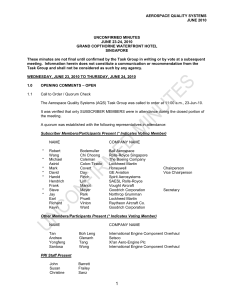

Auditing Standard No. 2 versus Auditing Standard No. 5

advertisement