Merchandising Transactions: General Journal Entries

advertisement

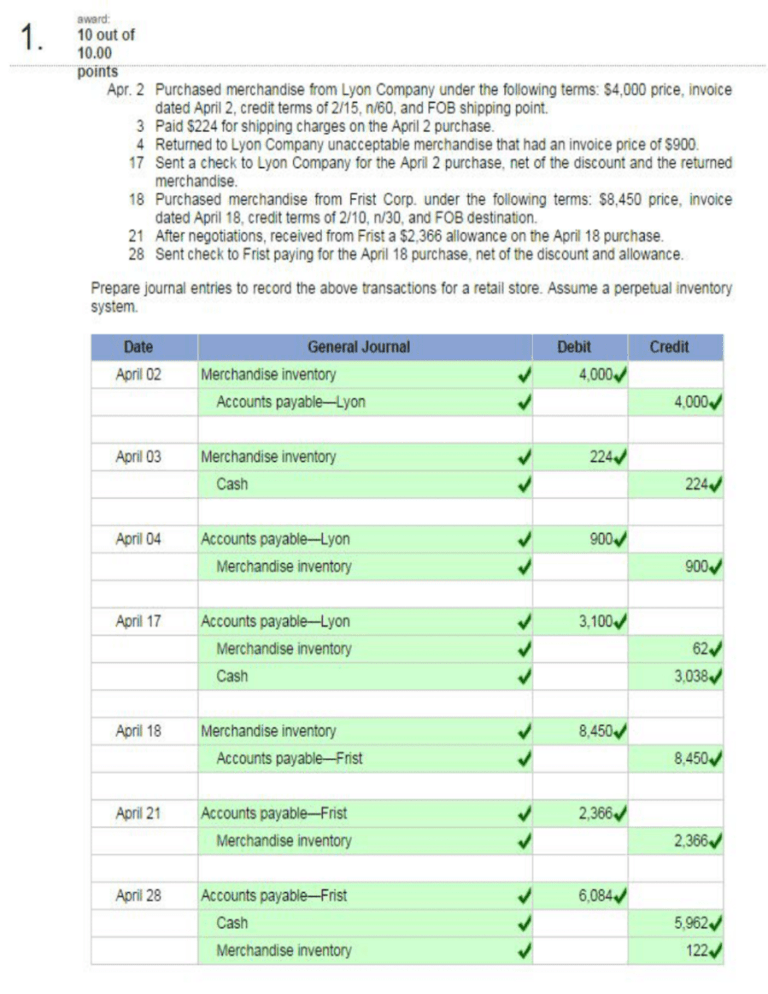

1. award: 10 out of 10.00 ...............points " Apr. 2 Purchased merchandise from Lyon Company under the following terms: S4,000 price, invoice dated April 2, credit terms of 2115, n/60, and FOB shipping point. 3 Paid S224 for shipping charges on the April 2 purchase. 4 Returned to Lyon Company unacceptable merchandise that had an invoice price of S900. 17 Sent a check to Lyon Company for the April 2 purchase. net of the discount and the returned merchandise. 18 Purchased merchandise from Frist Corp. under the following terms: $8,450 price, invoice dated April 18, credit terms of 2/10, n/30, and FOB destination. 21 After negotiations, received from Frist a $2,366 allowance on the April 18 purchase. 28 Sent check to Frist paying for the April 18 purchase. net of the discount and allowance. Prepare journal entries to record the above transactions for a retail store. Assume a perpetual inventory system. General Journal April 02 Merchandise inventor/ Accounts payable-lyon April 03 Merchandise inventory Cash April 04 Accounts payable-Lyon Merchandise inventory April 17 Accounts payable-Lyon Merchandise inventory Cash April 18 Merchandise inventory Accounts payable-flist April 21 Accounts payable-Frist Merchandise inventory April 28 Accounts payable-Frist Cash Merchandise inventory Debit ./ ./ 4,000.,, ./ ./ 224./ ./ ./ 900./ ./ ./ 4.000./ 224./ 900J 3,100./t 62./ .1C- 3.038./1 ./ ./ 8,450./ ./ ./ 2.366./ ./ ./ 6,084./ .1C Credit 8,450./ 2.366./ 5,962./ 122./ 2• award: 10 out of 10.00 · · · · · · · ·points·· Santa Fe Company purchased merchandise for resale from Mesa Company with an invoice price of $27,400 and credit terms of 2110, n/60. The merchandise had cost Mesa $18,687. Santa Fe paid within the discount period. Assume that both buyer and seller use a perpetual inventory system. 1(a)Prepare entries that the buyer should record for the purchase. Event General Journal Credit Debit Merchandise inventory 27,400./ Accounts payable 27,400./ --~- -~-- 1(b)Prepare entries that the buyer should record for the cash payment. Event General Journal Credit Debit Cash yl yl Merchandise inventory yl Accounts payable 27,400./ 26,852./ 548./ 2(a)Prepare entries that the seller should record for the sale. Event General Journal yl Accounts receivable yl Cost of goods sold 27,400./ 18,687./ yl Merchandise inventory Credit 27,400./ yl Sales 2 Debit 18,687./ 2(b)Prepare entries that the seller should record for the cash collection. Event ~ General Journal Debit Cash yl 26,852./ Sales discounts yl yl 548./ Accounts receivable Credit 27.400./ 3. Assume that the buyer borrowed enough cash to pay the balance on the last day of the d iscount period at an annual interest rate of 8% and paid it back o n the last day of the credit period. Compute how much the buyer saved by following this strategy. (Use 365 d ays a year. Round your i ntermediate cal culation s and final answer to 2 decimal p laces.) Amount borrowed INumber of days of interest ~nterest expense Buye~s net savings $ 26.852./ 50.I $ 294.27./ $ 253.73./ 3. S't\'3.rd: 10 out of 10.00 Allie<l Parts was organized on May 1, 20 13, and made its first purchase of merchandise on May 3. The purchase was for 1,100 units at a price of $10 per unit On May 5, Allied Parts sold 660 of the units for $14 per unit to Baker Co. Terms of the sale were 2110, n/60. a. On May 7, Baker returns 231 units because they did not fit the customer's nee-Os. Allie<l Parts restores the units to its inventory. b. On May 8, Baker discovers that 55 units are damaged but are still of some use and, therefore, keeps the units. Allied Parts sends Baker a cre<lit memorandum for S330 to compensate for the damage. c. On May 15, Baker discovers that 66 units are the wrong color. Baker keeps 40 of these units because Allie<l Parts sends a $86 credit memorandum to compensate. Baker returns the remaining 26 units to Allie<l Parts. Allied Parts restores the 26 retume<l units to its inventory. Prepare entries for Allied Parts to record the May 5 sale and each of the above separate transactions a through c using a perpetual inventory system. General Journal Date May05 Accounts receivable Sales May 05 Cost of goods sold Merchandise inventory Debit ./ ./ 9,240./ ./ ./ 6,600./ Credit 9,240./ 6,600.,I I May07 Sales returns and allowances ./ ./ 3,234./ ./ .I 2,310./ ./ .I 330./ 450./ Accounts receivable ./ ./ Merchandise inventory ./ 260.,I Cost oi goods sold ,/ Accounts receivable May07 Merchandise inventory Cost oi goods sold Mayos Sales returns and allowances Accounts receivable May 15 May 15 Sales returns and allowances 3.234./ 2,310./ 330./ 450./ 260./ av.'3.f'd: 4• 10 out of 10.00 ·· · · · · ···points · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · Allie<! Parts was organized on May 1, 2013, and made its first purchase of merchandise on May 3. The purchase was for 1,100 units at a price of $10 per unit. On May 5, Allied Parts sold 660 of the units for $14 per unit to Baker Co. Terms of the sale were 2/10, n/60. a. On May 7, Baker returns 231 units because they did not fit the customer's needs. Allied Parts restores the units to its inventory. b. On May 8, Baker discovers that 55 units are damaged but are still of some use and, therefore. keeps the units. Allie<! Parts sends Baker a cre<Jit memorandum for S330 to compensate for the damage. c. On May 15, Baker discovers that 66 units are the wrong color. Baker keeps 40 of these units because Allie<! Parts sends a $86 credit memorandul11l to compensate. Baker returns the remaining 26 units to Allie<! Parts. Allied Parts restores Ille 26 returned units to its inventory. Prepare the appropriate journal entries for Baker Co. to record the May 5 purchase and each of tile lhree separate transactions a through c. Baker is a retailer that uses a perpetual inventory system and purchases these units for resale. Date May OS General Journal Merchandise inventory Accounts payable May 07 Accounts payable Merchandise inventory May os Accounts payable Merchandise inventory May 15 Accounts payable Merchandise inventory Debit ./ ./ 9,240./ ./ ./ 3,234./ ./ ./ 330./ ./ ./ 450./ Credit 9,240./ 3,234"' 330./ 450./ 5. SV.'afd: 10 out of 10.00 · · · · · · · points · · · · · · · · · · · · · · · · · · · · · · · · · · · · · ··· · .. · The iollowing supplementary records summarize Tosca Company's merchandising activtties for year 20 13. Cost of merchandise sold to customers in sales transactions $ 172,000 24,974 176,334 Merchandise inventory, December 31, 2012 Invoice cost of merchandise purchases Shrinkage determined on December 31, 2013 Cost of transportation-in Cost of merchandise returned by customers and restored to inventory Purchase discounts received Purchase returns and allowances 790 1,763 2,750 1.41 1 3,800 Record the summarized activities in the T-accounts below. Merchandise Inventory 24,97~ Shrinkage Balance, Dec. 31, 2012 Returns by customers 2,750./ Purchase discounts received 176,33~ Invoice cost of purc11ases Transportation-in Purchase returns and allowances 1,763./' Cost of sales transactions Balance, Dec. 31, 2013 21.820 ./ 790./ ./ 1.411./ ./ 3,800./ ./ 172,000./ I ---- Cost of Goods Sold Cost of sales transactions Inventory shrinkage ./ Balance. Dec. 31, 2013 ./ ./ 172.000./ Returns by customers 790./ .------~ 170,040 ./ ± 6. awacd: 10 out of 10.00 Using your acc·ounting knowledge, find the missing amounts in the following separate income statements a through e. (Amou nts to be deducted should be indicated by a minus sign.) b 8 Sales $ 74,300 $ 52,604 r 29.200 8, : - r 40,609 10,528 (8.511) (3,158)./ 40,984./ 10,318 7,778 55,606 18,822./ 10,650 17,423 2,600 6,100 25.280 I$ ' (9,645) 1$ 7,059 4,261 Total cost of merchandise purchases 42,354 17,474./ Merchandise inventory (ending) (7,559)./ (5.061) Cost of goods sold 41,854 --I-- Gross profit 32,446./ --- Expenses Net income (loss) I 9,000 $ 23,446./ $ e d 96,590./ $ Cost of goods sold Merchandise inventory (beginning) c 16,674 35,930./ 48.295 $ 10,142 42.017./ <11.642) I 40,517./ -- 53,006 $ 3,008 I 12,722./ av.'3.f'd: 10 out of 7 • 10.00 ........ points ............................. . Following are the merchandising transactions for Chilton Systems. 1. On November 1, Chilton Systems purchases merchandise for $1,100 on credit with terms of 2/5, n/30, FOB shipping point; invoice dated November 1. 2. On November 5, Chilton Systems pays cash for tile November 1 purchase. 3. On November 7, Chilton Systems discovers and returns $1 10 of defective merchandise purchased on November 1 for a cash refund. 4. On November 10, Chilton Systems pays $55 cash for transportation costs with the November 1 purchase. 5. On November 13, Chilton Systems sells merchandise for Sl,188 on credit. The cost of tile merchandise is $594. 6. On November 16, the customer returns merc handise from the November 13 transaction. The returned items sell for $250 and cost $125. The merch andise is returned to inventory. Journalize tile above merchandising transactions for Chilton Systems assuming it uses a perpetual inventor/ system. Date Nov 01 General Journal Merchandise inventory Accounts payable Nov 05 Accounts payable Cash Merchandise inventory Nov 07 Cash Merchandise inventory Nov 10 Merchandise inventory Cash Nov 13 Accounts receivable Sales Nov 13 Cost of goods sold Merchandise inventory Nov 16 Sales returns and allowances Accounts receivable Nov 16 Merchandise inventor/ Cost of goods sold Debit Credit ./ ./ 1, 100./ ./ ./ ./ 1,100./ ./ ./f - - ./ ./ 1, 100./ 1,078,/ 22./ 108./ 108./ 55./ 55./ 1.188./ ./ ./f - - - ./ ./ 594./ ./ ./ 250./ ./ ./ 125./ 1.1 88./ 594./ 250./ 125./ av.ard: 10out of 8 • 10.00 .............................points··· The operating cycle of a merchandising company contains the following five activites. With merchandise acquisition as the starting point, arrange the events in the correct order. Inventory made available for sate 1Cash collections from customers c. Credit sales to customers d. Purchases of merchandise e. Accounts receivable accounted for 2 5 3 4 ./ ./ ./ ./ award: 10outof 9 • 10.00 .......................... ··points ....................................................................................................................................... Aug. 1 Purchased merchandise from Arotek Company for $9,000 under credit terms of 1/10, n/30, FOB destination, invoice dated August 1. 4 At Arotek's request, Sheng paid $360 cash for freight charges on the August 1 purchase, reducing the amount owed to Arotek. 5 Sold merchandise to Laird Corp. for 56,300 under credit terms of 2110, n/60, FOB destination, invoice dated August 5. The merchandise had cost $4,498. 8 Purchased merchandise from w aters Corporation for 58,300 under credit terms of 1/10. n/45, FOB shipping point, invoice dated August 8. The invoice showed that at Sheng's request, Waters paid the $240 shipping charges and added that amou nt to the bill. (Hint Discounts are not applied to freight and shipping charges.) 9 Paid $160 cash for shipping charges related ~o the August 5 sale to Lux Corp. 10 Laird returned merchandise from the August 5 sale that had cost Sheng S750 and been sold for $1,050. The merchandise was restored to inventory. 12 Alter negotiations v.;tll Waters Corporation concerning problems with the merchandise purchased on August 8, Sheng received a credit memorandum from Waters granting a price reduction of S1,253. 15 Received balance due from Lai rd Corp. for the August 5 sale less the return on August 10. 18 Paid tile amount due to Waters Corporation for the August 8 purchase less the price reduction granted. 19 Sold merchandise to Tux Co. for $5,400 under credit terms of 1/10, n/30, FOB shipping point, invoice dated August 19. The merchandise had cost $3,748. 22 Tux requested a price reduction on the August 19 sale because the merchandise did not meet specifications. Sheng sent Tux a $900 credit memorandum to resolve the issue. 29 Received Tux's cash payment for the amount due from the August 19 sate. 30 Paid Arotek Company the amount due from the August 1 purchase. Prepare journal entries to record the above merchan dising transactions of Sheng Company, which applies the perpetual inventory system. General Journal Date Aug 01 ./ ./ 9,000./ ./ ./ 360./ ./ ./ 6,300.I ./ .I 4.498./ ./ .I 8,540./ ./ .I 160./ ./ .I 1,050./ ./ .I 750./ ./ .I 1,253./ .I .I ./ 5, 145,,.I .I ./ ./ 7,287.I .I ./ 5,400.I .I ./ 3,748.I .I ./ 900.I Cash .I 4.455.I Sales discounts ,,.I 45,,.I Merchandise inventor/ Accounts payable-Arotek --4--Aug 04 Accounts payable-Arotek Cash Aug 05 Accounts receivable-Laird Sales Aug 05 Cost of goods sold Aug 08 Merchandise inventor/ Accounts payable-Waters ---;,;-g 09J M very expense 0 sh Aug 10 Sales returns and allowances Accounts receivable-Laird Aug 10 Merchandise inventor/ Cost of goods sold Aug 12 Accounts payable-Waters Merchandise inventory Aug 15 Cash Sales discounts Accounts receivable-Laird Aug 18 Accounts payable-Waters Cash Merchandise inventory -~I-= Aug 19 Accounts receivable-Tux Sales Aug 19 Cost of goods sold _ Aug 22 Merchandise inventory _,I-'~ Sales returns and allowances Accounts receivable-Tux -~1-~ Aug 29 Credit Debit Accounts receivable-Tux 9,000./ 360./ 6,300./ 4,498.I 8.540./ 160.I 1.050.I 750.I 1,253.I 105./ 5,250./ 7,217./ 70,,.I 5,400./ 3,748./ 900./ ./ 4.500./ 1 Aug 30 Accounts payable-Arotek Cash ,,.I ./ 8.640,,.I 8,640./ (The foflo~·1ing inforn1ation applies to tile quesUons iiiSPiiJYed ......................................................................................................................................................... be'iOi~l:f The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. NELSON COMPANY Unadjusted Trial Balance January 31, 2013 Debrt Credit Cash Merchandise inventor/ Store supplies Prepaid insurance Store equipment Accumulated depreciation- Store equipment Accounts payable J. Nelson, Caprtal J. Nelson, Withdrawals Sales Sales discounts Sales returns and aJlowances Cost of goods sold Depreciation expense-Store equipment Salaries expense Insurance expense Rent expense Store supplies expense Advertising expense $ 22,600 Totals $184,450 1 4,000 5,900 2,500 43,000 $ 16,800 15,000 37,000 2,250 115,650 1,900 2,100 38,000 0 26,500 0 16,000 0 9,700 $184,450 Rent expense and salaries expense are equally divided between selling activities and the general and administrative activities. Nelson Company uses a perpetual inventory system. a. b. c. d. 10. Store supplies still available at fiscal year-end amount to $2,950. Expired insurance, an administrative expense, for ~he fiscal year is S1,650. Depreciation expense on store equipment, a selling expense, is $1,675 for the fiscal year. To estimate shrinkage, a physical count of ending1merchandise inventory is taken. It shows $10,200 of inventory is still available at fiscal year-end. S't\'3rd: 10outof 10.00 Required : 1. Using the above information prepare adjusting journal entries: Jan 31 Store supplies expense Store supplies Jan 31 Debit General Journal Date .,/ .,/ Insurance expense 2.950.,/ 2,950.,/ 1,650.,/ Prepaid insurance Jan 31 Depreciation expense-Store equipment Accumulated depreciation-Store equipment Cost of goods sold Merchandise inventory Credit 1,650.,/ .,/ 1,675.,/ .,/ .,/ .,/ 1,675.,/ 3,800.,/ 3,800.,/ award: 10out of 11 • 10.00 . . . . . . .. 'jjoii\IS' . . . . . . . . . . . . . . . . . . . . . . . . . .. . 2. Prepare a multiple-step income statement for fiscal year 2013. NELSON COMPANY Income Statement For Year Ended January 31, 2013 Sales --...-$ Less: Sales discounts ./ $ 1,900./ Less: Sales returns and allowances ./ 2,100./ Net sales ./ Cost of goods sold ./ ./ Gross profit Expense 115.650./ 4.000 .~~~~~~~~~~~~~ + Selling expenses 111,650 41.800./ 69,850 ._ Advertising expense 9,700.,I Depreciation expense-Store equipmen t 1,675./ Rent expense-Selling space 8,000./ Sales salaries expense 13,250./ Store supplies expense 2,950v' 0 0 Total selling expenses 35,575 General and administrative expenses Insurance expense ./ 1,650./ Office salaries expense ./ 13,250./ ./ 8,000./ Rent expense-Office space ~~--~~~~~-! Total general and administrative expenses Total expenses Net income 22,900 I I $ 58,475 11,375.I 12 - award: 10out of 10.00 .............................poims·· 3. Prepare a single-step income statement for fiscal year 2013. NELSON COMPANY Income Statement For Year Ended January 31 , 2013 Net sales ./ $ 111,650./ Expenses General and administrative expenses ./ $ 22,900./t - Selling expenses ./ 35,575./ Cost of goods sold 41,800./ 0 oT_ Total expenses Net income I $ 100,275 11,375./ 13. S'N3.!d: 10 out of 10.00 4. Compute the current ratio, acid-test ratio, and gross margin ratio as of January 31, 2013. (Round you r answers to 2 decimal p laces.) Current ratio 24 4.,I Acid-test ratio 1.56.,I Gross margin ratio 0.60.,I 1 Valley Company's adjusted trial balance on August 31, 2013, its fiscal year-end, follows. Debit 31,000 124,000 Merchandise inventory Other (noninventory) assets Total liabilities K. Valley, Capital K. Valley, Withdrawals Sales Sales discounts Sales returns and allowances Cost of goods sold Sales salaries expense Rent expense-Selling space Store supplies expense Advertising expense Office salaries expense Rent expense-Office space Office supplies expense s Totals $ 352,486 Credit $ 35,805 104,641 8,000 212,040 3,244 13,995 82,768 29,049 9,966 2,544 18,023 26,505 2,544 848 $ 352,486 On August 31, 2012, merchandise inventory was $25,017. Supplementary records of merchandising activities for the year ended August 31, 2013, reveal the following itemized costs. Invoice cost oi merchandise purchases Purchase discounts received Purchase returns and allowances Costs of transportation-in 14. $ 91,140 1,914 4,375 3,900 award: 10 out of 10.00 · ·· ·· ·· ·· ·· ··· points · ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· · ·· Required: 1. Compute the company's net sales for the year. Net sales 15 ' $ 194,801./ award: 10out of 10.00 ·· ·· ·· ·· ·· ·· ·· points ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· · ·· 2. Compute the company's total cost of merchandise purchased for Ille year. otal cost of merchandise purchased $ 88,751./ 16 • av.ard: 10out of 10.00 .............................PO'i'Ots ··· 3. Prepare a multiple-step income statement that includes separate categories for selling expenses and for general and administrative expenses. VALLEY COMPANY Income Statement For Year Ended August 31, 2013 Sales ./ Less: Sales discounts ./ 3,244./ Less: Sales returns and allowances ./ 13,995./ Net sales ./ ./ Cost of goods sold Gross profit Expense Selling expenses Advertising expense Store supplies expense Rent expense - Selling space Sales salaries expense $ 17,239 194,801~ 82,768./ 4F --f ./ ./ ./ ./ 212,040./ 112,033 18,023./ 2,544./ 9,966./ 29,049./ 0 Total selling expenses General and administrative expenses Office salaries expense Rent expense - Office space Office supplies expense ~ ./ ./ ./ Total general and administrative expenses Total expenses Net income I./ oT 59.582 26,505./ 2,544./ 848./ I I $ 29,897 89,479 22,554./ award: 10outof 17 . 10.00 ............................. pornts ................................................................................................................... 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. VALLEY COMPANY Income statement For Year Ended August 31, 2013 Net sales ./ $ I Expenses General and administrative expenses Cost of goods sold ./ ./ ./ Total expenses J Net income ./ Selling expenses - 194,801 ./ 29.897./ 59,582./ 82.768./ -- 0 0 I 1$ 172,247 22,554./ 18. award: 10outof 10.00 From the dropdown box beside each definition, select the appropriate letter for each term. A. Sales discount B. Credi! period C. Discount period D. FOB destination - E. FOB shipping point F. Gross profit G. Merchandise inventory H. Purchase discount I. Cash discount J. Trade discount Goods a company owns and expects to sell toils customers. G Time period that can pass before a customer's payment is due. 8 3. Seller's description of a cash discount granted lo buyers in return for ea ~y payment A 4. •5. Reduction below list or catalog price that is negotiated in setting the price of goods. J Ownership of goods is transferred when the seller delivers goods to the carrier. E 6. Purchaser's description of a cash discount received from a supplier of goods. H 7. Reduction in a receivable or payable if it is paEd within the discount period. I ,8. Difference between net sales and the cost of goods sold. F f9. Time period in which a cash discount is available. c Ownership of goods is transferred when delivered to the buyer's place of business. D 1. ' 2. - 10. -- -- -- -- -- -- .I .I .I .I .I .I .I .I .I .I 19 • S't\'3.rd: 10 out of 10.00 ...... ··· ··· ··· ··· ··· ·points ···· ··· ··· ··· ··· ··· ··· ··· ··· ··· ··· ··· ··· ··· ··· ··· ... The cost of merchandise inventor/ includes which of the following: 0 c. Costs incurred to buy the goods. 0 a.Costs incurred to make the goods ready for saJe. 0 d. Both band c. @ e. a, b, and c. 0 b. Costs incurred to ship the goods to th-e store(s). 20 award: 10 out of 10.00 . ............... points .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. ... .. ........................................................................... · Nov. 5 Purchased 600 units of product at a cost of $10 per unit. Terms of the sale are 2110, n/60; the invoice is dated November 5. Nov. 7 Returned 25 defective units from the November 5 purchase and received full credit Nov. 15 Paid the amount due from the November 5 purchase, less the return on November 7. Prepare the journal entries to record each of the above purchases transactions of a merchandising company. Assume a perpetual inventory system. Date Nov 05 Nov 07 Merchandise inventory ./ Accounts payable ./ Accounts payable Merchandise inventory Nov 15 Debit General Journal Accounts payable Gash Merchandise inventory Credit & 6.000./ 6,000./ ./ ./ 250./ ./ ./ ./ 5.750./ 250./ 5,635./ 115./ • • 21. award: 10 out of 10.00 · · · · · · · ·points · · · · · · · · · · · · · · · · · · · ...... · · · · · .. · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · ··· · · ·· Apr. 1 Sold merchandise for $3,000, granting the customer terms of 2/10, EOM; invoice dated April 1. The cost of the merchandise is $1 ,800. Apr. 4 The customer in the April 1 sale returned merchandise and received credit for $600. The merchandise, which had cost $360, is returned to inventory. Apr. 11 Received payment for the amount due from the April 1 sale less the return on April 4. Prepare journal entries to record each of the above sales transactions oi a merchandising company. Assume a perpetual inventor/ system. Gene Date i__;;,;;;;;~~..-~~~~;;,.;;.;;~ - Apr. 1 Journal Accounts receivable Debit Credit 3,000./ Sales Apr. 1 Cost of goods sold 1,800./ Merchandise inventory Apr. 4 Sales returns and allowances Accounts receivable 600./ Apr. 4 Merchandise inventor; Cost of goods sold 360./ Apr. 11 Cash Sales discounts Accounts receivable 2,352./ 48./ S't\'3.rd: 22. 10 out of 10.00 a $ 150,000 5,000 20,000 Sales Sales discounts Sales returns and allowances Cost of goods sold 79,750 b c $550,000 $ 38,700 17,500 600 6,000 5,100 329,589 24,453 d s 255,700 4,800 900 126,500 Compute net sales. gross profit, and the gross margin ratio for each separate case a through d. (Round your gross margin ratio to 1 decimal place.) (a) Net sales $ (c) (b) 125,00G./ $ 526.500./ $ (d) 33,000./ $ 250.000./ l Gross profit 45,250./ 196,911./ 8,547./ 123,500./ IGross margin ratio 36.2%./ 37.4%./ 25.9%./ 49.4%./ 23 . award: 10 out of 10.00 ..............................points··· Nix'lt Company's ledger on July 31, its fiscal year-end, includes the following selected accounts that have normal balances (Nix'lt uses the perpetual inventory system). Merchandise inventory T. Nix, Capital T. Nix, Withdrawals Sales Sales discounts $ 37,800 115,300 7,000 160,200 4,700 Sales returns and allowances Cost of goods sold Depreciation expense Salaries expense Mis.cellaneous expenses s 6,500 105,000 10,300 32,500 5,000 A physical count of its July 31 year-end inventor/ discloses that the cost of the merchandise inventor/ still available is 535,900. Prepare the entry to record any inventory shrinkage. Date July 31 General Journal Cost of goods sold Merchandise inventory Debit ./ ./ Credit 1.900./ 1,900./ 24. S't\'3.rd: 10 out of 10.00 Identify whether each description best applies to a periodic or a perpetual inventory system. Description Inventory system a. Updates the inventory account only at period-end. Periodic inventory system ./ b. Requires an adjusting entry to record inventory shrinkage. c. Markedly increased in frequency and popularity in business witllin the past decade. Perpetual inventor/ system Perpetual inventory system d. Records cost of goods sold each time a sales transaction occurs. Perpetual inventory system e. Provides more timely information to managers. Perpetual inventory system ./ ./ ./ ./ 25 . &'9\'al'd: 10 out of 10.00 ................... ·poii\Hf . Income statement information for adidas Group, a Gem1an footwear, apparel, and accessories manufacturer, for the year ended December 31 , 2011, follows. The company applies IFRS, as adopted by the European Union, and reports its results in millions of Euros. Net income Financial income Financial expenses Operating profrt Cost of sales Income taxes Income before taxes Gross profit Royal~/ and commission income Other operating income Other operating expenses Net sales € 670 31 115 1,011 7,000 257 927 6,344 93 98 5,524 13,344 1. Prepare the multiple-step income statement for the company for the year ended December 31 , 2011 . (Enter you r answers in millions.) ADIDAS GROUP Income Statement (€ mfflions) For Year Ended December 31, 2011 Net sales ./ € Cost of sales Gross profit ./ 7,000./ ./ 6,344./ 13,344./ 0 Royalty and commission income 93./ other operating expenses ./ ./ ./ 5.524./ Operating profit ./ 1.011./ Financial expenses ./ 115./ Financial income ./ ./ ./ other operating income Income before laxes Income taxes 98./ ~ 31./ 927./ 257./ 0 Net income ./€ 670./ 2. Prepare the single-step income statement for tile company for tile year ended December 31, 2011. (Enter your answers in millions.) ADIDAS GROUP Income Statement (€ millions) For Year Ended December 31, 2011 Revenues Net sales Royalty and commission income € 93./ other operating income 98./ Financial income t Total revenues Expenses other operating expenses ./€ ./ ./ Income taxes ./ Cost of sales Financial expenses Total expenses Net income 13,344./ --t- 31./ --~ ~ j 13,566j 7,000./ 115./ 5,524./ 257./ ~ € j 12.096 610 I I