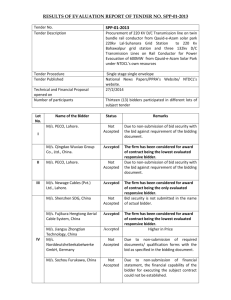

general guide to the

advertisement