PowerPoint Slides - Federal Reserve Education

advertisement

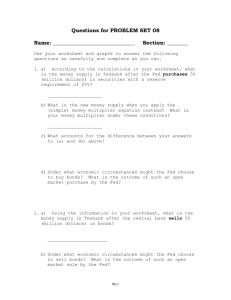

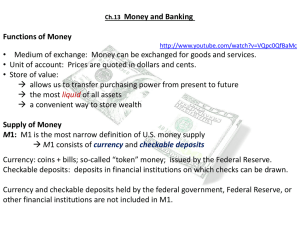

The Modern Federal Reserve System Fed Functions The Federal Reserve System’s Traditional Functions Conducting the Nations’ Monetary Policy Supervising and Regulating Financial Institutions Providing Payment Services to Financial Institutions Conducting the Nation’s Monetary Policy The Federal Reserve System’s primary function is to conduct monetary policy. Monetary policy is used to achieve the Fed’s primary economic goals of maximum employment, price stability, and moderate long-term interest rates. Monetary Policy Tools Open market operations—The purchase and sale of U.S. Treasury and federal agency securities by the Federal Reserve System through the Federal Open Market Committee; the Federal Reserve’s principal tool for implementing monetary policy. The discount window—Federal Reserve lending programs to financial institutions. The reserve requirement—The percentage of a bank’s deposits it is required to hold as cash in its vaults and/or on deposit with the Federal Reserve. Supervising and Regulating Financial Institutions The Federal Reserve System is charged with helping to protect the integrity of the nation’s financial institutions. The Fed examines and regulates depository institutions to help ensure the safety and soundness of the financial system, to promote stability in financial markets, and to promote compliance with applicable laws. Regulations are written by the Board of Governors of the Federal Reserve System, and the Federal Reserve Banks supervise the institutions. Through supervision and regulation, the Fed reinforces the public’s confidence in the banking system. Providing Payment Services to Financial Institutions The Federal Reserve System provides services to depository institutions and the federal government. Just as banks hold cash and process checks and electronic payments for customers, the Fed holds cash reserves and processes checks and electronic payments for depository institutions.