3.1 Days Sales Outstanding

advertisement

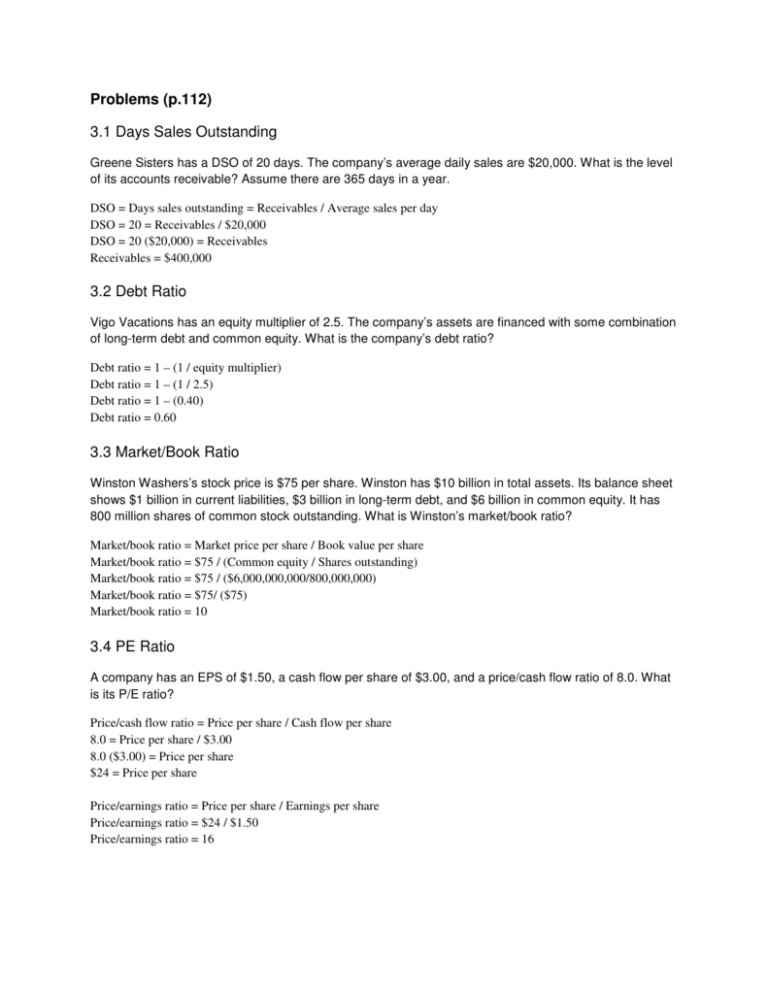

Problems (p.112) 3.1 Days Sales Outstanding Greene Sisters has a DSO of 20 days. The company’s average daily sales are $20,000. What is the level of its accounts receivable? Assume there are 365 days in a year. DSO = Days sales outstanding = Receivables / Average sales per day DSO = 20 = Receivables / $20,000 DSO = 20 ($20,000) = Receivables Receivables = $400,000 3.2 Debt Ratio Vigo Vacations has an equity multiplier of 2.5. The company’s assets are financed with some combination of long-term debt and common equity. What is the company’s debt ratio? Debt ratio = 1 – (1 / equity multiplier) Debt ratio = 1 – (1 / 2.5) Debt ratio = 1 – (0.40) Debt ratio = 0.60 3.3 Market/Book Ratio Winston Washers’s stock price is $75 per share. Winston has $10 billion in total assets. Its balance sheet shows $1 billion in current liabilities, $3 billion in long-term debt, and $6 billion in common equity. It has 800 million shares of common stock outstanding. What is Winston’s market/book ratio? Market/book ratio = Market price per share / Book value per share Market/book ratio = $75 / (Common equity / Shares outstanding) Market/book ratio = $75 / ($6,000,000,000/800,000,000) Market/book ratio = $75/ ($75) Market/book ratio = 10 3.4 PE Ratio A company has an EPS of $1.50, a cash flow per share of $3.00, and a price/cash flow ratio of 8.0. What is its P/E ratio? Price/cash flow ratio = Price per share / Cash flow per share 8.0 = Price per share / $3.00 8.0 ($3.00) = Price per share $24 = Price per share Price/earnings ratio = Price per share / Earnings per share Price/earnings ratio = $24 / $1.50 Price/earnings ratio = 16 3.5 ROE Needham Pharmaceuticals has a profit margin of 3% and an equity multiplier of 2.0. Its sales are $100 million and it has total assets of $50 million. What is its ROE? Total assets turnover = Sales / Total assets Total assets turnover = $100,000,000 / $50,000,000 Total assets turnover = 2 ROE = Profit margin * Total assets turnover * Equity multiplier ROE = 3% * 2 * 2.0 ROE = 12% 3.6 Du Pont Analysis Donaldson & Son has an ROA of 10%, a 2% profit margin, and a return on equity equal to 15%. What is the company’s total assets turnover? What is the firm’s equity multiplier? ROA = Profit margin * Total asset turnover 10% = 2% * Total asset turnover 10% / 2% = Total asset turnover 5 = Total asset turnover ROE = ROA * Equity multiplier 15% = 10% * Equity multiplier 15% / 10% = Equity multiplier 1.5 = Equity multiplier 3.7 Current and Quick Ratios Ace Industries has current assets equal to $3 million. The company’s current ratio is 1.5, and its quick ratio is 1.0. What is the firm’s level of current liabilities? What is the firm’s level of inventories? Current ratio = Current assets / Current liabilities 1.5 = $3,000,000 / Current liabilities 1.5 * Current liabilities = $3,000,000 Current liabilities = $3,000,000 / 1.5 Current liabilities = $2,000,000 Quick ratio = Current assets – Inventories / Current liabilities 1.0 = ($3,000,000 – Inventories) / $2,000,000 1.0 * $2,000,000 = $3,000,000 – Inventories $2,000,000 - $3,000,000 = - Inventories $1,000,000 = Inventories Problems (pp. 165-167) 4.1 FV of Single Amount If you deposit $10,000 in a bank account that pays 10% interest annually, how much will be in your account after 5 years? $16,105.10 = FV(10%,5,,-10000) 4.2 PV of Single Amount What is the present value of a security that will pay $5,000 in 20 years if securities of equal risk pay 7% annually? $1,292.10 = PV(7%,20,,-5000) 4.6 FV of Ordinary Annuity Future Value: ordinary Annuity versus Annuity Due What is the future value of a 7%, 5-year ordinary annuity that pays $300 each year? If this were an annuity due, what would its future value be? Ordinary Annuity Due $1,725.22 $1,845.99 Ordinary = FV(7%,5,-300) Annuity Due = FV(7%,5,-300,,1) 4.13 a PV of an Annuity Find the present value of the following ordinary annuities (see the notes to Problem 4-12). a. $400 per year for 10 years at 10% Ordinary Annuity Due $2,457.83 $2,703.61 Ordinary = PV(10%,10,-400) Annuity Due = PV(5%,5,-200,,1) b. $200 per year for 5 years at 5% Ordinary Annuity Due $865.90 $909.19 Ordinary = PV(5%,5,-200) Annuity Due = FV(7%,5,-300,,1) c. $400 per year for 5 years at 0% Ordinary Annuity Due $2,000.00 $2,000.00 Ordinary = PV(0%,5,-400) Annuity Due = PV(0%,5,-400,,1) d. Now rework parts a, b, and c assuming that payments are made at the beginning of each year, that is, they are annuities due. 4.14 PV Uneven Cash Flow Stream Find the present values of the following cash flow streams. The appropriate interest rate is 8%. (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that, when working with the calculator’s cash flow register, you must enter CF0 = 0. Note also that it is quite easy to work the problem with Excel, using procedures described in the Chapter 4 Tool kit.) Year 1 2 3 4 5 Cash Stream A $ 100 $ 400 $ 400 $ 400 $ 300 Cash Stream B $ 300 $ 400 $ 400 $ 400 $ 100 Cash Stream A: $1,251.25 = NPV(8%,100,400,400,400,300)+0 Cash Stream B: $1,300.32 = NPV(8%,300,400,400,400,100)+0 b. What is the value of each cash flow stream at a 0% interest rate? Cash Stream A: $1,600.00 = NPV(0%,100,400,400,400,300)+0 Cash Stream B: $1,600.00 = NPV(0%,300,400,400,400,100)+0