Business Studies in Action: HSC Course 3rd edition

advertisement

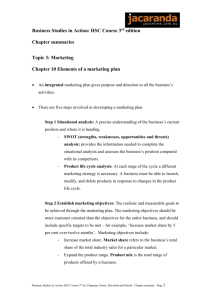

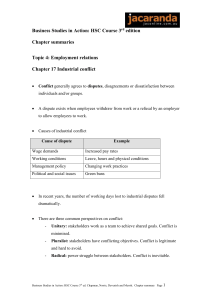

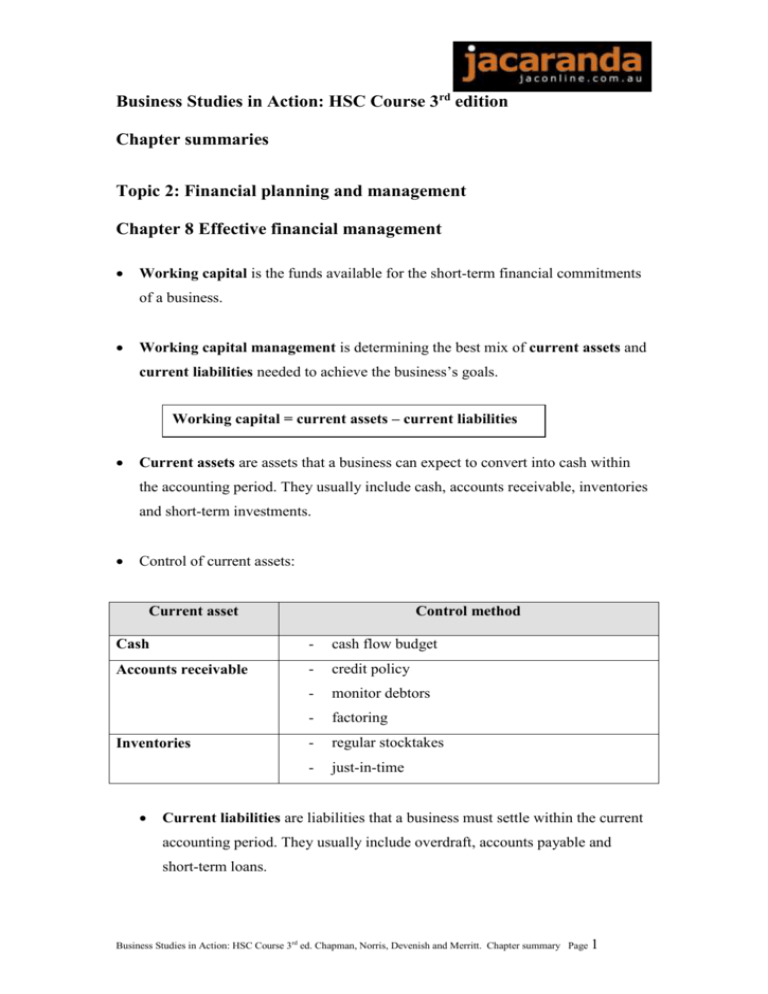

Business Studies in Action: HSC Course 3rd edition Chapter summaries Topic 2: Financial planning and management Chapter 8 Effective financial management Working capital is the funds available for the short-term financial commitments of a business. Working capital management is determining the best mix of current assets and current liabilities needed to achieve the business’s goals. Working capital = current assets – current liabilities Current assets are assets that a business can expect to convert into cash within the accounting period. They usually include cash, accounts receivable, inventories and short-term investments. Control of current assets: Current asset Control method Cash - cash flow budget Accounts receivable - credit policy - monitor debtors - factoring - regular stocktakes - just-in-time Inventories Current liabilities are liabilities that a business must settle within the current accounting period. They usually include overdraft, accounts payable and short-term loans. Business Studies in Action: HSC Course 3rd ed. Chapman, Norris, Devenish and Merritt. Chapter summary Page 1 Control of current liabilities: Current liability Control method - monitor creditors - holding back payment - stretching - early payment discounts Loans - capital budgeting – compare return and risk Overdrafts - regular payments - monitor budgets and bank charges Accounts payable Strategies for managing (improving) working capital: - Leasing: ‘frees up’ cash and no upfront fees. - Factoring: sale of accounts receivable generates immediate cash inflow. - Sale and lease back: cash is obtained from asset sales. Cash flow management is the movement of cash in and out of a business over a period of time. Cash flow statements show the movement of cash receipts and cash payments. In preparing a statement of cash flows, the activities of a business are generally divided into three categories: 1. Operating flows: Sales revenue and operating expenses related to the business’s main activity. 2. Investment flows: purchase and sale of non-current assets. 3. Financing flows: borrowing, debt and equity, of the business. Many businesses use bank overdrafts to cover temporary cash shortfalls. Cash flow management strategies: - Distribute payments throughout the year to avoid cash shortfalls. - Discount for early payment to minimise late payment and bad debts. Business Studies in Action: HSC Course 3rd ed. Chapman, Norris, Devenish and Merritt. Chapter summary Page 2 Effective profitability management requires control of both the business’s costs and its revenue. Profit is the difference between costs and revenue. Cost-control measures: - Fixed and variable costs – identify and account for expenses. - Cost centres – managers accountable for their business unit expenses. - Expense minimisation – expenses budgets assist in cost control. Revenue is the income earned from the main activity of a business. Revenue-control measures: - Sales objectives – set to generate maximum revenue. - Sales mix – review each product’s profit margin contribution. - Pricing policy – balance market share with profitability. Strategies to assist ethical practices: - Independently checked audited accounts. (An audit is an independent check of the accuracy of financial records and accounting procedures.) - Code of ethics and internal controls minimises misuse of funds. - Australian Securities and Investment Commission (ASIC) monitors business practices to ensure compliance with the Corporations Law. Unethical practices: - Creative accounting – inappropriate cut-off periods can create a false financial position. - Corporate raiders – manipulate share price. - Asset stripping – sell assets after takeover. Business Studies in Action: HSC Course 3rd ed. Chapman, Norris, Devenish and Merritt. Chapter summary Page 3