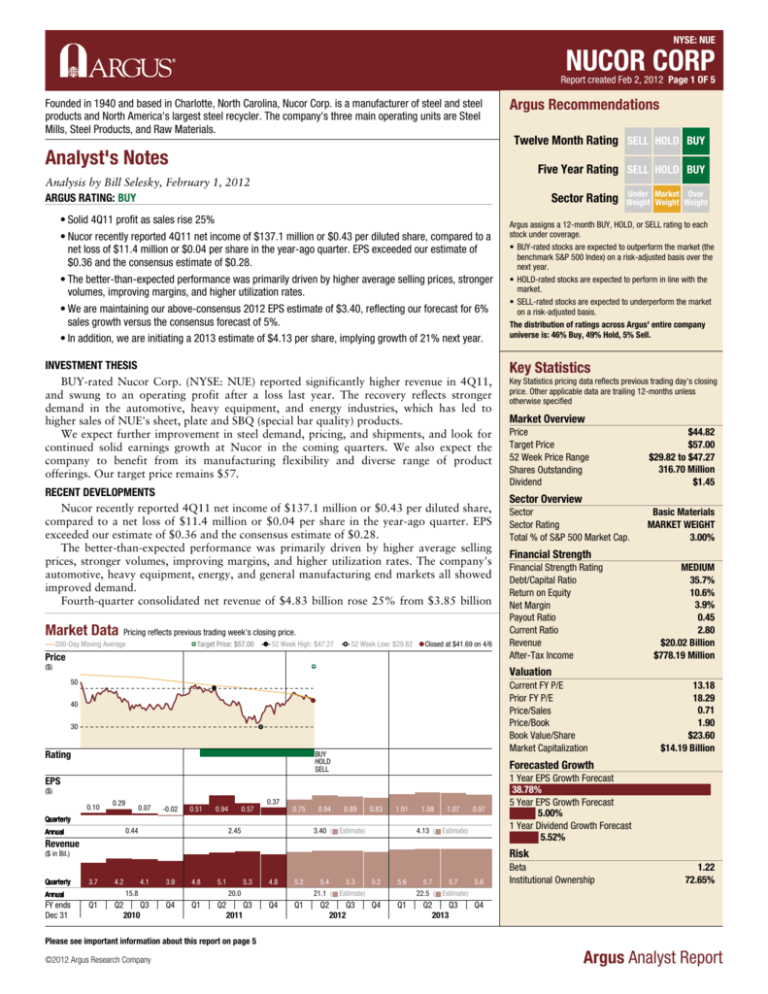

NYSE: NUE

NUCOR CORP

Report created Feb 2, 2012 Page 1 OF 5

Founded in 1940 and based in Charlotte, North Carolina, Nucor Corp. is a manufacturer of steel and steel

products and North America's largest steel recycler. The company's three main operating units are Steel

Mills, Steel Products, and Raw Materials.

Argus Recommendations

Twelve Month Rating SELL HOLD BUY

Analyst's Notes

Five Year Rating SELL HOLD BUY

Analysis by Bill Selesky, February 1, 2012

ARGUS RATING: BUY

Sector Rating

• Solid 4Q11 profit as sales rise 25%

• Nucor recently reported 4Q11 net income of $137.1 million or $0.43 per diluted share, compared to a

net loss of $11.4 million or $0.04 per share in the year-ago quarter. EPS exceeded our estimate of

$0.36 and the consensus estimate of $0.28.

• The better-than-expected performance was primarily driven by higher average selling prices, stronger

volumes, improving margins, and higher utilization rates.

• We are maintaining our above-consensus 2012 EPS estimate of $3.40, reflecting our forecast for 6%

sales growth versus the consensus forecast of 5%.

• In addition, we are initiating a 2013 estimate of $4.13 per share, implying growth of 21% next year.

INVESTMENT THESIS

BUY-rated Nucor Corp. (NYSE: NUE) reported significantly higher revenue in 4Q11,

and swung to an operating profit after a loss last year. The recovery reflects stronger

demand in the automotive, heavy equipment, and energy industries, which has led to

higher sales of NUE's sheet, plate and SBQ (special bar quality) products.

We expect further improvement in steel demand, pricing, and shipments, and look for

continued solid earnings growth at Nucor in the coming quarters. We also expect the

company to benefit from its manufacturing flexibility and diverse range of product

offerings. Our target price remains $57.

RECENT DEVELOPMENTS

Nucor recently reported 4Q11 net income of $137.1 million or $0.43 per diluted share,

compared to a net loss of $11.4 million or $0.04 per share in the year-ago quarter. EPS

exceeded our estimate of $0.36 and the consensus estimate of $0.28.

The better-than-expected performance was primarily driven by higher average selling

prices, stronger volumes, improving margins, and higher utilization rates. The company's

automotive, heavy equipment, energy, and general manufacturing end markets all showed

improved demand.

Fourth-quarter consolidated net revenue of $4.83 billion rose 25% from $3.85 billion

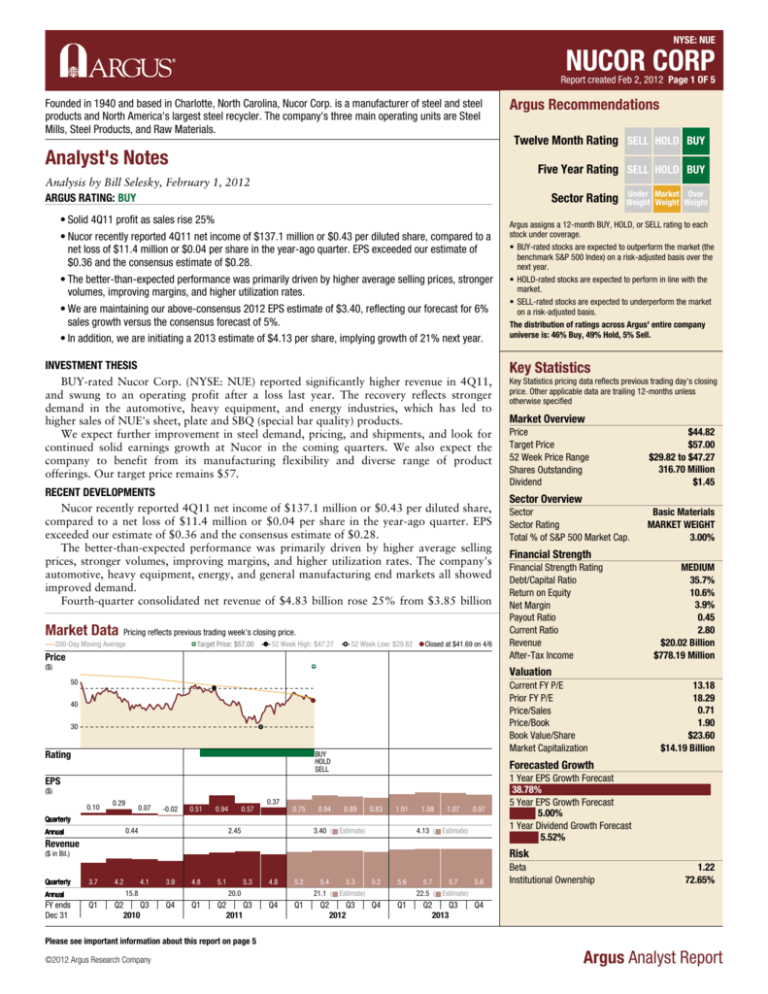

Market Data

Pricing reflects previous trading week's closing price.

200-Day Moving Average

Target Price: $57.00

52 Week High: $47.27

52 Week Low: $29.82

Closed at $41.69 on 4/6

Price

($)

Under Market Over

Weight Weight Weight

Argus assigns a 12-month BUY, HOLD, or SELL rating to each

stock under coverage.

• BUY-rated stocks are expected to outperform the market (the

benchmark S&P 500 Index) on a risk-adjusted basis over the

next year.

• HOLD-rated stocks are expected to perform in line with the

market.

• SELL-rated stocks are expected to underperform the market

on a risk-adjusted basis.

The distribution of ratings across Argus' entire company

universe is: 46% Buy, 49% Hold, 5% Sell.

Key Statistics

Key Statistics pricing data reflects previous trading day's closing

price. Other applicable data are trailing 12-months unless

otherwise specified

Market Overview

Price

Target Price

52 Week Price Range

Shares Outstanding

Dividend

$44.82

$57.00

$29.82 to $47.27

316.70 Million

$1.45

Sector Overview

Sector

Sector Rating

Total % of S&P 500 Market Cap.

Basic Materials

MARKET WEIGHT

3.00%

Financial Strength

Financial Strength Rating

Debt/Capital Ratio

Return on Equity

Net Margin

Payout Ratio

Current Ratio

Revenue

After-Tax Income

MEDIUM

35.7%

10.6%

3.9%

0.45

2.80

$20.02 Billion

$778.19 Million

Valuation

50

Current FY P/E

Prior FY P/E

Price/Sales

Price/Book

Book Value/Share

Market Capitalization

40

30

Rating

BUY

HOLD

SELL

Forecasted Growth

EPS

($)

0.10

0.29

0.07

0.37

-0.02

0.51

0.94

0.57

0.75

0.94

0.89

0.83

1.01

1.08

1.07

0.97

Quarterly

0.44

Annual

2.45

3.40 ( Estimate)

4.13 ( Estimate)

Revenue

3.7

4.2

4.1

3.9

4.8

5.1

5.3

4.8

5.2

Q1

Q2

Q3

2010

Q4

Q1

Q2

Q3

2011

Q4

Q1

15.8

Annual

FY ends

Dec 31

1 Year EPS Growth Forecast

38.78%

5 Year EPS Growth Forecast

5.00%

1 Year Dividend Growth Forecast

5.52%

Risk

($ in Bil.)

Quarterly

13.18

18.29

0.71

1.90

$23.60

$14.19 Billion

20.0

5.4

5.3

5.2

21.1 ( Estimate)

Q2

Q3

2012

Q4

5.6

Q1

5.7

5.7

5.6

22.5 ( Estimate)

Q2

Q3

2013

Beta

Institutional Ownership

1.22

72.65%

Q4

Please see important information about this report on page 5

©2012 Argus Research Company

Argus Analyst Report

NYSE: NUE

NUCOR CORP

Report created Feb 2, 2012 Page 2 OF 5

Analyst's Notes...Continued

in 4Q10. The average sales price per ton rose 18%, while total tons

shipped to outside customers rose 7%.

The average scrap and scrap substitute cost per ton was $441 in

4Q11, up 23% from 4Q10. The average scrap and scrap substitute

cost per ton for the full year was $439, up 25% from 2010.

The full-year utilization rate at NUE steel mills was 74%, up

from 70% in 2010 and 54% in 2009. Fourth-quarter utilization of

71% was down from 74% in 3Q11 but up from 68% in 4Q10.

Total full-year energy costs rose $1 per ton from the prior year,

primarily due to higher unit electricity costs. Fourth-quarter energy

costs were down approximately $5 per ton from 3Q11, due mainly

to lower sequential electricity costs, but were flat with the prior

year.

The company reported 2011 net income of $778.2 million or

$2.45 per diluted share, compared to $134.1 million or $0.42 per

diluted share in 2010.

EARNINGS & GROWTH ANALYSIS

Nucor posted an operating profit in 4Q11 following a loss in

4Q10; however, earnings were still down from 3Q as additional

supply in the domestic sheet market and higher imports of Chinese

sheet steel pressured pricing and margins in this segment. Chinese

imports have moderated in recent weeks, however, setting the stage

for increased orders at Nucor if demand remains strong. During the

call, management also noted signs of modest improvement in the

residential and nonresidential construction markets.

We are maintaining our above-consensus 2012 EPS estimate of

$3.40, reflecting our forecast for 6% sales growth versus the

consensus forecast of 5%. In addition, we are initiating a 2013

estimate of $4.13 per share, implying growth of 21% next year.

Our long-term growth rate forecast is 5%.

FINANCIAL STRENGTH & DIVIDEND

We rate Nucor's financial strength as Medium, the midpoint on

our five-point scale. The company's debt is rated A2/negative by

Moody's and A/stable by Standard & Poor's.

At the end of 4Q11, the company's debt/capitalization ratio was

35.7%, compared to 36.9% at the end of 4Q10. Nucor had cash

and equivalents of $1.20 billion at the end of 4Q11, down from

$1.33 billion at the end of 4Q10. Long-term debt totaled $3.63

billion at the end of the quarter, compared to $4.28 billion at the

end of 4Q10. The company has an undrawn $1.5 billion unsecured

revolving credit facility that will mature in December 2016.

Nucor recently announced an increase in its quarterly dividend

from $0.3625 to $0.365 per share, or $1.46 annually, for a

projected yield of about 3.3%. The first payment at the new rate

will be made on February 10, 2012 to holders of record as of

December 30, 2011. The February payment will mark Nucor's

155th consecutive quarterly cash dividend. Our dividend estimates

are $1.53 for both 2012 and 2013.

RISKS

The steel industry is extremely cyclical and highly competitive.

Growth & Valuation Analysis

GROWTH ANALYSIS

($ in Millions, except per share data)

Revenue

COGS

Gross Profit

SG&A

R&D

Operating Income

Interest Expense

Pretax Income

Income Taxes

Tax Rate (%)

Net Income

Diluted Shares Outstanding

EPS

Dividend

GROWTH RATES (%)

Revenue

Operating Income

Net Income

EPS

Dividend

Sustainable Growth Rate

VALUATION ANALYSIS

Price: High

Price: Low

Price/Sales: High-Low

P/E: High-Low

Price/Cash Flow: High-Low

Financial & Risk Analysis

2007

16,593

13,463

3,130

578

—

2,552

5

2,253

781

35

1,472

298

4.94

1.13

2008

23,663

19,612

4,051

714

—

3,104

90

3,104

959

31

1,831

305

5.98

1.51

2009

11,190

11,036

154

348

—

-332

135

-414

-177

—

-294

315

-0.94

1.41

2010

15,845

15,001

844

391

—

452

153

267

61

23

134

317

0.42

1.44

2011

20,024

18,075

1,949

521

—

1,428

166

1,252

391

31

778

317

2.45

1.45

12.5

-11.2

-16.2

-13.0

182.5

22.8

42.6

21.6

24.4

21.1

33.6

21.0

-52.7

—

—

—

-6.6

1.1

41.6

—

—

—

2.3

-4.5

26.4

215.7

480.3

483.3

0.7

4.3

$69.93

$41.62

1.3 - 0.7

14.2 - 8.4

10.8 - 6.4

$83.56

$25.25

1.1 - 0.3

14.0 - 4.2

10.2 - 3.1

$51.08

$29.84

1.4 - 0.8

—-—

13.6 - 7.9

$50.72

$35.71

1.0 - 0.7

120.8 - 85.0

18.4 - 12.9

$49.24

$29.82

0.8 - 0.5

20.1 - 12.2

15.1 - 9.2

FINANCIAL STRENGTH

Cash ($ in Millions)

Working Capital ($ in Millions)

Current Ratio

LT Debt/Equity Ratio (%)

Total Debt/Equity Ratio (%)

2009

2,017

3,955

4.22

41.7

41.8

2010

1,325

4,357

3.90

60.1

60.3

2011

1,201

4,312

2.80

48.6

57.3

RATIOS (%)

Gross Profit Margin

Operating Margin

Net Margin

Return On Assets

Return On Equity

1.4

-3.0

-2.6

-2.2

-3.8

5.3

2.9

0.8

1.0

1.8

9.7

7.1

3.9

5.5

10.7

RISK ANALYSIS

Cash Cycle (days)

Cash Flow/Cap Ex

Oper. Income/Int. Exp. (ratio)

Payout Ratio

79.3

—

—

—

44.8

—

2.7

405.0

45.8

—

8.0

405.0

The data contained on this page of this report has been

provided by Morningstar, Inc. (© 2012 Morningstar, Inc.

All Rights Reserved). This data (1) is proprietary to

Morningstar and/or its content providers; (2) may not be

copied or distributed; and (3) is not warranted to be

accurate, complete or timely. Neither Morningstar nor its

content providers are responsible for any damages or

losses arising from any use of this information. Past

performance is no guarantee of future results. This data

is set forth herein for historical reference only and is not

necessarily used in Argus’ analysis of the stock set forth

on this page of this report or any other stock or other

security. All earnings figures are in GAAP.

Please see important information about this report on page 5

©2012 Argus Research Company

Argus Analyst Report

NYSE: NUE

NUCOR CORP

Report created Feb 2, 2012 Page 3 OF 5

Analyst's Notes...Continued

It may also be affected by excess global capacity, which has limited

price increases during periods of economic growth and led to price

decreases during periods of economic contraction. In addition, the

industry faces competition in many markets from producers of

aluminum, cement, composites, glass, plastics and wood. Steel

producers also faces risks associated with commodity prices,

interest and exchange rates, asbestos liability, and environmental

issues.

COMPANY DESCRIPTION

Founded in 1940 and based in Charlotte, North Carolina,

Nucor Corp. is a manufacturer of steel and steel products and

North America's largest steel recycler. The company's three main

operating units are Steel Mills, Steel Products, and Raw Materials.

The Steel Mills segment offers hot-rolled steel products,

including angles, rounds, flats, channels, sheet, wide-flange beams,

and cold-rolled steel products. Steel Products provides steel joists

and joist girders, steel deck, fabricated concrete-reinforcing steel,

cold-finished steel, steel fasteners, steel grating, and metal and wire

mesh. The Raw Materials segment produces direct-reduced iron

(DRI); brokers ferrous and nonferrous metals, pig iron, hot

briquetted iron, and DRI; and processes ferrous and nonferrous

scrap products. The company also has international steel trading

operations.

INDUSTRY

Our rating on the Basic Materials sector is Market-Weight. The

sector looks fairly valued, with growth expectations in line with the

market.

The sector accounts for 3.6% of the S&P 500, and includes

industries such as chemicals, paper, metals and mining. Over the

past five years, the weighting has ranged from 3% to 5%. We think

investors should consider allocating 3%-4% of their diversified

portfolios to stocks in this sector. The sector got off to a positive

start in 2011, but underperformed during 2Q, slumped badly

during the sharp market selloff in 3Q, and ended up trailing the

S&P 500 by hundreds of basis points.

Fundamentals for the Basic Materials group are reasonable. The

P/E ratio on projected 2012 EPS is 11.6, below the market

multiple. The sector's debt ratios appear sound, as many in the

group have deleveraged as the credit markets have reopened. Yields

are in line with the market at about 2.2%. Growth expectations are

average. The Street consensus calls for profits to climb 10.2% in

2012.

VALUATION

NUE shares are trading at 13.3-times our 2012 EPS estimate

and at 10.9-times our 2013 forecast, compared to a 12-year

historical P/E range of 25-43. The shares are also trading below the

low end of their historical range for price/book and price/sales, and

appear attractive relative to peers.

Although the U.S. steel industry faces ongoing challenges from

rising raw material costs, lower-than-expected utilization, and the

Peer & Industry Analysis

Growth

X

400

P/E

NUE vs.

Market

NUE vs.

Sector

More Value

More Growth

Price/Sales

NUE vs.

Market

NUE vs.

Sector

200

More Value

More Growth

Price/Book

0

NUE

AA

NEM

NUE vs.

Market

NUE vs.

Sector

ACI

ABX

ASH

FCX

VMC

P/E

The graphics in this section are designed to

allow investors to compare NUE versus its

industry peers, the broader sector, and the

market as a whole, as defined by the Argus

Universe of Coverage.

• The scatterplot shows how NUE stacks up

versus

its

peers

on

two

key

characteristics: long-term growth and

value. In general, companies in the lower

left-hand corner are more value-oriented,

while those in the upper right-hand corner

are more growth-oriented.

• The table builds on the scatterplot by

displaying more financial information.

• The bar charts on the right take the

analysis two steps further, by broadening

the comparison groups into the sector

level and the market as a whole. This tool

is designed to help investors understand

how NUE might fit into or modify a

diversified portfolio.

Value

5

5-yr Growth Rate(%)

Market Cap

Ticker Company

($ in Millions)

ABX Barrick Gold Corporation

49,281

FCX

Freeport Mcmoran Copper & Gold 43,756

NEM Newmont Mining Corp

29,840

NUE Nucor Corp

14,195

AA

Alcoa Inc

10,856

VMC Vulcan Materials Co (Hldg Co

5,688

ASH Ashland Inc

5,009

X

United States Steel Corp

4,488

ACI

Arch Coal Inc

3,113

Peer Average

18,469

5-yr

Growth

Rate (%)

8.0

7.0

6.0

5.0

3.0

6.0

7.0

5.0

8.0

6.1

Current

FY P/E

10.1

10.5

11.9

13.2

13.1

-46.3

11.4

519.5

12.3

61.7

Net

Margin

(%)

32.8

21.8

21.8

3.9

2.4

-3.5

3.4

-.3

3.4

9.5

More Value

More Growth

More Value

More Growth

PEG

7.5

1-yr EPS

Growth

(%)

21.3

28.2

21.9

21.5

29.5

34.7

18.4

4,533.3

132.5

537.9

Argus

Rating

BUY

BUY

BUY

BUY

BUY

BUY

BUY

BUY

BUY

NUE vs.

Market

NUE vs.

Sector

5 Year Growth

NUE vs.

Market

NUE vs.

Sector

More Value

More Growth

Debt/Capital

NUE vs.

Market

NUE vs.

Sector

More Value

More Growth

Please see important information about this report on page 5

©2012 Argus Research Company

Argus Analyst Report

NYSE: NUE

NUCOR CORP

Report created Feb 2, 2012 Page 4 OF 5

Analyst's Notes...Continued

dumping of lower-cost imported steel, these issues have receded in

recent months as demand has improved. We expect these more

favorable industry fundamentals to continue through at least the

first half of 2012, which should help to drive the shares higher.

Our target price of $57 implies a multiple of 13.8-times our 2013

EPS estimate, still well below the low end of the historical P/E

range.

On February 1, BUY-rated NUE closed at $44.82, up $0.33.

Please see important information about this report on page 5

©2012 Argus Research Company

Argus Analyst Report

NYSE: NUE

METHODOLOGY & DISCLAIMERS

Report created Feb 2, 2012 Page 5 OF 5

About Argus

Argus Research, founded by Economist Harold Dorsey in 1934,

has built a top-down, fundamental system that is used by Argus

analysts. This six-point system includes Industry Analysis, Growth

Analysis, Financial Strength Analysis, Management Assessment,

Risk Analysis and Valuation Analysis.

Utilizing forecasts from Argus’ Economist, the Industry Analysis

identifies industries expected to perform well over the next

one-to-two years.

The Growth Analysis generates proprietary estimates for

companies under coverage.

In the Financial Strength Analysis, analysts study ratios to

understand profitability, liquidity and capital structure.

During the Management Assessment, analysts meet with and

familiarize themselves with the processes of corporate management

teams.

Quantitative trends and qualitative threats are assessed under

the Risk Analysis.

And finally, Argus’ Valuation Analysis model integrates a

historical ratio matrix, discounted cash flow modeling, and peer

comparison.

THE ARGUS RESEARCH RATING SYSTEM

Argus uses three ratings for stocks: BUY, HOLD, and SELL.

Stocks are rated relative to a benchmark, the S&P 500.

• A BUY-rated stock is expected to outperform the S&P 500 on

a risk-adjusted basis over a 12-month period. To make this

determination, Argus Analysts set target prices, use beta as the

measure of risk, and compare expected risk-adjusted stock

returns to the S&P 500 forecasts set by the Argus Market

Strategist.

• A HOLD-rated stock is expected to perform in line with the

S&P 500.

• A SELL-rated stock is expected to underperform the S&P 500.

Argus Research Disclaimer

Argus Research is an independent investment research provider and is not a member of the FINRA or the SIPC. Argus Research is not a registered broker dealer and does not have

investment banking operations. The Argus trademark, service mark and logo are the intellectual property of Argus Group Inc. The information contained in this research report is

produced and copyrighted by Argus, and any unauthorized use, duplication, redistribution or disclosure is prohibited by law and can result in prosecution. The content of this report

may be derived from Argus research reports, notes, or analyses. The opinions and information contained herein have been obtained or derived from sources believed to be reliable,

but Argus makes no representation as to their timeliness, accuracy or completeness or for their fitness for any particular purpose. This report is not an offer to sell or a solicitation of

an offer to buy any security. The information and material presented in this report are for general information only and do not specifically address individual investment objectives,

financial situations or the particular needs of any specific person who may receive this report. Investing in any security or investment strategies discussed may not be suitable for

you and it is recommended that you consult an independent investment advisor. Nothing in this report constitutes individual investment, legal or tax advice. Argus may issue or may

have issued other reports that are inconsistent with or may reach different conclusions than those represented in this report, and all opinions are reflective of judgments made on the

original date of publication. Argus is under no obligation to ensure that other reports are brought to the attention of any recipient of this report. Argus shall accept no liability for any

loss arising from the use of this report, nor shall Argus treat all recipients of this report as customers simply by virtue of their receipt of this material. Investments involve risk and an

investor may incur either profits or losses. Past performance should not be taken as an indication or guarantee of future performance. Argus has provided independent research

since 1934. Argus officers, employees, agents and/or affiliates may have positions in stocks discussed in this report. No Argus officers, employees, agents and/or affiliates may

serve as officers or directors of covered companies, or may own more than one percent of a covered company’s stock.

Morningstar Disclaimer

© 2012 Morningstar, Inc. All Rights Reserved. Certain financial information included in this report: (1) is proprietary to Morningstar and/or its content providers; (2) may not be

copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising

from any use of this information. Past performance is no guarantee of future results.

©2012 Argus Research Company

Argus Analyst Report