basic salary only. Any commission, bonus, overtime allowance, double pay, reimbursement, and/or other payments made on top of the basic salary will be excluded from the calculation. g) The above rewards are not applicable to existing banking clients of Citibank (Hong Kong) Limited ("The Bank") or client who has had a banking relationship with the Bank in the past 12 months. h) Rewards will be credited to each eligible client with the schedule as below: Account opening date 3 consecutive monthly payroll deposit before Rewards will be credited before April 1 – April 30, 2012 August 31, 2012 September 30, 2012 i) Credit card spending will be paid in terms of Citibank credit card spending. The priority of card type for offering credit card spending to Citibanking clients will be Citibank Rewards card, Octopus Citibank credit card, and Citibank PremierMiles VISA. The priority of card type for offering credit card spending to Citigold clients will be Citibank PremierMiles VISA, Citibank Rewards card, and Octopus Citibank credit card. Customer is not allowed to choose card type for the credit card spending offer. If clients are not currently a holder of a Citibank Credit Card, they will require to apply a Citibank Credit Card and the credit card is subject to approval. The same value of cash rebate will be offered if client’s card application is rejected or invalid without further notice. Cash rebate will be credited to client’s Step-Up Interest Account. j) Only those Eligible Clients whose relevant accounts are valid and in good standing during the entire promotion and redemption period will be eligible for the rewards. If the account status has changed, the Bank reserves the right to terminate the Offers to the Eligible Client without prior notice. 6. Citibank payroll account Referral Program: a) HK$1,000 credit card spending will be offered to the Referrer for each Referee (New client) who successfully becomes a new Citigold Step-Up Interest Account client during the Promotional Period, bring in new funds of HK$500,000 and has 3 consecutive monthly payroll deposit in 5 months upon account opening month, with HK$30,000 or above (as per client’s declared basic salary). HK$100 credit card spending will be offered to the Referrer for each Referee (New client) who successfully becomes a new Citibanking Step-Up Interest Account client during the Promotional Period and have 3 consecutive monthly payroll deposit in 5 months upon account opening month, with HK$10,000 or above (as per client’s declared basic salary). Credit card spending will be credited to client according to the referee’s (New client) account opening date and requirement fulfillment date (please refers to clause 5h-5j). b) For referee to be eligible for the welcome offer, referee must not have had a banking relationship with the Bank in the past 12 months. c) For referee to apply the Citigold account, referrer must hold a Citibank banking account / Citibank credit card. d) For referee to apply the Step-Up Interest Account / Citibanking account, referrer must hold a Citibank banking account. e) Referrer cannot refer himself/herself as a new client. Referrer’s entitlement to the program offer will be subject to the bank’s confirmation on the Referee’s fulfillment of the program offer requirements. For each joint account, only one reward will be given to the referrer. If clients are not currently a holder of a Citibank Credit Card, they will require to apply a Citibank Credit Card and the credit card is subject to approval. The same value of cash rebate will be offered if client’s card application is rejected or invalid without further notice. Cash rebate will be credited to client’s Step-Up Interest Account. 7. Citibank Customer Referral Ambassador Program: a) Referrals must be made before April 30, 2012. b) Referrer must be an existing Citibank banking client (i.e. with bank account number). c) Referee (New client) must not have had a banking relationship with Citibank during the previous 12 months. d) Referee (New client) should have 3 consecutive monthly payroll deposit in 5 months upon account opening month, with HK$10,000 or above (as per client’s declared basic salary) e) Rewards correspond to the number of successful referrals made: Number of successful Citibanking referral 3 or above 5 or above 10 or above Rewards for each successful referral HK$450 credit card spending HK$750 credit card spending HK$2,000 credit card spending f) Referrer’s offer will be subject to the bank’s confirmation on the referee’s fulfillment of the program requirements. g) Rewards will be credited to each eligible client according to the referee’s (New client) account opening date and requirement fulfillment date (please refers to clause 5h-5j). 8. MPF Preserved Assets Consolidation Services: a) For details of the one-off management fees rebate and management fees, please refer to the relevant promotional leaflet. b) Welcome offer for Citibank payroll account are not applicable to MPF products distributed by Citibank. 9. Stock Account Opening Offer: a) The offer is only applicable to new stock/new securities Clients (“Clients”) who have opened a new securities account with the Bank during the period from April 1 to June 30, 2012 (the “Promotion Period”) and have not canceled or held any sole or joint securities account with the Bank within the past 12 months. b) Clients can enjoy brokerage fee waiver for the BUY and SELL trades of Hong Kong and US stocks carried out via our Dedicated Trading Hotline, Internet Securities Services or Mobile Securities Services (where applicable) within the first 61 days of securities account opening. Initial Public Offering (“IPO”) related transactions are not applicable. c) Clients will enjoy brokerage fee waiver for buy and sell trades of Hong Kong and US stocks until the total cumulative regular brokerage fee reaches: (i) HK$1,500 for Citibanking clients; (ii) HK$3,000 for Citigold clients; All subsequent transactions will be subject to regular brokerage fee (with minimum charge per transaction). Example: A Citigold client opened a new securities account on April 10, 2012 and conducted the following transactions during the period of April 10 to June 10, 2012 via online channel. Transaction Date April 13 May 10 May 16 June 1 Total: Transaction Amount (HKD) $700,000 $1,000,000 $30,000 $500,000 Regular Brokerage Fee - 0.2% (HKD) $1,400 $2,000 $100 (minimum charge) $1,000 $4,500 (Brokerage fee waived: $3,000) Important Disclaimer You should seek advice from your professional advisors as to your particular tax position, including but not limited to estate duty and withholding tax that might arise from investing in overseas products. This material is for information purpose only and does not constitute any offer or solicitation or advice to buy or sell any security. Investments are not bank deposits and are not obligations of, guaranteed or insured by Citibank (Hong Kong) Limited, Citibank, N.A., Citigroup Inc. or any of its affiliates or subsidiaries, or by any local government or insurance agency, and involve risks, including the possible loss of the principal amount invested. Share prices may go down as well as up. Investment products are not available for U.S. persons and might only be applicable to limited jurisdiction. Any person considering an investment should seek independent advice on the suitability or otherwise of the particular investment. ^ You may visit Citibank website (www.citibank.com.hk)/any branch or 24-hour Citiphone Hotline at 2860 0333 to obtain the latest copy. © 2012 Citibank Citibank and Arc Design is a registered service mark of Citibank, N.A. or Citigroup Inc. Citibank (Hong Kong) Limited OFSCTB-0030312 The waived brokerage fee of HK$3,000 will be refunded to clients’ settlement account linked to the securities account within 6 months of securities account opening. d) Clients will still be charged non-brokerage fee items such as, but are not limited to, Stamp Duty, Transaction Levy and Trading Fee where applicable. e) Clients are required to pay the regular brokerage fees at the time of trading. The waived brokerage fee will be refunded to clients’ settlement account linked to the securities account within 6 months of securities account opening. Clients should maintain a valid securities account and settlement account at the time when the refund is made. f) The Bank will credit the refund amount to clients’ Hong Kong Dollar settlement account. If only a US Dollar settlement account is linked to the securities account, the refund amount will be credited to that account. Exchange rate of US$1 = HK$7.8 will be used for calculation. 10. Citibank Rewards Card: The promotion offer is valid from April 1, 2012 to April 30, 2012. All welcome offers are only applicable for New Citibank Credit Card Clients. New Citibank Credit Card Clients are defined as applicants who do not currently hold and/or in the past 12 months have not been successfully approved for or cancelled any Principal Citibank Credit Card, Citibank Cobrand Card, Citibank Private Label Card, issued by Citibank (Hong Kong) Limited and/or Diners Club Card issued by Diners Club International (HK) Limited (“Diners”). Spending requirements apply. For details, please refer to relevant marketing materials. 11. Offer for Citibank Ready Credit: a) The promotional period is from April 1 to April 30, 2012. b) Citibank Ready Credit applicants must be Hong Kong permanent residents and aged 18 or above. c) Credit limit is up to 3 times monthly salary or HK$500,000 (whichever is lower). Credit limit is up to 3 times monthly salary or HK$40,000 (whichever is lower) for applications without income proof. d) Introductory rate at P for first 3 months; the Prime Rate (“P”) is the Hong Kong Dollar Prime Rate of the Bank. The P is 5.25% (APR 5.38%) as of September 15, 2010. The introductory rate and personalized interest rate will vary whenever the Bank’s P changes. e) HK$100 cash coupons are not applicable to clients currently hold and/or in the past 12 months have successfully applied for or cancelled any Citibank Ready Credit Account. If the clients cancel their new Citibank Ready Credit account within 12 months from the account opening date, the Bank reserves the right to charge clients the face value of the welcome offer from the Citibank Ready Credit Account without prior notice. 12. Terms and conditions apply for all the offers. For details, please refer to the related promotion materials. 13. If a new client closes all of his/her accounts within 6 months from his/her account opening date, an account closure fee of HK$500 (or equivalent) will be charged. 14. All rewards cannot be redeemed for cash. 15. The above offers cannot be used in conjunction with any other promotion offers. 16. The above banking welcome offers are not applicable for U.S. persons, except deposit interest rate. 17. The Bank reserves the right to amend any of these terms and conditions without prior notice. All matters and disputes will be subject to the final decision of Citibank. 18. In the event of discrepancy between the English and Chinese versions of these terms and conditions, the English version shall prevail.