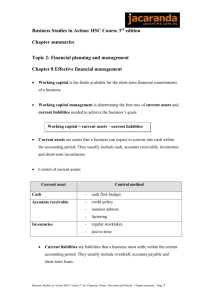

Financial Management

advertisement