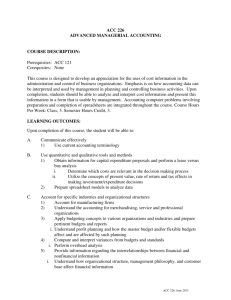

ACC 204 Chapter 2 PPT Handout

advertisement

Dutchess Community College ACC 204 – Managerial Accounting Quiz Prep Chapter 2 Job Order Cost Accounting Peter Rivera January 2010 Disclaimer This Quiz Prep is provided as an outline of the key concepts from the chapter. It is not intended to be comprehensive or exhaustive. Quizzes may include material from the classroom lectures, the text or the homework assignments. ACC 204 Chapter 2 1 2 Types of Cost Accounting Systems Job Order Cost This Chapter Costs are assigned to • Individual job, e.g., movie, fire truck • Batch, e.g., wedding invitation printer Process Cost Costs are accumulated over a period of time for a continuous manufacturing process, e.g., corn flakes Predetermined Overhead Rate Estimated Annual Overhead Costs = Expected Annual Operating Activity ! Be sure you are using the correct activity Predetermined Overhead Rate • Direct Labor Hours • Direct Labor Costs • Machine Hours • Other ACC 204 Chapter 2 2 Normal Balances Recall from ACC 104 Debit Credit Liabilities Assets Balance Sheet Equity Statement of Retained Earnings Dividends Expenses Revenues P&L Normal Balances Normal Balances can be either Debit or Credit. The Normal Balance is the side that increases the account balance. For example, Cash has a Debit Normal Balance: Debits increase Cash ACC 204 Chapter 2 Cash Debit Credit Opening Balance 100 25 Ending Balance 85 Credits decrease Cash 40 3 Journal Entries There are 9 journal entries required in a Job Order Cost system: 1 - Raw Materials: Accumulate (Purchase) 2 - Raw Materials: Allocate 3 - Labor: Accumulate Note the 4 - Labor: Allocate Accumulate/Allocate 5 - Overhead: Accumulate pattern for the 3 6 - Overhead: Allocate categories of cost: 7 - WIP Finished Goods • Materials 8 - Sale • Labor 9 - Finished Goods COGS • Overhead Note that COGS is recorded at the time of sale because it is a Perpetual Inventory System Purchase Raw Materials General Ledger Raw Materials Inventory Accounts Payable Dr Cr 5,000 5,000 Subsidiary Ledger: Materials Inventory Record This record tracks the Receipts and Issuances of Raw Materials by • Specific Item; e.g., sparkplug # 1234 • # of Units The sum of the subsidiary ledgers • Unit Cost should equal the general ledger • Total Cost ACC 204 Chapter 2 4 Labor General Ledger Dr Factory Labor FICA Tax Payable (Social Security) Medicare Tax Payable Federal Tax Payable State Tax payable Salaries Payable FICA Tax Payable (Employer) Medicare Tax Payable (Employer) Cr 1,077 62 15 220 50 653 62 15 Factory Labor is an intermediate account Overhead General Ledger Dr Manufacturing Overhead Rent Payable Utilities Payable Prepaid Insurance Cr 2,000 1,000 800 200 Manufacturing Overhead is an intermediate account ACC 204 Chapter 2 5 Job Cost Sheet Each Job has a unique Job Identification number. The Job Cost Sheet accumulates the • Raw Material, • Labor and • Overhead costs for each individual job. Allocate Raw Materials to Jobs The Materials Requisition Slip documents the distribution of raw materials from the warehouse to be used on • specific jobs • and/or as overhead. This information must be reflected in both the General Ledger and the Job Cost Sheets. ACC 204 Chapter 2 6 Allocate Raw Materials to Jobs General Ledger Journal Entry Work In Process Inventory Manufacturing Overhead Dr Cr 2,400 600 Raw Materials Inventory Job #1 Cost Sheet Direct Materials Direct Labor Overhead + 2,000 Job #2 Cost Sheet Direct Materials Direct Labor Overhead + 400 3,000 The sum of the Job Cost Sheets should equal the General Ledger Allocate Labor to Jobs Time Sheets are used to allocate Labor Costs from the Factory Labor account to • specific jobs • and/or as overhead. This information must be reflected in both the General Ledger and the Job Cost Sheets. ACC 204 Chapter 2 7 Allocate Labor to Jobs General Ledger Journal Entry Dr Cr Work In Process Inventory 700 Manufacturing Overhead 377 Factory Labor Job #1 Cost Sheet Direct Materials Direct Labor Overhead 2,000 + 600 Job #2 Cost Sheet Direct Materials Direct Labor Overhead 400 + 100 1,077 Intermediate Account The sum of the Job Cost Sheets should equal the General Ledger Allocate Overhead to Jobs Use the Predetermined Overhead Rate to calculate the amount of overhead to be applied to the individual jobs. This information must be reflected in both the General Ledger and the Job Cost Sheets. Assume that Overhead is applied on the basis of 120% of direct labor costs: Job #1: 120% x $600 = $720 Job #2: 120% x $100 = $120 ACC 204 Chapter 2 8 Allocate Overhead to Jobs General Ledger Journal Entry Work In Process Inventory Dr Cr 840 Manufacturing Overhead 840 Intermediate Account Job #1 Cost Sheet Direct Materials Direct Labor Overhead 2,000 600 +720 Job #2 Cost Sheet Direct Materials Direct Labor Overhead 400 100 +120 The sum of the Job Cost Sheets should equal the General Ledger Completed Work In Process Assume that Job #1 is completed General Ledger Journal Entry Finished Goods Work In Process Inventory Dr Cr 3,320 3,320 Job #1 Cost Sheet Direct Materials Direct Labor Overhead 2,000 600 720 ACC 204 Chapter 2 9 Sale & Cost Of Goods Sold Assume that Job #1 is sold for $4,000. Note that as a Perpetual Inventory System, the COGS entry is made at the time of sale. General Ledger Journal Entries Accounts Receivable Dr Cr 4,000 Sales Revenue 4,000 Dr Cost Of Goods Sold Cr 3,320 Finished Goods 3,320 Under / Over-applied Overhead Note that the Predetermined Overhead Rate is based on 2 estimates, and therefore is highly unlikely to be exact, which will result in Overhead being either under-applied or over-applied Estimated Annual Overhead Costs = Expected Annual Operating Activity ACC 204 Chapter 2 Predetermined Overhead Rate 10 Under / Over-applied Overhead Manufacturing Overhead Dr Actual Costs Cr Costs Applied At the end of the year: if Actual > Applied (i.e., a net debit balance) then Under-applied if Actual < Applied (i.e., a net credit balance) then Over-applied Generally, the balances are closed out as an adjustment to COGS. ACC 204 Chapter 2 11