Weekly Commentary from 17-Sep-2007 to 21-Sep-2007

advertisement

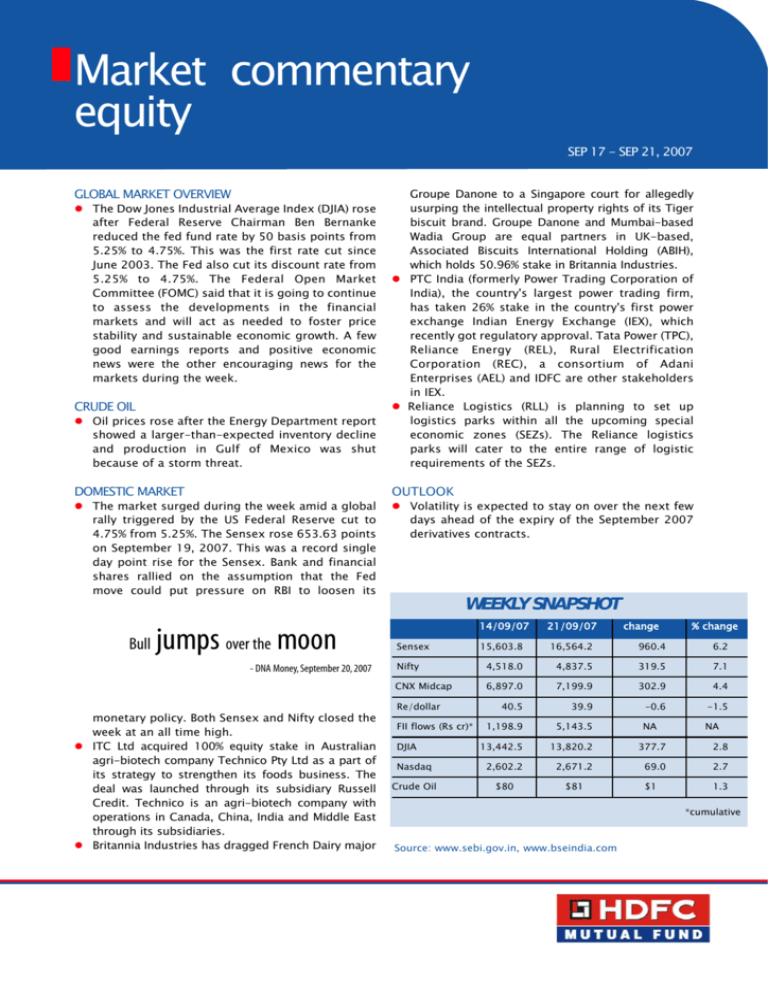

Market commentary equity GLOBAL MARKET OVERVIEW SEP 17 - SEP 21, 2007 z Oil prices rose after the Energy Department report showed a larger-than-expected inventory decline and production in Gulf of Mexico was shut because of a storm threat. Groupe Danone to a Singapore court for allegedly usurping the intellectual property rights of its Tiger biscuit brand. Groupe Danone and Mumbai-based Wadia Group are equal partners in UK-based, Associated Biscuits International Holding (ABIH), which holds 50.96% stake in Britannia Industries. z PTC India (formerly Power Trading Corporation of India), the country's largest power trading firm, has taken 26% stake in the country's first power exchange Indian Energy Exchange (IEX), which recently got regulatory approval. Tata Power (TPC), Reliance Energy (REL), Rural Electrification Corporation (REC), a consortium of Adani Enterprises (AEL) and IDFC are other stakeholders in IEX. z Reliance Logistics (RLL) is planning to set up logistics parks within all the upcoming special economic zones (SEZs). The Reliance logistics parks will cater to the entire range of logistic requirements of the SEZs. DOMESTIC MARKET OUTLOOK z The Dow Jones Industrial Average Index (DJIA) rose after Federal Reserve Chairman Ben Bernanke reduced the fed fund rate by 50 basis points from 5.25% to 4.75%. This was the first rate cut since June 2003. The Fed also cut its discount rate from 5.25% to 4.75%. The Federal Open Market Committee (FOMC) said that it is going to continue to assess the developments in the financial markets and will act as needed to foster price stability and sustainable economic growth. A few good earnings reports and positive economic news were the other encouraging news for the markets during the week. CRUDE OIL z The market surged during the week amid a global rally triggered by the US Federal Reserve cut to 4.75% from 5.25%. The Sensex rose 653.63 points on September 19, 2007. This was a record single day point rise for the Sensex. Bank and financial shares rallied on the assumption that the Fed move could put pressure on RBI to loosen its Bull jumps over the moon - DNA Money, September 20, 2007 monetary policy. Both Sensex and Nifty closed the week at an all time high. z ITC Ltd acquired 100% equity stake in Australian agri-biotech company Technico Pty Ltd as a part of its strategy to strengthen its foods business. The deal was launched through its subsidiary Russell Credit. Technico is an agri-biotech company with operations in Canada, China, India and Middle East through its subsidiaries. z Britannia Industries has dragged French Dairy major z Volatility is expected to stay on over the next few days ahead of the expiry of the September 2007 derivatives contracts. WEEKLY SNAPSHOT 14/09/07 21/09/07 15,603.8 16,564.2 960.4 6.2 Nifty 4,518.0 4,837.5 319.5 7.1 CNX Midcap 6,897.0 7,199.9 302.9 4.4 40.5 39.9 -0.6 -1.5 1,198.9 5,143.5 NA NA 13,442.5 13,820.2 377.7 2.8 Nasdaq 2,602.2 2,671.2 69.0 2.7 Crude Oil $80 $81 $1 1.3 Sensex Re/dollar FII flows (Rs cr)* DJIA change % change *cumulative Source: www.sebi.gov.in, www.bseindia.com Market commentary debt GLOBAL MARKET OVERVIEW z US treasuries remained mixed on inflation worries tied to rising commodity prices and the Federal Reserve's aggressive interest rate cut. z Federal Reserve's Open Market Committee (FOMC) in its meeting on September 18, 2007 lowered the fed fund interest rate by 50 basis points from 5.25% to 4.75%. Fed also cut its discount rate from 5.25% to 4.75%. Bernanke and group reiterated that turmoil in financial markets was a threat to economic growth. z Oil prices rose after the production in the Gulf of Mexico was shut because of a storm threat. DOMESTIC MARKET SEP 17 - SEP 21, 2007 and a weak US dollar. Prices eased later as some investors pocketed profits. z India Infrastructure Finance Corporation Limited (IIFCL) and Sumitomo Mitsui Banking Corporation (SMBC) announced the start of a strategic partnership to co-operate on various aspects of infrastructure financing in India. OUTLOOK z Liquidity continues to remain an important factor for the debt market. The central bank will auction 5.87% Government Stock, 2010 for Rs 5,000 crore and 5.48% Government Stock, 2009 for Rs 5,000 crore under the MSS on September 26, 2007. z G-Sec yields eased in the early part of the week after the US Federal Reserve cut interest rate by 50 basis points. But it edged later on tighter cash conditions caused by tax outflows. Cash conditions in the banking system started showing signs of tightening, with corporates making their advance tax payments. Call rates traded in the range of 6.00%-7.80%. YIELD MOVEMENTS rupee scales against dollar Red-hot Sep 17, 2007 Sep 21, 2007 7.88 7.9 -The Economic Times, September 21, 2007. 7.3 7.86 7.6 YIELD % z Rupee edged higher as a sharp cut in interest rates by the US Federal Reserve increased appetite for emerging market assets and a surging stock market attracted capital inflows. z The 182-day and 91-day Treasury bill auction on September 19, 2007, saw a cut-off of 7.25% and 6.98 % respectively. z Inflation declined to 3.32% for the week from 3.52% in the previous week due to decrease in energy and mineral products. The wholesale price-based annual inflation rate stood at 5.22% in the corresponding week last year. z Gold prices hit a new all time high world over as investors continued to park money in the traditional safe haven to counter high oil prices 7.3 7.0 7.21 6.7 10 yrs G-Sec Source: www.debtonnet.com DISCLAIMER: The update is for information purposes only and is not an offer to sell or a solicitation to buy any mutual fund units/securities. The information contained in this commentary is not a complete disclosure of every material fact regarding any industry, security or the fund. The information/ data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. Neither HDFC Asset Management Company Limited (HDFC AMC) nor any person connected with it, accepts any liability arising from the use of this information/data. While utmost care has been exercised while preparing the update, HDFC AMC does not warrant the completeness or accuracy of the information/data and disclaims all liabilities, losses and damages arising out of the use of this information/data. The recipient of this material should rely on their investigations and take their own professional advice.