ACC3201 Intermediate Financial Accounting I

advertisement

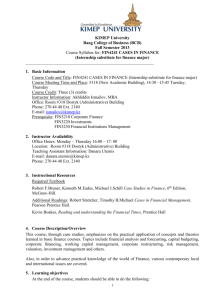

KIMEP UNIVERSITY Bang College of Business Summer I 2013 Course Syllabus for: ACC3201 INTERMEDIATE ACCOUNTING I __________________________________________________________________________________________ 1. Basic Information Course Code and Title: ACC3201 INTERMEDIATE ACCOUNTING I Course Meeting Time and Place: Hall #125, Valikhanov Building, 11:30 – 12:40, Tuesday and Thursday Course Credit: Three (3) credits Instructor Information: Serzhan Nurgozhin, MA, DipIFRS Office: Room #322 Dostyk (Administrative) Building Phone: 270 44 40 Ext. 2110; E-mail: serzhan@kimep.kz Prerequisite: ACC2101 Intermediate Financial Accounting 2. Instructor Availability Office Hours: Tuesday, Thursday, 13:30 – 14:30or by appointment Location: Office #322 Dostyk (Administrative) Building 3. Instructional Resources Required Textbook Intermediate Accounting by J.D. Spiceland, J.F. Sepe, M.W. Nelson; McGraw-Hill, sixth edition, 2011. 1 4. Course Description/Overview This course begins in-depth analysis of accounting issues introduced in Financial Accounting. It addresses some of the following topics: the accounting process, financial accounting and reporting, the income statement and the statement of retained earnings, the balance sheet and the statement of cash flows, revenue recognition and income determination, cash and receivables, inventory valuation and departures from historical cost and estimating inventory cost. 5. Learning objectives At the end of the course, students should be able to do the following: To further develop understanding of accounting and its role in the business environment. To have a deeper and more detailed consideration of the accounting valuation techniques and reporting practices existing in the current business environment. To have deeper understanding of conceptual framework for financial reporting and provides a variety of practical solutions for presenting and interpreting accounting data. Describe the function and primary focus of financial accounting. Explain the purpose of the FASB’s conceptual framework and discuss the historical development of accounting standards. Describe the purpose of the income statement and understand its usefulness and limitations. Demonstrate ability to prepare income statement in accordance with the GAAP requirements. Explain the difference between net income and comprehensive income and how we report components of the difference. Convert from cash basis net income to accrual basis net income. Describe the purpose of the balance sheet and understand its usefulness and limitations. Demonstrate ability to prepare balance sheet in accordance with the GAAP requirements. Describe the purpose of the statement of cash flows. Demonstrate ability to prepare cash flow statement in accordance with the GAAP requirements using direct or indirect method. Understand the concepts of future and present value. Briefly describe how the concept of the time value of money is incorporated into the valuation of bonds, long-term leases, and pension obligations. Understand the issues related to accounting for cash and receivables, such as: o approaches to estimating bad debts; o the accounting treatment of short-term notes receivable; Differentiate between the use of receivables in financing arrangements accounted for as a secured borrowing and those accounted for as a sale. Understand the issues related to accounting for inventories such as: o valuation of inventories; o accounting for cash discounts; o merchandise returns; Differentiate between the specific identification, FIFO, LIFO, and average cost methods used to determine the cost of ending inventory and cost of goods sold. Understand and apply the lower-of-cost-or-market rule used to value inventories. Estimate ending inventory and cost of goods sold using the gross profit method the retail inventory method. Understand the issues related to accounting for property, plant, and equipment, such as: o costs included in the initial cost of property, plant, and equipment, natural resources, and intangible assets; o cost of individual operational assets acquired as a group for a lump-sum purchase price; o cost of operational assets acquired in exchange for equity securities, or through donation; o cost of a self-constructed asset and the amount of capitalized interest; o dispositions and exchanges of nonmonetary assets; 2 o depreciation, amortization, and depletion of long-term assets; o impairment of the value of long-term assets; o accounting treatment of repairs and maintenance, additions, improvements, and rearrangements to operational assets. 6. Teaching Methodology The format of the course is a mix of lecture and tutorial. 7. Assessment Scheme Continuous Assessment Mid-term Exam 1 Mid-term Exam 2 Final Assessment Examination TOTAL 60% 30% 30% 40% 40% 100% ASSESSMENT IN DETAIL Class Attendance and Participation Attendance of the lectures and tutorials is mandatory. Up to 2% bonus for ACTIVE participation may be awarded on top of the normal grade. Examination There will be a continuous assessment throughout the course in the form of three mid-term and one final in-class examinations, which may include problem solving, quizzes, multiple choice questions, and essays. Bring your passport, or personal ID, or driving license to the each exam. Cheating will result in disciplinary action. 8. Grading Scale Letter grades for the course will follow the same standards as specified in the Catalog. See the following table for grading scale: 90 to 100 85 to 89 80 to 84 77 to 79 73 to 76 70 to 72 Pass A+ Pass A Pass APass B+ Pass B Pass B- 67 to 69 63 to 66 60 to 62 57 to 59 53 to 56 50 to 52 Pass C+ Pass C Pass CPass D+ Pass D Pass D- below 50 F 9. Course Policies and Instructor’s expectations of students Course instructor is available to you to assist and answer your questions individually during the office hours. Attendance of the lectures and tutorials is strongly required. Students are expected to be on time on the designated class periods. Students are required to access information on KIMEP Network – disk L for problem solutions, announcements, etc. 3 Grading, attendance and examination policies and procedures will be applied in accordance with stated KIMEP rules of conduct and discipline. 10. Period-by-period Schedule (Tentative) Date of the Session Topics Sep 3, 5 Introduction: course structure. Ch.1: Environment and the Theoretical Structure of Financial Accounting Sep 10, 12, 17 Ch.2: Review of the Accounting Process Sep 19, 24, 26 Ch.3: The Balance Sheet and Financial Disclosures Oct 1,3, 8 Ch.4: The Income Statement and Statement of Cash Flows Oct 10 Short Exams Exam 1 - Ch. 1, 2, 3, 4 Oct 15, 17, 22 Ch.5: Income Measurement and Profitability Analysis Oct 24, 29 Ch 6: Time Value of Money Concepts Oct 31, Nov 5, 7 Ch 7: Cash and Receivables Nov 12 Exam 1 - Ch. 5, 6, 7 Nov 14, 21, 26 Ch 8: Inventories, Measurement Nov 26, 28 Ch 9: Inventories: Additional Issues Dec 3, 5, 10, 12 Ch 10: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition. Ch11: Property, Plant, and Equipment and Intangible Assets: Utilization Impairments Date will beand determined by the Registrar Final Exam – Ch. 8, 9, 10, 11. 4