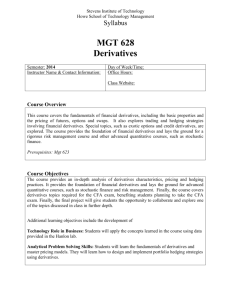

Derivatives and Risk Management in The Petroleum, Natural Gas

advertisement