Working capital

advertisement

Chapter

10

Working capital

1

10.1

Working capital

Working capital is the capital available for conducting the day-to-day operations of the

business and consists of current assets and current liabilities.

Current assets

Inventories

Trade receivables

Cash

Short term investments

Current liabilities

Trade payables

Bank overdrafts

Working capital can be viewed as a whole but interest is usually focussed on the individual

components such as inventories or trade receivables. Working capital is effectively the net

current assets of a business.

Working capital can either be:

Positive

Negative

Current assets are greater than current liabilities

Current assets are less than current liabilities

Working capital management

Working capital management is the administration of current assets and current liabilities.

Effective management of working capital ensures that the organisation is maximising the

benefits from net current assets by having an optimum level to meet working capital

demands.

It is difficult trying to achieve and maintain an optimum level of working capital for the

organisation. For example having a large volume of inventories will have two effects, firstly

there will never be stock outs, so therefore the customers are always satisfied, but secondly it

means that money has been spent on acquiring the inventories, which is not generating any

returns (i.e. inventories is a non productive asset), there are also additional costs of holding

the inventories (i.e. warehouse space, insurance etc).

The important aspect of working capital is to keep the levels of inventories, trade receivables,

cash etc at a level which ensures customer goodwill but also keeps costs to the minimum.

With trade payables, the longer the period of credit the better as this is a form of free credit,

but again the goodwill with the supplier may suffer.

2

10.2

Working capital cycle (operating/trading/cash cycle)

The working capital cycle measures the time between paying for goods supplied to you and

the final receipt of cash to you from their sale. It is desirable to keep the cycle as short as

possible as it increases the effectiveness of working capital. The diagram below shows how

the cycle works.

Cash

Trade receivables

Customer owing money,

as sales made on credit

Trade payables

Money owing to

suppliers as stock

purchased on credit

Inventories

Sold on credit

The table below shows how the activities of a business have an impact on the cash flow.

TRADE PROCESS

Inventories are purchased on credit

which creates trade payables.

The sale of inventories is made on

credit which creates trade

receivables.

Trade payables need to be paid, and

the cash is collected from the trade

receivables.

EFFECTS ON CASH

Inventories bought on credit temporarily help with

cash flow as there is no immediate to pay for these

inventories.

This means that there is no cash inflow even

though inventory had been sold. The cash for the

sold inventory will be received later.

The cash has to be collected from the trade

receivables and then paid to the trade payables

otherwise there is a cash flow problem.

3

The control of working capital is ensuring that the company has enough cash in its bank.

This will save on bank interest and charges on overdrafts. The company also needs to ensure

that the levels of inventories and trade receivables is not too great, as this means funds are

tied up in assets with no returns (known as the opportunity cost).

The working capital cycle therefore should be kept to a minimum to ensure efficient and cost

effective management.

Working capital cycle for a trade

Inventories days (time inventories are

held before being sold)

+

(Inventories / cost of sales) x 365 days

Trade receivables days (how long the

credit customers take to pay)

-

(Trade receivables / credit sales) x 365 days

Trade payables days (how long the

company takes to pay its suppliers)

=

(Trade payables / purchases) x 365 days

Working capital cycle (in days)

Working capital cycle (in days)

+

-

=

Please note that for the “trade payable days” calculation, if information about credit

purchases is not known then cost of sales is used instead.

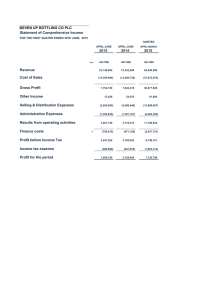

Example 10.1 – (CIMA P7 Nov 06)

DX had the following balances in its trial balance at 30 September 2006:

Trial balance extract at 30 September 2006

$000

Revenue

Cost of sales

Inventories

Trade receivables

Trade payables

Cash and cash equivalents

$000

2,400

1,400

360

290

190

95

Calculate the length of DX’s working capital cycle at 30 September 2006.

4

Working capital cycle in a manufacturing business

Average time raw materials are in stock

+

(Raw materials / purchases) x 365 days

+

Time taken to produce goods

+

(WIP & finished goods / cost of sales) x 365 days

+

Time taken by customers to pay for goods

-

(Trade receivables / credit sales) x 365 days

-

Period of credit taken from suppliers

=

(Trade payables / purchases) x 365 days

=

Working capital cycle (in days)

Working capital cycle (in days)

Please note that for the “trade payable days” calculation, if information about credit

purchases is not known then cost of sales is used instead.

Example 10.2 – (CIMA P7 May 05)

AD, a manufacturing entity, has the following balances at 30 April 2005:

Extract from financial statements:

$000

Trade receivables

Trade payables

216

97

Revenue (all credit sales)

Cost of sales

Purchases in year

992

898

641

Inventories at 30 April 2005:

Raw materials

Work in progress

Finished goods

111

63

102

Calculate AD’s working capital cycle.

5

The shorter the cycle, the better it is for the company as it means:

Inventories are moving though the organisation rapidly.

Trade receivables are being collected quickly.

The organisation is taking the maximum credit possible from suppliers.

The shorter the cycle, the lower the company’s reliance on external supplies of finance like

bank overdrafts which is costly.

Excessive working capital means too much money is invested in inventories and trade

receivables. This represents lost interest or excessive interest paid and lost opportunities (the

funds could be invested elsewhere and earn a higher return).

The longer the working capital cycle, the more capital is required to finance it.

Exam questions often ask how working capital can be managed effectively. To answer the

question you need to discuss the overall working capital levels, and then the individual

components like stock, debtors and creditors.

10.3

Overtrading

When a company is trading large volumes of sales very quickly, it may also be generating

large amounts of credit sales, and as a result large volume of trade receivables. It will also be

purchasing large amounts of inventories on credit to maintain production at the same rate as

sales and therefore have large volumes of trade payables. This will extend the working capital

cycle which will have an adverse effect on cash flow. If the company doesn’t have enough

working capital, it will find it difficult to continue as there would be insufficient funds to

meet all costs as they fall due.

Overtrading occurs when a company has inadequate finance for working capital to support its

level of trading. The company is growing rapidly and is trying to take on more business that

its financial resources permit i.e. it is “under-capitalised”. Overtrading typically occurs in

businesses which have just started to trade and where they may have suddenly begun to

experience rapid sales growth. In this situation it is quite easy to place high importance on

sales growth whilst neglecting to manage the working capital.

6

Symptoms of overtrading

·

·

·

·

Fast sales growth.

Increasing trade payables.

Increasing trade receivables.

Fall in cash balances and

increasing overdraft.

Remedies for overtrading

Short-term solutions

· Speeding up collection from customers.

· Slowing down payment to suppliers.

· Maintaining lower inventory levels.

Long term solutions

· Increase the capital by equity or longterm debt.

Overtrading may result in insolvency which means a company has severe cash flow

problems, and that a thriving company, which may look very profitable, is failing to meets its

liabilities due to cash shortages.

Over-capitalisation

This is the opposite of over trading. It means a company has a large volume of inventories,

trade receivables and cash balances but very few trade payables. The funds tied up could be

invested more profitably elsewhere and so this an effective use of working capital.

Differences in working capital for different industries

Manufacturing

Inventories

Trade

receivables

Trade

payables

High volume of WIP

and finished goods.

High levels of trade

receivables, as they tend

be dependant on a few

customers.

Low to medium levels

of trade payables.

Retail

Service

Goods for re-sale only

and usually low

volume.

Very low levels as

most goods are bought

in cash.

None or very little

inventories.

Very high levels of

trade payables due to

huge purchases of

inventory.

Low levels of

payables.

7

Usually low levels as

services are paid for

immediately.

10.4

Types of working capital policy

Within a business, funds are required to finance both non-current and current assets. The

level of current assets fluctuates, although there tends to be an underlying level required for

current assets.

Assets

£m

100

Temporary fluctuating current assets

80

Permanent current assets

(Core level of inventories, trade receivables etc)

50

Non current assets

0

Time

A company must decide on a policy on how to finance its long and short-term assets. There

are 3 types of policies that exist:

Conservative policy

Moderate policy

Aggressive policy

All the non current assets,

permanent assets and some

of the temporary current

assets are financed by longterm finance.

All the non current assets

and permanent asset are

financed by long-term

finance. The temporary

fluctuating assets financed

by short-term finance.

£90m long term debt and

equity.

£80m long term debt and

equity.

All the non current assets

and part of permanent

assets financed by long

term. Remaining

permanent assets all

temporary fluctuating assets

by short term.

£65m long term debt and

equity.

£10m short term overdrafts

and bank loans.

£20m short term overdrafts

and bank loans.

£35m short term overdrafts

and bank loans.

8

Summary of the three policies:

Conservative policy

Moderate policy

Aggressive policy

Long term

finance

Non current assets

Permanent assets

Temporary current assets

Non current assets

Permanent assets

Non current assets

Permanent assets

Short term

finance

Temporary current assets

Temporary current assets

Permanent assets

Temporary current assets

With an aggressive working capital policy, a company will hold minimal levels of inventories

in order to minimise costs. With a conservative working capital policy the company will hold

large levels of inventories. The moderate policy is somewhere in between the conservative

and aggressive.

Short-term debt can be cheap, but it is also riskier than long-term finance since it must be

continually renewed. Therefore with an aggressive policy, the company may report higher

profits due to lower level of inventories, trade receivables and cheaper finance, but there is

greater risk.

Example 10.3 – (CIMA P7 May 06)

A conservative policy for financing working capital is one where short-term finance is used

to fund:

A

B

C

D

all of the fluctuating current assets, but no part of the permanent current assets.

all of the fluctuating current assets and part of the permanent current assets.

part of the fluctuating current assets and part of the permanent current assets.

part of the fluctuating current assets, but no part of the permanent current assets.

Example 10.4 – (CIMA P7 Nov 05)

An entity’s working capital financing policy is to finance working capital using short-term

financing to fund all the fluctuating current assets as well as some of the permanent part

of the current assets.

What is this policy an example of?

9

10.5

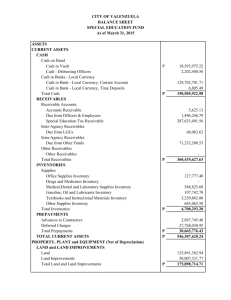

Working capital ratios

Ratios are way of comparing financial values and quantities to improve our understanding. In

particular they are used to asses the performance of a company.

When analysing performance through the use of ratios it is important to use comparisons as a

single ratio is meaningless.

The use of ratios

·

·

·

·

To compare results over a period of time

To measure performance against other organisations

To compare results with a target

To compare against industry averages

We shall now look at some of the working ratios in detail and explain how they can be

interpreted.

1

Current ratio (CA) or working capital ratio

CA

=

Current assets

Current liabilities

(times)

The current ratio measures the short term solvency or liquidity; it shows the extent to which

the claims of short-term creditors are covered by assets. The current ratio is essentially

looking at the working capital of the company. Effective management of working capital

ensures the organisation is running efficiently. This will eventually result in increased

profitability and positive cash flows. Effective management of working capital involves low

investment in non productive assets like trade receivables, inventory and current account

bank balances. Also maximum use of free credit facilities like trade payables ensures

efficient management of working capital.

The normal current ratio is around 2:1 but this varies within different industries. Low current

ratio may indicate insolvency. High ratio may indicate not maximising return on working

capital. Valuation of inventories will have an impact on the current ratio, as will year end

balances and seasonal fluctuations.

2

Quick ratio or acid test

Quick ratio

=

Current assets less inventories

Current liabilities

(times)

This ratio measures the immediate solvency of a business as it removes the inventories out of

the equation, which is the item least representing cash, as it needs to be sold. Normal is

around 1: 1 but this varies within different industries.

10

3

Trade payable days (turnover)

Year end trade payables

Credit purchases (or cost of sales)

x

365 days

This is the length of time taken to pay the suppliers. The ratio can also be calculated using

cost of sales, as credit purchases are not usually stated in the financial statements. High trade

payable day’s is good as credit from suppliers represents free credit. If it’s too high then there

is a risk of the suppliers not extending credit in the future and may lose goodwill. High trade

payable days may also indicate that the business has no cash to pay which indicates

insolvency problems.

4

Trade receivable days (turnover)

Year end trade receivables

Credit sales (or turnover)

x

365 days

This is the average length of time taken by customers to pay. A long average collection

means poor credit control and hence cash flow problems may occur. The normal stated credit

period is 30 days for most industries. Changes in the ratio may be due to improving or

worsening credit control. Major new customer pays fast or slow. Change in credit terms or

early settlement discounts are offered to customers for early payment of invoices.

5

Inventory days

Average inventory

Cost of sales

x

365 days

Average inventory can be arrived by taking this year’s and last year’s inventory values and

dividing by 2 - (Opening inventories + closing inventories) / 2. This ratio shows how long

the inventory stays in the company before it is sold. The lower the ratio the more efficient

the company is trading, but this may result in low levels of inventories to meet demand. A

lengthening inventory period may indicate a slow down in trade and an excessive build up of

inventories, resulting in additional costs.

6

Inventory turnover is the reciprocal of inventory days.

Cost of sales

Average inventory

x

number of times

This shows how quickly the inventory is being sold. It shows the liquidity of inventories, the

higher the ratio the quicker the inventory is sold.

11

Example 10.5 – (CIMA P7 May 07)

DR has the following balances under current assets and current liabilities:

Current assets

$

Current liabilities

$

Inventory

50,000

Trade payables

88,000

Trade receivables

70,000

Interest payable

7,000

Bank

10,000

Calculate DR’s quick ratio.

Example 10.6

A company's current assets are less than its current liabilities. The company issues new

shares at full market price.

What will be the effect of this transaction upon the company’s working capital and on

its current ratio?

Working capital

A

B

C

D

Increase

Constant

Constant

Decrease

Current ratio

Increase

Increase

Decrease

Decrease

Example 10.7

If the current ratio for a company is equal to its acid test (that is, the quick ratio), then:

A

B

C

D

The current ratio must be less than one.

Working capital is negative.

Trade payables and overdraft are greater than trade payables plus inventories.

The company does not carry any inventories

12

Example 10.8

The following are extracts of the Income Statement and Balance Sheet for Umar plc.

Extract Balance Sheet at 30 June

20X2

£’000

£’000

Current assets

Inventories

Trade receivables

Bank

Current liabilities

Trade payables

Taxation

20X1

£’000

84

58

6

148

74

46

10

130

72

20

92

82

20

102

Net current assets

56

Extract Income Statement for the year ended 30 June

20X2

20X1

£’000

£’000

£’000

Turnover

418

Opening inventory

74

58

Purchases

324

318

398

376

Closing inventory

(84)

(74)

314

Gross profit

104

Calculate and comment on the following ratios for Umar plc:

1

2

3

4

5

6

Current ratio

Quick ratio

Inventory days

Trade receivable days

Trade payable days

Working capital cycle in days

13

£’000

-

£’000

392

302

90

Example 10.9

Controlling working capital

Explain how a manufacturing company could control its working capital levels, and the

impact of the suggested control measures.

Example 10.10

Working capital mini Q’s

During January 20X4, Gazza Ltd made credit sales of £30,000, which have a 25% mark up.

It also purchased £20,000 of inventories on credit.

Calculate by how much the working capital will increase or decrease as a result of the

above transactions?

Tuffy Ltd has an annual turnover of £18m on which it earns a margin of 20%. All the sales

and purchases are made on credit and it has a policy of maintaining the following levels of

inventories, trade receivables and payables throughout the year.

Inventory

Trade receivable

Trade payable

£2 million

£5 million

£2.5 million

Calculate Tuffy Ltd’s cash cycle to the nearest day?

14

Key summary of chapter

Working capital is the capital available for conducting the day-to-day operations of the

business and consists of current assets and current liabilities.

Working capital management is the administration of current assets and current liabilities.

Effective management of working capital ensures that the organisation is maximising the

benefits from net current assets by having an optimum level to meet working capital

demands.

TRADE PROCESS

Inventories are purchased on credit

which creates trade payables.

The sale of inventories is made on

credit which creates trade

receivables.

Trade payables need to be paid, and

the cash is collected from the trade

receivables.

EFFECTS ON CASH

Inventories bought on credit temporarily help with

cash flow as there is no immediate to pay for these

inventories.

This means that there is no cash inflow even though

inventory had been sold. The cash for the sold

inventory will be received later.

The cash has to be collected from the trade

receivables and then paid to the trade payables

otherwise there is a cash flow problem.

Working capital cycle

Inventories days (time inventories are

held before being sold)

+

(Inventories / cost of sales) x 365 days

Trade receivables days (how long the

credit customers take to pay)

-

(Trade receivables / credit sales) x 365 days

Trade payables days (how long the

company takes to pay its suppliers)

=

(Trade payables / purchases) x 365 days

Working capital cycle (in days)

Working capital cycle (in days)

+

-

=

15

Working capital cycle in a manufacturing business

Average time raw materials are in stock

+

(Raw materials / purchases) x 365 days

+

Time taken to produce goods

+

(WIP & finished goods / cost of sales) x 365 days

+

Time taken by customers to pay for goods

-

(Trade receivables / credit sales) x 365 days

-

Period of credit taken from suppliers

=

(Trade payables / purchases) x 365 days

=

Working capital cycle (in days)

Working capital cycle (in days)

Overtrading occurs when a company has inadequate finance for working capital to support

its level of trading. The company is growing rapidly and is trying to take on more business

that its financial resources permit i.e. it is “under-capitalised”.

Conservative policy

Moderate policy

Aggressive policy

Long term

finance

Non current assets

Permanent assets

Temporary current assets

Non current assets

Permanent assets

Non current assets

Permanent assets

Short term

finance

Temporary current assets

Temporary current assets

Permanent assets

Temporary current assets

16

Working capital ratios

Current assets_ (number of times)

Current liabilities

Current ratio

Quick ratio

Current assets – inventory

Current liabilities

(number of times)

Trade payables_____

Cost of sales (or purchases)

Trade payable days

Inventory_

Cost of sales

Inventory days

Trade receivable days

Trade receivable

Sales

Inventory turnover

Cost of sales

Average inventory

17

x 365 days

x 365 days

x 365 days

x

number of times

Solutions to lecture examples

18

Chapter 10

Example 10.1 – (CIMA P7 Nov 06)

Inventories days

Trade receivable days

Trade payable days

Working capital cycle

(Inventories / cost of sales) x 365 days

(360 / 1,400) x 365 days

(Trade receivables / credit sales) x 365 days

(290 / 2,400) x 365 days

(Trade payables / cost of sales) x 365 days

(190 / 1,400) x 365 days

93.9 + 44.1 – 49.5

Example 10.2 – (CIMA P7 May 05)

1

Average time raw materials are in stock

(Raw materials / purchases) x 365 days

(111 / 641) x 365 = 63.2 days

2

Time taken to produce goods

(Work in progress & finished goods / cost of sales) x 365 days

(63 + 102 / 898) x 365 = 67.1 days

3

Time taken by customers to pay for goods

(Trade receivables / credit sales) x 365 days

(216 / 992) x 365 = 79.5 days

4

Period of credit taken from suppliers

(Trade payables / purchases) x 365 days

(97 / 641) x 36 = 55.2 days

Working capital cycle = 63.2 + 67.1 + 79.5 – 55.2 = 154.6 days

19

93.9 days

44.1 days

49.5 days

88.5 days

Example 10.3 – (CIMA P7 May 06)

The answer is D.

Example 10.4 – (CIMA P7 Nov 05)

An aggressive policy.

Example 10.5 – (CIMA P7 May 07)

Quick ratio

=

(current assets – inventory) / current liabilities

=

(70,000 + 10,000) / (88,000 + 7,000)

=

0.84

Example 10.6

The answer is A.

The cash balance will increase, which means there is more working capital. The current ratio

will increase as there are more current assets than current liabilities.

Example 10.7

The answer is D.

20

Example 10.8

1

Current ratio

= 148 / 92

=130 / 102

=

=

1.61

1.27

for 20X2

for 20X1

The current ratio has increased, meaning that the organisation is more liquid. This is due to

the fact that inventory and trade receivables have increased (which are non productive assets),

and trade payables have been reduced. Although this may be better for the current ratio, it

may not necessarily mean that the company is operating more efficiently. Has it increased it

inventory piles because it anticipates higher sales and doesn’t want to run out? Is it offering

it’s credit customers longer time to pay to increase sales? Why are they paying their suppliers

quicker? Surely it would be better to take as long as possible?

2

Quick ratio

=

=

(148 – 84) / 92 =

(130 – 74) / 102 =

0.70

0.55

for 20X2

for 20X1

In 20X2 current liabilities are better covered than 20X1. Bad management of working capital

perhaps…investigate further.

3

Inventory days =

=

(74 + 84) x 0.5 / 314 x 365 days =

(58 + 74) x 0.5 / 302 x 365 days =

91.8 days for 20X2

79.8 days for 20X1

Inventory is taking longer to sell; this could indicate poor inventory management. Why have

inventory levels risen? Maybe the company is taking a cautious approach and wants to

ensure enough is available to meet customer needs. But this is resulting in additional costs

(unproductive asset)

4

Trade receivable days =

=

58 / 418 x 365 days

46 / 392 x 365 days

=

=

50.6 days for 20X2

42.8 days for 20X1

The collection of debts is worsening. Have the credit terms been extended to increase sales.

Are there new customers who were not screened properly, resulting in delayed payments? Is

there a delay in issuing invoices, lack of screening new customers? Are the year end figures

representatives of the year? Perhaps there are seasonal fluctuations that need to be

considered. Further investigation required as yet again this is an unproductive asset.

5

Trade payable days =

=

72 / 324 x 365 =

82 / 318 x 365 =

81.1 days for 20X2

94.1days for 20X1

(Alternatively could have used cost of sales)

The suppliers are being paid quicker, which is good for relationship with the suppliers, but

bad for cash flow purposes. It is still quite high and might jeopardise supplier relationship,

discounts foregone etc. Trade credit is a free source of finance, and the company must try to

maximise this.

21

6

Working capital cycle

Inventories days

Plus

Trade receivables days

Minus

Trade payables days

Equals

Working capital cycle (in days)

20X2

91.8

20X1

79.8

50.6

42.8

(81.1)

(94.1)

61.3

28.5

In 20X2, the working capital cycle increased to 61.3 days from 28.5 days in 20X1. The

company is taking longer to covert its inventories into cash. The management of inventories,

receivables and payables has deteriorated, and this needs to be investigated and corrected.

Example 10.9

Controlling working capital

Some of the practical aspects that could be taken to achieve this include:

1

Reducing average raw material inventory holding period

·

Ordering in small quantities to meet immediate production requirements, but could

lose quantity discounts.

·

Reducing the level of buffer stocks if these are held, but this will increase the risk of

production being halted due to a stock out.

·

Reducing the lead time allowed to suppliers, but could also increase the risk of a

stock out.

2

Increase the period of credit taken from suppliers

·

If the credit period is extended then the company may lose discounts from prompt

payment. The financial effect of this should be calculated and compared with the cost

of funds from other sources.

·

If credit period is extended then goodwill may be lost, which is important in the event

of goods being required urgently.

22

3

Reducing the time taken to produce goods and inventory holding period or

finished inventories

·

Efficiency leads to cost savings, therefore finding an efficient way to produce goods

(i.e. in economic batch quantities), but the company must ensure than quality is not

sacrificed.

·

The savings arising from inventory holding reduction must be evaluated against the

cost of inventory out, together with the effect on customer service.

4

Reducing the average debt collection period

·

The administrative costs of speeding up debt collection and the effect on sales of

reducing credit period allowed must be evaluated.

Example 10.10

Working capital mini Q’s

Firstly note the difference between a mark up and a margin

Mark-up = 100% + 25% = 125%

Margin = 75% + 25% = 100%

Profit = (25 / 125)

Profit = (25 / 100)

1

Cost = 100 / 125

Cost = 75 / 100

Effect on WC

Increase in trade receivables

Increase in trade payables

Inventories – increase due to purchases

Inventories – Decrease due to sales (i.e. COS)

{30,000 x 100 / 125}

Net effect on WC - increase

£30,000

(£20,000)

£20,000

(£24,000)

£ 6,000

2

Cash cycle = inventory days + trade receivable days – trade payable days

Inventory days

=

Average inventory

x

365

Cost of sales

Cost of sales = £18 million x 0.8 = £14.4 million

23

Inventory days

= £2 / £14.4 x 365

=

51 days

Trade receivable days

= Trade receivable / sales x 365

= £5 / £18 x 365

=

101 days

= Trade payable / COS x 365

= £2.5m / £14.4 x 365

=

(63) days

=

89 days

Trade payable days

Cash cycle

89 days is the average time from the payment of a supplier to the receipt from a customer.

24