Net Present Value and Capital Budgeting What to Discount

advertisement

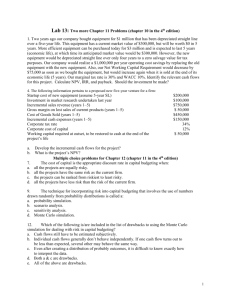

Net Present Value and Capital Budgeting (Text reference: Chapter 7) Topics what to discount the CCA system total project cash flow vs. tax shield approach detailed CCA calculations and examples project interactions AFM 271 - NPV and Capital Budgeting Slide 1 What to Discount some general principles: 1. Only cash flow is relevant the NPV rule is stated in terms of cash flows cash flow is a simple idea: dollars in - dollars out don’t confuse cash flow with accounting income (note that accounting income is needed in some cases to calculate taxes) 2. Always estimate cash flows on an incremental basis incremental cash flows are the additional cash flows generated by the project. To identify them, ask two questions: What is the cash flow if the project is taken? What is the cash flow if the project is not taken? If the answers differ, then the cash flow is incremental. AFM 271 - NPV and Capital Budgeting Slide 2 Cont’d some things to watch for: exclude sunk costs: it is incorrect to include costs which have already been incurred and cannot be recovered include opportunity costs: e.g. a firm owns some land worth $25 million which it is considering using as a new factory site. If the firm builds the factory, it is giving up the $25 million it could have received by selling the land. incorporate side effects: it is important to ensure that all effects on the remainder of a firm’s operations are taken into account (e.g. a new product line may reduce sales of existing products) AFM 271 - NPV and Capital Budgeting Slide 3 Cont’d include working capital requirements: most projects will require an additional investment in working capital (e.g. due to increased inventories, accounts receivable, etc.); such investments are typically recovered later on allocated overhead costs: ensure that only those charges which are actually due to a project are allocated to it interest expense: ignore this for now AFM 271 - NPV and Capital Budgeting Slide 4 Cont’d 3. Treat inflation consistently nominal interest rate i notation: inflation rate π real interest rate r recall the “Fisher relation” 1 + i = (1 + r) × (1 + π ) ⇒ r = 1+i −1 1+π example: if i = 10% and π = 3.5%, what is the FV after 2 years of $10,000 in real and nominal terms? (assume the money is invested at i = 10%) AFM 271 - NPV and Capital Budgeting Slide 5 Cont’d consistency requires that nominal cash flows be discounted at a nominal discount rate and real cash flows be discounted at a real discount rate. For example, suppose that i = 8% and π = 3% and that we have the following real cash flows: C0 C1 C2 -1000 750 900 NPV in real terms: NPV in nominal terms: AFM 271 - NPV and Capital Budgeting Slide 6 Cont’d why does this work? Let C0 ,C1 ,C2 , . . . be real cash flows, so: PVnominal = C0 + = C0 + C1 (1 + π ) C2 (1 + π )2 + +... 1+i (1 + i)2 C1 (1 + π ) C2 (1 + π )2 + +... (1 + r)(1 + π ) (1 + r)2 (1 + π )2 it is important to understand how to use both real and nominal discounting since you sometimes have to use both approaches. This is because some cash flow forecasts (e.g. sales revenue) are often made in real terms, whereas others (e.g. depreciation tax shields) are calculated in nominal terms. AFM 271 - NPV and Capital Budgeting Slide 7 Cont’d for a single cash flow received at period n: Cnominal = Creal × (1 + π )n for a series of cash flows, the growth rate must also be changed (e.g. a perpetuity which is constant in nominal terms is actually decreasing in real terms due to inflation). The relationship between real and nominal growth rates is: (1 + gnominal ) = (1 + greal ) × (1 + π ) e.g. a perpetuity of $1,000 per year (nominal), with r = 10% and π = 3%: AFM 271 - NPV and Capital Budgeting Slide 8 Cont’d some examples (assume i = 10% and π = 5%): 1. perpetuity Cnominal = $100, 1st payment at t = 1, gnominal = 2% 2. perpetuity Cnominal = $100, 1st payment at t = 4, greal = 2% 3. 10 period annuity Creal = $500, 1st payment at t = 1, greal = 4% AFM 271 - NPV and Capital Budgeting Slide 9 The CCA System depreciation or capital cost allowance (CCA) is not a cash flow, but it has cash flow consequences because it is deductible from taxable income since CCA reduces taxable income, it increases cash flow assets such as land or securities cannot be depreciated. Others are assigned to various classes, with varying depreciation rates. Table 7A.1 (text p. 219) provides some common classes: e.g. manufacturing and processing equipment is in Class 8 with a 20% rate, brick buildings are in Class 1 with a 4% rate. The depreciation rate d reflects the economic life of the asset. note that all assets of a firm within a particular class are treated as if they are a single asset (a “pool”) AFM 271 - NPV and Capital Budgeting Slide 10 Cont’d how to calculate CCA: CCA is calculated on a declining balance allows for faster depreciation than straight line receive cash flows from CCA tax shield faster increases NPV of investments the half year rule: in the first year of its life, an asset is depreciated at half the normal rate, i.e. d/2 example: a firm purchases some Class 8 (d = 20%) equipment for $150,000. What CCA can be claimed for the first four years? AFM 271 - NPV and Capital Budgeting Slide 11 Cont’d how to calculate PV of CCA tax shield: assume for now that you keep the asset forever, and ignore the half year rule. We have: Year Beginning UCC CCA Ending UCC 1 C Cd C(1 − d) 2 C(1 − d) Cd(1 − d) C(1 − d)2 3 C(1 − d)2 Cd(1 − d)2 C(1 − d)3 ... ... ... ... n C(1 − d)n−1 Cd(1 − d)n−1 C(1 − d)n ... ... ... ... the tax shields are just CCA multiplied by the corporate tax rate Tc , so (using k as the discount rate): PV = AFM 271 - NPV and Capital Budgeting CdTc CdTc CdTc (1 − d) CdTc (1 − d)2 + + + · · · = 1+k (1 + k)2 (1 + k)3 k+d Slide 12 Cont’d now incorporate the half year rule. We have two perpetuities, decreasing at rate d, one with first payment after one year, the other after two years: 1 2 CdTc 1 2 CdTc 1 + × k+d k+d 1+k " # 1 CdTc 1 = + 2 k+d 2 1+k " # 1 1 CdTc 2 (1 + k) + 2 = k+d 1+k " # k 1 + CdTc 2 = k+d 1+k PV = AFM 271 - NPV and Capital Budgeting Slide 13 Cont’d now assume that the asset is sold for an amount S at the end of year n. If the firm has other assets in this CCA class, this might reduce the PV of the CCA tax shield as follows: " # k CdTc 1 + 2 1 min(C, S)dTc PV = × − k+d 1+k k+d (1 + k)n note that the above formula is only an example: it and the similar equation (7.6) from p. 203 of the text are not always applicable! AFM 271 - NPV and Capital Budgeting Slide 14 Cont’d in general, the following steps apply when a firm sells a CCA eligible asset: 1. The UCC in the asset class is reduced by the lesser of the sale price or the initial cost. 2. If step 1 leaves a negative balance, this amount is added to taxable income (recaptured depreciation), and the UCC of the asset class is reset to zero. 3. If step 1 leaves a positive balance and there are no other assets in the asset class, this amount is deducted from taxable income (terminal loss), and the UCC of the asset class is reset to zero. 4. If step 1 leaves a positive balance and there are assets left in the class, the balance becomes the new UCC for the class. 5. If the asset is sold for more than its initial cost, the difference is a capital gain (50% inclusion rate). 6. Suppose there is a new acquisition in the same year as an asset is sold. Define net acquisitions as acquisitions less disposals. If net acquisitions are > 0, apply the half year rule to net acquisitions; if net acquisitions are < 0, do not apply the half year rule. AFM 271 - NPV and Capital Budgeting Slide 15 Cont’d example: Atlantic Trucking Co. is starting up business and has just purchased its first truck for $25,000. The truck is in Class 10 with a CCA rate of 30%. Calculate applicable CCA for years 1, 2, and 3: Year Beginning UCC CCA Ending UCC 1 2 3 now suppose that the firm buys a second truck for $35,000 in year 2 and that it sells the first truck for $7,000 in year 3: AFM 271 - NPV and Capital Budgeting Slide 16 Cont’d Year Beginning UCC CCA Ending UCC 1 12,500 3,750 8,750 2 3 instead suppose that the firm buys a second truck for $35,000 in year 2 and that it sells the first truck for $7,000 in year 2: Year Beginning UCC CCA Ending UCC 1 12,500 3,750 8,750 2 3 AFM 271 - NPV and Capital Budgeting Slide 17 Cont’d to illustrate some asset disposition cases, consider the following four scenarios. Here a firm purchased a number of assets in a single class some time ago for $117,000, and at the beginning of the current year, this pool of assets had a UCC of $82,500. Scenario 1 2 3 4 $82,500 $82,500 $82,500 $82,500 assets sold $35,000 $117,000 $85,000 $117,000 Sale proceeds $12,000 $100,000 $90,000 $50,000 Beginning UCC Capital cost of Capital gains UCC after sale Terminal loss Recapture Ending UCC AFM 271 - NPV and Capital Budgeting Slide 18 Total Project Cash Flow vs. Tax Shield Approach to illustrate, we will consider in detail the MMCC example from the text (pp. 188-193, 200-204). The information provided includes: Expected life of machine Costs of test marketing Current market value of factory site Cost of machine Salvage value after 8 years Production in thousands of units (by year) Unit price in first year Growth rate in unit price after first year Unit production costs in first year Growth rate in production costs after first year Corporate tax rate Working capital: initial Working capital: end Working capital: during Inflation: Fixed costs: 8 years $250,000 $0 $800,000 $150,000 6, 9, 12, 13, 12, 10, 8, 6 $100 2% $64 5% 40% $40,000 $0 15% of sales 5% $50,000 per year AFM 271 - NPV and Capital Budgeting Slide 19 Cont’d the total project cash flow approach: the basic idea is to determine the project cash flows year by year, add them up, and discount to obtain NPV some notes: in general, cannot use convenient PV formulas (annuities, perpetuities) requires that all cash flows (for a given year) must be either in real terms or in nominal terms requires that all cash flows be discounted at the same rate must use this approach if we want to calculate IRR, payback, or AAR see spreadsheet handouts for MMCC example AFM 271 - NPV and Capital Budgeting Slide 20 Cont’d the tax shield approach: a “divide and conquer” method recall that after tax operating cash flow = revenues expenses - taxes since taxable income = revenues - expenses - CCA, we have taxes = Tc × ( revenues − expenses − CCA ) this implies after tax operating cash flow = revenues × (1 − Tc ) − expenses × (1 − Tc ) + Tc × CCA see spreadsheet handout for MMCC example AFM 271 - NPV and Capital Budgeting Slide 21 Detailed CCA Calculations and Examples assume that salvage takes place at the end of year n, and consider the following formula for the PV of CCA tax shields: " # k CdTc 1 + 2 ∆UCCdTc PV of CCA = − × (1 + k)−n k+d 1+k k+d ∆UCC depends on circumstances. Let the undepreciated capital cost of the asset class just before the asset is disposed of be UCCn . if the firm only ever has one asset in the class, then UCCn = C(1 − d/2)(1 − d)n−1 AFM 271 - NPV and Capital Budgeting Slide 22 Cont’d Calculate the value X = UCCn − min(C, S). Then: 1. If X < 0 ⇒ recaptured depreciation add X to taxable income in year n: PV of recapture = −XTc (1 + k)n set UCC of asset class to zero (so ∆UCC = UCCn ): " # k CdTc 1 + 2 UCCn dTc PV of CCA = − × (1 + k)−n k+d 1+k k+d AFM 271 - NPV and Capital Budgeting Slide 23 Cont’d 2. If X > 0 and there are no other assets in the class ⇒ terminal loss subtract X from taxable income in year n: PV of terminal loss = XTc (1 + k)n set UCC of asset class to zero (so ∆UCC = UCCn ): " # k UCCn dTc CdTc 1 + 2 − × (1 + k)−n PV of CCA = k+d 1+k k+d AFM 271 - NPV and Capital Budgeting Slide 24 Cont’d 3. If X > 0 and there are other assets in the class X becomes the new UCC of the asset class (so ∆UCC = min(C, S)): " # CdTc 1 + 2k min(C, S)dTc PV of CCA = − × (1 + k)−n k+d 1+k k+d three further points: 1. If S > C, there is a capital gain: PV of tax liability = −(S −C)Tc /2 × (1 + k)−n 2. Formulas for CCA tax shields are always given in nominal terms. AFM 271 - NPV and Capital Budgeting Slide 25 Cont’d 3. The formulas given on the preceding slides have a half year rule adjustment applied to the first term but not the second term. This may not always be the case: the half year rule may instead be applied to both terms, neither term, or the second term but not the first, depending on circumstances. In particular, the net acquisitions rule works as follows. Recall that all assets of a given firm within a single CCA class are treated as part of a common pool. In practice, firms often buy and sell many assets in a single class within a year. Define net acquisitions for an asset class as the total capital cost of all acquisitions (in a year) less the total adjusted cost of all disposals within that class and in that year. If net acquisitions is positive, apply the half year rule. If net acquisitions is negative, there is no adjustment for the half year rule. AFM 271 - NPV and Capital Budgeting Slide 26 Cont’d illustrative problem: you are considering whether to undertake a project that will generate revenues of $50,000 per year for 8 years and expenses of $20,000 per year for 8 years. The project requires an investment of $150,000 today in class 8 machinery (d = 25%). Assume k = 12%, Tc = 40%, and all cash flows are nominal, and calculate project NPV under the following scenarios: 1. You always have many other class 8 assets and a positive UCC in that class and you can salvage the machinery at the end of the 9th year for (i) $10,000; and (ii) $200,000. (Assume there are no other acquisitions or disposals of class 8 assets in either the current year or in the 9th year.) 2. The machinery will always be in its own class and it can be salvaged in 9 years for (i) $10,000; (ii) $20,000; and (iii) $200,000. 3. From this point on, the machinery will be in its own class and it can be salvaged in 9 years for $10,000. However, you purchased one other class 8 asset 5 years ago for $200,000 which you have just sold for (i) $100,000; and (ii) $175,000. AFM 271 - NPV and Capital Budgeting Slide 27 Cont’d 1. (i) Cost of machine: -$150,000.00 PV after-tax operating revenues: $149,029.19 PV after-tax operating expenses: -$59,611.68 PV salvage: PV perpetual tax shield on $150,000: PV lost tax shield: NPV: AFM 271 - NPV and Capital Budgeting $3,606.10 $38,368.73 -$974.62 -$19,582.28 Slide 28 Cont’d 1. (ii) Cost of machine: -$150,000.00 PV after-tax operating revenues: $149,029.19 PV after-tax operating expenses: -$59,611.68 PV salvage: $72,122.00 PV capital gain tax: -$3,606.10 PV perpetual tax shield on $150,000: $38,368.73 PV lost tax shield: -$14,619.33 NPV: $31,682.81 AFM 271 - NPV and Capital Budgeting Slide 29 Cont’d 2. (i) Cost of machine: -$150,000.00 PV after-tax operating revenues: $149,029.19 PV after-tax operating expenses: -$59,611.68 PV salvage: $3,606.10 PV perpetual tax shield on $150,000: $38,368.73 PV lost tax shield: -$1,280.64 PV terminal loss: NPV: AFM 271 - NPV and Capital Budgeting $452.90 -$19,435.40 Slide 30 Cont’d 2. (ii) Cost of machine: -$150,000.00 PV after-tax operating revenues: $149,029.19 PV after-tax operating expenses: -$59,611.68 PV salvage: $7,212.20 PV perpetual tax shield on $150,000: $38,368.73 PV lost tax shield: -$1,280.64 PV recapture: -$989.54 NPV: -$17,271.74 AFM 271 - NPV and Capital Budgeting Slide 31 Cont’d 2. (iii) Cost of machine: -$150,000.00 PV after-tax operating revenues: $149,029.19 PV after-tax operating expenses: -$59,611.68 PV salvage: $72,122.10 PV capital gain tax: -$3,606.10 PV perpetual tax shield on $150,000: $38,368.73 PV lost tax shield: -$1,280.64 PV recapture: NPV: AFM 271 - NPV and Capital Budgeting -$19,741.26 $25,280.24 Slide 32 Cont’d 3. (i) Cost of machine: -$150,000.00 PV after-tax operating revenues: $149,029.19 PV after-tax operating expenses: -$59,611.68 PV salvage: $3,606.10 PV perpetual tax shield on $50,000: $12,789.58 PV continuing tax shield on $55,371.09 $14,965.16 PV lost tax shield: -$832.08 PV recapture (year 9): -$210.96 PV avoided recapture today: NPV: $17,851.56 -$12,413.13 AFM 271 - NPV and Capital Budgeting Slide 33 Cont’d 3. (ii) Cost of machine: -$150,000.00 PV after-tax operating revenues: $149,029.19 PV after-tax operating expenses: -$59,611.68 PV salvage: $3,606.10 PV perpetual tax shield on $30,371.09: $8,208.40 PV lost tax shield: -$222.25 PV recapture (year 9): -$1,113.51 PV avoided recapture today: $47,851.56 NPV: -$2,252.19 AFM 271 - NPV and Capital Budgeting Slide 34 Project Interactions many projects have effects on others, e.g. it is important to incorporate effects on other aspects of a firm’s business in capital budgeting analysis (including opportunity costs), and CCA pooling of assets can lead to other interactions between projects another aspect of this is choosing between investments of unequal lives. Suppose that two machines produce the same output but have the following after-tax operating costs per year: Machine C0 C1 C2 C3 A -1,000 -500 -500 0 B -2,000 -100 -100 -100 At a 10% discount rate, which is cheaper to operate? AFM 271 - NPV and Capital Budgeting Slide 35 Cont’d the replacement chain: why not just use NPV and choose the machine with lower discounted costs? assume that machines are needed forever the matching cycle approach: run the example for 6 years. A has 3 complete cycles, B has 2: PV of costs over 6 years: AFM 271 - NPV and Capital Budgeting Slide 36 Cont’d the equivalent annual cost (EAC) approach: idea is to convert PV of costs for machine into an appropriate annuity: firm is indifferent between PV of costs and EAC since the project is assumed to continue forever, the EAC lasts forever, so choose the machine with lower EAC AFM 271 - NPV and Capital Budgeting Slide 37 Cont’d when to replace an old machine? 1. Calculate EAC for new machine (EACnew ) 2. Calculate cost of operating old machine for 1 more year (Cold ) 3. Replace just before Cold > EACnew example: a firm has an existing machine, which could be salvaged for $2,800 today, $2,100 after one year, $1,200 after two years, or zero after 3 years (at which point it would have to be replaced). Maintenance costs on this old machine are $1,175 after one year, $1,600 after two years, and $1,800 after three years. A new machine is available which costs $5,000 and can be salvaged after four years for $1,800. Its maintenance costs are $1,000 after one year, $1,250 after two years, $1,500 after three years, and $2,000 after four years. The new machine produces the same output as the old machine. When should the firm replace the old machine? Assume a discount rate of 10%. AFM 271 - NPV and Capital Budgeting Slide 38 Cont’d the EAC for the new machine is: should the existing machine be replaced now? AFM 271 - NPV and Capital Budgeting Slide 39 Cont’d what about replacing it after one year? note that these types of decisions can easily get far more complicated (e.g. different output levels for the machines, different numbers of machines required, anticipated new technology, etc.) AFM 271 - NPV and Capital Budgeting Slide 40