Executive Summary - Commission on Audit

advertisement

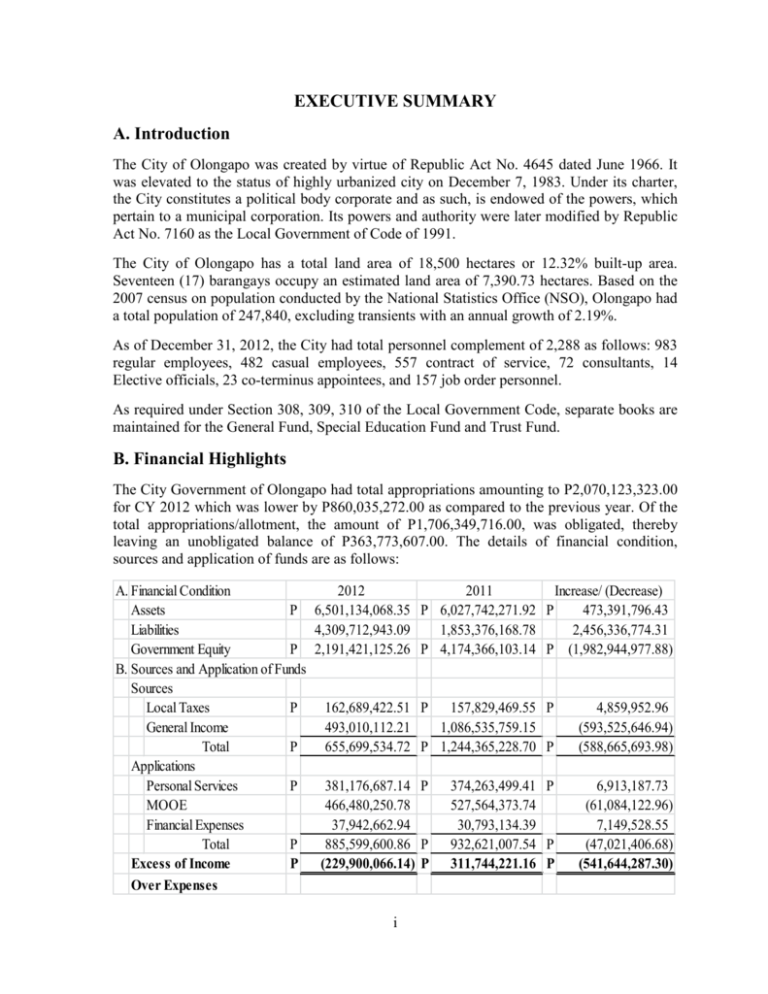

EXECUTIVE SUMMARY A. Introduction The City of Olongapo was created by virtue of Republic Act No. 4645 dated June 1966. It was elevated to the status of highly urbanized city on December 7, 1983. Under its charter, the City constitutes a political body corporate and as such, is endowed of the powers, which pertain to a municipal corporation. Its powers and authority were later modified by Republic Act No. 7160 as the Local Government of Code of 1991. The City of Olongapo has a total land area of 18,500 hectares or 12.32% built-up area. Seventeen (17) barangays occupy an estimated land area of 7,390.73 hectares. Based on the 2007 census on population conducted by the National Statistics Office (NSO), Olongapo had a total population of 247,840, excluding transients with an annual growth of 2.19%. As of December 31, 2012, the City had total personnel complement of 2,288 as follows: 983 regular employees, 482 casual employees, 557 contract of service, 72 consultants, 14 Elective officials, 23 co-terminus appointees, and 157 job order personnel. As required under Section 308, 309, 310 of the Local Government Code, separate books are maintained for the General Fund, Special Education Fund and Trust Fund. B. Financial Highlights The City Government of Olongapo had total appropriations amounting to P2,070,123,323.00 for CY 2012 which was lower by P860,035,272.00 as compared to the previous year. Of the total appropriations/allotment, the amount of P1,706,349,716.00, was obligated, thereby leaving an unobligated balance of P363,773,607.00. The details of financial condition, sources and application of funds are as follows: A. Financial Condition Assets P Liabilities Government Equity P B. Sources and Application of Funds Sources Local Taxes P General Income Total P Applications Personal Services P MOOE Financial Expenses Total P Excess of Income P Over Expenses 2012 2011 Increase/ (Decrease) 6,501,134,068.35 P 6,027,742,271.92 P 473,391,796.43 4,309,712,943.09 1,853,376,168.78 2,456,336,774.31 2,191,421,125.26 P 4,174,366,103.14 P (1,982,944,977.88) 162,689,422.51 P 157,829,469.55 P 493,010,112.21 1,086,535,759.15 655,699,534.72 P 1,244,365,228.70 P 4,859,952.96 (593,525,646.94) (588,665,693.98) 381,176,687.14 P 466,480,250.78 37,942,662.94 885,599,600.86 P (229,900,066.14) P 6,913,187.73 (61,084,122.96) 7,149,528.55 (47,021,406.68) (541,644,287.30) i 374,263,499.41 P 527,564,373.74 30,793,134.39 932,621,007.54 P 311,744,221.16 P C. Operational Highlights The City of Olongapo maintains various economic enterprises, which are (a) James L. Gordon Memorial Hospital; (b) Public Utilities Department; (c) Gordon College; (d) Olongapo City Convention Center; (e) Environmental Sanitation and Management Office; (f) Two (2) Public Markets; and (g) Slaughterhouse. In addition, the City of Olongapo also has a continuing banner program called HELPS (Health & Housing, Education & Environment, Livelihood, Labor, Peace and Order, Social Welfare and Sports). Under the HELPS Program, various sectors considerably improved their service delivery through systems upgrade, facility and equipment modernization. One remarkable achievement of the program is the City Government’s employment generation project. Consequently, concrete and tangible achievements were attained for the benefit of the general welfare of its constituents. D. Scope of Audit The audit covered the financial transactions and operations of the City of Olongapo for the year 2012. The objective of the audit was to a) ascertain the level of assurance that may be placed on management’s assertion on the financial statements; b) recommend agency improvement opportunities and c) determine the extent of implementation of prior years’ audit recommendations. E. Independent Auditor’s Report The Auditor rendered a qualified opinion on the fairness of presentation of the financial statements of the City Government of Olongapo for the year ended December 31, 2012 due to deviations from prescribed procedures and non-compliance with rules and regulations resulting in errors in some account balances and accounting deficiencies which are discussed in detail in Part II of this report and summarized as follows: ii AO No. Nature of Error Effect on the FS % of Error Accounts Affected Amount of Under to Account (Over) Statements Balance Errors affecting Assets Accounts 1 Unliquidated but Due from Officers Employees/ expended cash and Disbursing advances for time- Cash Officers bound activities 1 Erroneous inclusion of Due from Officers various transactions and improperly classified as Employees/Payroll cash advances Account 2 Overstatement of Receivables receivable account due Inter-Agency to dormant, long Receivables outstanding accounts Net errors affecting Asset Accounts Total Assets % to Total Assets Errors affecting Liability Accounts 5 Dormant, long Accounts Payable outstanding payables, aged 2 to 8 years 5 Inclusion of various Accounts Payable transactions debited to the account without prior recorded credits 5 Set up of liability and/or Accounts Payable transactions with negative credit balances 7 Doubtful/Unsupported Due to Other Funds Due to Other Funds 26 Dormant Due to BIR Due to BIR accounts, aged 3-17 years Net errors affecting Liability Accounts Total Liabilities % to Total Liabilities iii (9,037,441.61) -0.14% (3,076,181.62) -0.05% (2,122,187.36) (6,115,256.17) -0.03% -0.09% (20,351,066.76) 6,501,134,068.35 -0.31% -0.31% (84,679,245.39) -1.96% 25,113,678.04 0.58% 1,043,896.87 0.02% (11,423,003.83) -0.27% (14,596,217.15) -0.34% (84,540,891.46) 4,309,712,943.09 -1.96% -1.96% Errors affecting Government Equity 1 Unliquidated but expended cash advances for time-bound activities 1 Erroneous inclusion of various transactions improperly classified as cash advance 2 Overstatement of receivables account due to dormant, long outstanding accounts 5 Dormant, long outstanding payables, aged 2 to 8 years 5 Inclusion of various transactions debited to the accounts without prior recorded debits/credits 5 Set up of liability and/or transactions with negative credit balances 7 Doubtful/unsupported due to other funds 26 Dormant, Due to BIR, aged 3-17 years Net errors affecting Government Equity Total Government Equity % to Total Government Equity AO Accounting Deficiencies No. 4 Improper classification of cash advances 9 (9,037,441.61) -0.41% (3,076,181.62) -0.14% (2,122,187.36) (6,115,256.17) 84,679,245.39 -0.10% -0.28% 3.86% (25,113,678.04) -1.15% (1,043,896.87) -0.05% 11,423,003.83 14,596,217.15 64,189,824.70 2,191,421,125.26 2.93% 0.52% 0.67% 2.93% Accounts Affected Accounts Receivable Cash Advances Unreconciled difference between the physical inventory report and accounting records PPE Accounts 11 Unrecorded liabilities to PSALM on interest, VAT and other charges Total Accounts Payable Amount Involved (3,530,000.00) 3,530,000.00 (116,792,920.11) 1,223,460,907.00 1,106,667,987.59 For the foregoing errors and deficiencies, we recommended that management: For all Unliquidated Cash Advances a) Require the City Accountant and the City Treasurer to demand the immediate liquidation of outstanding cash advances and remittance of shortages in collection of all officials and employees still in the service. b) Require the City Accountant to take responsibility to conduct a final review, analysis and reconciliation of all dormant cash advance accounts pursuant to the Guidelines on iv the Proper Disposition/Closure of Dormant funds and/or accounts as provided by COA Circular No. 97-001 dated February 5, 1997. For the long-outstanding balances of Receivable Accounts a) Require the City Accountant to conduct a regular review, reconciliation and monitoring of all booked receivables to ensure that only valid receivables are recorded in the books. Analyse the accounts that are dormant and long outstanding and take necessary actions to drop them from the books pursuant to COA Circular No. 97-001. Reclassify the accounts which were improperly recorded as Accounts Receivable to their appropriate accounts. For the unreliable Property, Plant and Equipment account a) Require the General Service Office and the Inventory Committee to complete the physical inventory of property, plant and equipment and to prepare and submit a report thereon to determine the accuracy and correctness of the year-end balance and reconcile the material discrepancy noted in audit totalling P116,792,920.11. b) Require the Inventory Committee to conduct a thorough review of the Report on the Physical Count of Property, Plant and Equipment by conducting actual count, validation, verification and inspection of PPE owned by the City to establish their existence. c) Require the Accounting Office and the General Service Office to maintain complete PPELC and property cards, reconcile their records and effect the necessary adjustments to fairly present the balance of the affected PPE. For the Dormant Due to Other Funds Account a) Require the City Accountant to analyse the composition of the account and prepare the subsidiary ledgers for the Withheld Salaries/Wages Due for remittance to the Trust Fund Account. b) Remit immediately to the Trust Fund account the balance of Due to Other Funds amounting to P11,423,003.83 in order to correct the abnormal balances of the recipient trust fund account. For the Dormant Due to BIR Account a) Require the City Accountant to take responsibility for conducting review, analysis and reconciliation of the dormant and long outstanding Due to BIR accounts of P14,596,917.15, reconcile them with the Tax Remittance Advice and Tax Remittance Reports. Prepare adjusting entries/reconciliation entries and remit all taxes due to the BIR. v Other Significant Audit Observations and Recommendations Summarized below are the other significant audit observations noted and the corresponding recommendations that are discussed in detail in Part II of the report. 1. The terms and conditions of the contract of lease executed by and between the City Government and SM Prime Holdings allowed the demolition of the Olongapo City Mall without proper adherence to the Audit Guidelines on the divestment or disposal procedures, thereby caused the overstatement of the Property, Plant and Equipment by P0.174 billion due to the failure of the City Accountant to drop the demolished property in the books of accounts contrary to Section 370 of RA 7160 and COA Circular No. 89296 dated January 27, 1989 and the Manual on NGAS. We recommended that management (a) submit explanation and justifications from the signing officials and members of the negotiating team on why the terms and conditions of the Contract of Lease allowed the demolition of the Olongapo City Mall which resulted to their failure to comply with the provisions of Commission on Audit Circular No. 89296 dated January 27, 1989 which governs the disposal and divestment of government property knowing fully well that the said property would be demolished and would no longer be used by the LESSEE; and (b) Require the City Accountant to request an Authority from the COA Central Office for the write-off/dropping of the demolished asset from the books of accounts duly supported with the Contract of Lease, other supporting documents and management justifications pursuant to the 2009 Revised Rules and Procedures of the Commission on Audit for the purpose of fair presentation of the PPE account in the financial statements 2. The management incurred delays of almost one year from the issuance of the CY 2011 Annual Audit Report in the submission of explanation and justifications relative to its compliance with the Previous Year’s AAR Recommendations on the adoption of the rental rate of P40/square meter/month instead of the P520/square meter/month rental rate recommended by the agency’s appraisal committee; the minimal increase in Monthly Guaranteed Lease (MGL) of 6% beginning the 11th year of the term of the lease and every five (5) years thereafter is lower than the allowable 7% annual increase of the agreed rental on residential apartments and other terms and conditions which were found in the initial review of the Lease Contract of Olongapo City Mall (OCM) with SM Prime Holdings, Inc. The prolonged inaction by the management in complying with the recommendations contained in the previous year’s Annual Audit Report cast doubts on the legality and regularity of the terms and conditions of the contract of lease. We recommended that management create a technical committee to review the terms and conditions of the Lease Contract entered into by the City with SM Prime Holdings to evaluate and assess the stipulations contained therein taking into consideration the amendment of the terms and conditions that are disadvantageous on the part of the management. 3. The management submitted a Supplement to the Asset Purchase Agreement (APA) with the Cagayan Electric Power and Light Company, Inc. (CEPALCO) dated July 12, 2012 vi providing stipulations on the sunset date, assets added by the seller, aggregate increase in the assets and joint inventory of the assets which are deemed advantageous only on the part of the buyer because all additions to assets, regardless of their utility and length of service life shall be treated as “Excluded Assets” within the purview of the PPA. We recommended that (a) management should restudy the terms and conditions of the “Supplement” such that assets purchased during the prolonged transition period until sunset date such as poles, distribution transformers, wires and other electrical hardware which prolong the life, improve the reliability, safety and efficiency of the distribution utility service and installation of assets to serve new customers be considered as additions to the Asset Base defined as Assets in Article 2, Section 2.01 of the APA; and (b) require the Transition Distribution Utility Improvement and Maintenance Team created by the City Mayor under Executive Order No. 01 dated January 3, 2011 to submit their accomplishment report on the extent of implementation of the capital expenditures, civil works and construction services undertaken by the buyer during the transition period pursuant to the General Scope of Works provided in Schedule 10 (Transition Distribution Utility Efficiency and Maintenance Program) of the Asset Purchase Agreement. Our findings and recommendations were discussed with the concerned agency officials and their comments were incorporated in the report, where appropriate. Status of Implementation of Prior Year’s Audit Recommendations Of the fourteen prior year’s audit recommendations, six were implemented, two were partially implemented and six were not implemented. vii