EC 351 PUBLIC FINANCE

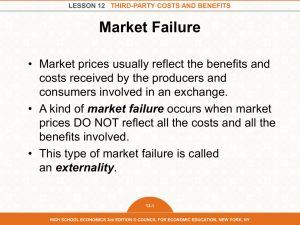

advertisement

EC 351 PUBLIC FINANCE Fall 2015 Instructor: E-mail: Office Hours: Fikret Adaman adaman@boun.edu.tr By Appointment Graduate Assistant: tba Undergraduate Assistants: There will be a contingency of assistants who will be responsible in running the “reading discussion sessions”, the names of whom tba Text Book The below textbook is mainly for background reading: Leach, J., A Course in Public Economics, Cambridge University Press. The textbook is now available at the bookstore, a copy will be made ready at the Library. Overview Public Finance is the branch of economics that studies the role of the public sector in the economy. In this course we will study the economic rationale of the public sector and the foundations of the economic theory that describes what the role of the public sector should be. In addition to material that will be covered during the semester in the class and in the problem sessions, through discussion hours we aim to give a brief introduction to the historical trajectory of public finance. These additional readings will help create the links between theories discussed in the class and their historical backgrounds as well as policy implications. There will also be a documentary movie to be shown and discussed: “The Shock Doctrine” by Naomi Klein. Schedule of the problem and discussion sessions The course will consist of four modules (see below), and for each module there will be one problem session and one discussion session. Information will be sent you separately with respect to the sessions. Course Format Attendance is required in the sense that you will be responsible from the materials that will be covered in the lectures as well as in the problem sessions. In addition, we are aiming at conducting four discussion sections, the days of which will be announced after consulting your schedule. Problem sets for the problem sessions will be put into the web site of the course a week before, and their solutions will be made available again in the website at the end of the week. You are supposed to make an attempt to solve these problems on your own before coming to recitations. Assigned readings for the discussion sessions should be read prior to meetings, and students should be prepared to participate and discuss in those sessions. Evaluation 1st Midterm: Final: Quizzes: 35% 50% 15% (To be announced) (There will be five quizzes in total, and the highest three will be counted.) Course Outline MODULE 1 SUBJECTS WILL BE COVERED IN CLASS INTRODUCTION Rationale for Public Economics FUNDAMENTALS OF WELFARE ECONOMICS Market Efficiency The beauty of the general equilibrium Welfare Economics and Pareto Efficiency (Edgeworth and Walras) Fundamental Theorems of Welfare Economics Market Failure Basic Market Failures (Public Goods and Externalities) Redistribution and Merit Goods The Role of Government Efficiency and Equity Efficiency and Distribution Trade-Offs Utilitarianism and Rawlsianism MODULE 2 SUBJECTS WILL BE COVERED IN CLASS Externalities The Problem of Externalities Private Solutions to Externalities Public Sector Solutions to Externalities Public Goods Pure and Impure Public Goods Free-rider Problem Publicly Provided Private Goods Efficiency Conditions of Public Goods Lindahl solution Manipulation of the Lindahl solution Introduction to Taxation The Desirable Characteristics of Tax Systems Taxes and Economic Efficiency Fairness General Framework for Choosing Among Tax Systems Tax Incidence Effect of Tax at the Level of a Firm Impact on Market Equilibrium Ad Valorem versus Specific Taxes The Effect of Elasticity Relationship between the Change in the Price and the Tax Taxation and Economic Efficiency Effect of Taxes Borne by Consumers Deadweight Loss of a Tax Effect of Taxes Borne by Producers Effect of Taxes Borne Partly by Consumers, Partly by Producers Taxation of Savings Taxation of Labor Income MODULE 3 SUBJECTS WILL BE COVERED IN CLASS Project Evaluation; Policy Tools Cost-Benefit Analysis Information Problem Moral hazard Adverse selection Misrepresentation Two applications Health Care Rationale for a Role of Government in the Health Care Sector Education Why is Education Publicly Provided and Publicly Financed? MODULE 4 SUBJECTS WILL BE COVERED IN CLASS State Theory Public Choice The Problem of Preference Revelation Individual Preferences for Public Goods The Problem of Aggregating Preferences Voting Mechanisms Bureaucracy Comparison of Efficiency in the Public and Private Sectors Sources of Inefficiency in the Public Sector Rent Seeking The Analyses of Expenditure Policy Income and Substitution Effects The reading materials will be made ready at the beginning of the term. A very successful term to all of you!