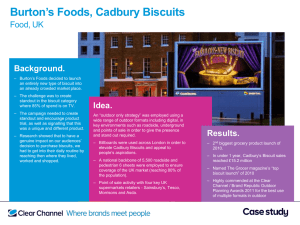

dr pepper snapple group, inc.

advertisement