Risk Assessment, Audit Processes and Sample Sizes

advertisement

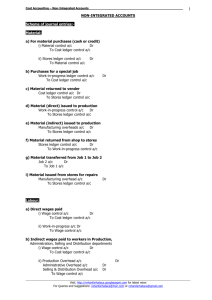

Risk Assessment, Audit Processes and Sample Sizes It’s Really Just Auditing…..But Agenda • • • What is Really Necessary? Risk Assessment Audit Processes and Sample Size • Labor • Indirect Costs • • Guidelines Conclusion What is Really Necessary? It’s Not Just About Auditing CPA Firm Responsibilities • Comply with professional standards • • • • • • • Generally Accepted Government Auditing Standards –GAGAS (Yellowbook) Generally Accepted Auditing Standards (GAAS) UNDERSTAND terms of engagement Realistic self-assessment Establish quality control standards unique to overhead audits Communicate with state DOT Allow cognizant agency full access to workpapers Basic Accounting Alignment • • • • • • • Accrual based (GAAP) Accounting required. Labor cost must be reconcilable to individual payroll records. Project costs (labor and ODCs) must reconcile to General Ledger Direct Costs. Overhead must reconcile to General Ledger. Total labor per General Ledger must reconcile to annual payroll records. Overhead must correspond to firm fiscal year. Job Cost system under General Ledger control. Two Sets of Books? Accrual Meter Profit = Revenue – Direct Costs – Overhead Project Costs Personnel Adjustments WIP Invoice Write-offs Expenses A/R Cash Flow = Cash In – Cash Out Equipment Usage Collection Pay to $ Payroll $ Value Added (Pricing) Cash Meter Cash in the Bank $ Accounts Payable What is “Overhead”? Which of these cost elements should legitimately be charged directly to jobs and which to overhead? Cost Element Overtime premium on a project Time spent preparing a proposal Use of equipment on a project Time spent by accounting to prepare an invoice Company vehicle used on project Personal vehicle used on project Use of CAD equipment on a project Use of a pencil to write the final report Direct OH Answer It Depends Internally Allocated Costs • Typically known as “in-house” costs • Allocates costs to projects based on an estimated unit rate using a “contra” account • Typically used for: • Company owned vehicles • Printing • Equipment • Can be used for CADD costs but not typical Debits and Credits • • • • Contra accounts should be set up to “relieve” overhead of allocated costs These accounts can be anywhere in the overhead section of the chart of accounts but we prefer them to be at the bottom of the chart of accounts before other income/expense Separate contra accounts should be set up for each category of cost. Eg: vehicles, equipment, unit pricing Unit costs ALWAYS are charged to projects Labor Costing Options Standard cost (preferred) – Standard hourly rate based on hours employee is expected to work during year (usually 2,080). Any differences (uncompensated overtime, premium overtime) allocated to overhead. (Labor rate stays fixed) Average cost – Divide paycheck by actual hours worked during pay period. (Labor rate can change each pay period) The Golden Rules of Accounting Policies Bill according to contract Accumulate costs according to policy The BIG Breakdown • • • • Anything FAR is an accounting issue thus the responsibility of the financial/accounting department FAR compliance is NOT just about accounting for unallowable costs or even accounting procedures FAR compliance issues typically occur when principals or project managers propose and negotiate contracts that DO NOT reflect current firm policies Firm policies MUST be communicated to the entire organization Risk Assessment The First Step Internal Control Questionnaire (ICQ) for Consulting Engineers • • • • • • • • • • Great starting point for audit planning Covers major areas of cost accumulation POLICY! Identifies firm size Identifies officers Identifies owners Identifies related parties Information on financial management system Labor costing method Premium overtime Contract labor Formal Risk Assessment • • • • • • • • • Fraud Evaluate the controls over cash disbursements Evaluate the controls over payroll (including time reporting) Evaluate the controls over the computer systems Consider fraud risk factors Control environment (management attitude) Control methods (policies and procedures) Communications Monitoring Accounting System • • • • • • • • • Deltek Vision Deltek (Axium) Ajera BST Clearview InFocus BillQuick Oracle QuickBooks Peachtree Other Audit Processes and Sample Sizes Where it all Comes Together Labor Largest Cost and Least Documented Executive Compensation Key Matrix Points • • • • • Match executive job description and duties to position description in Matrix Only one each Chairman, CEO and Executive Vice President are allowed Multiple Senior Vice Presidents and Vice Presidents are allowed Small firms must pay close attention to “duties” as opposed to title Related parties must be evaluated The Word on Timesheets They are very important! Individuals • • • EVERYONE must prepare a time sheet Total hours MUST be reported Time sheets must be approved by employee and supervisor Firm • • • Must have a timekeeping system that identifies employees’ labor by intermediate and final cost objective System must charge direct and indirect labor to the appropriate cost objectives At least monthly posting to financial management system This Means… • • • • • Firm must maintain a comprehensive accounting system. Firm must prepare time (total hours). Time sheets must be posted to job cost records. Job cost records must be posted to the general ledger. Time sheet changes must be approved by employee and supervisor What is Really Necessary • • A timesheet from each pay period Selections MUST be traced from the timesheet to: • Payroll register (actual pay) • Personnel file (approved pay rate) • Job cost system • General ledger • Is every item on the timesheet necessary? • It depends on RISK ASSESSMENT • Over 60 individual time entries Do We have a Problem? Indirect Costs FAR Knowledge is Critical Guidelines • Materiality (Only for planning purposes) • Cost Certification • • • • • • Use of sampling Minimum sample size of 2 to 20 items High risk accounts Evil alcohol No fun Marketing (now we are talking about some dollars) Conclusion Quality is not in Quantity Audit Quality • • • • • Art not science The CPAs understanding of industry accounting best practices is critical Understanding of the accounting system set-up is critical Understanding of the firm’s accounting policies is critical Sample size……not so much T. Wayne Owens & Associates, PC [Built for A/E/C] We are a CPA firm that provides a full range of accounting and financial management solutions, including audits, FAR audits and tax services tailored for the design industry. Our services are specifically geared toward boosting the effectiveness, well-being and profitability of your A/E/C firm. Our relationship with you is the driver; consider us a partner on your success team, providing experienced guidance and advice for your situation and spotting opportunities to position your company for the future. Questions T. Wayne Owens, CPA T. Wayne Owens & Associates, PC O: 678.325.1063 C: 404.358.2390 wowens@twocpa.com www.twocpa.com Sign up for the semi-regular newsletter on A/E firm management and government contracting at www.twocpa.com