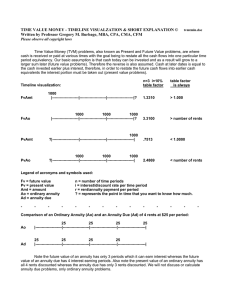

interval deposits

advertisement

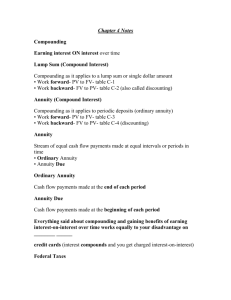

MCR3U Future Value – The Amount of an Ordinary Annuity Mr Watts wants to help pay for his 12 year old granddaughter’s future university expenses. He deposits $3000 at the end of each year for 7 years that pays 7.5%/a compounded annually. Find the amount at the end of 7 years. Set up a time line to represent the deposits The amount after 7 years represents a geometric series with 7 terms; To calculate the amount of the deposits, find the sum of the series The series of deposits shown above is called an annuity. An annuity is a series of equal deposits made at equal time intervals. A simple annuity is an annuity in which the payments coincide with the compounding period, or conversion period. If deposits are made at the end of each time interval, it is called an ordinary annuity. The total value of all deposits at the end of the last time interval is called the amount of an ordinary annuity. The sum of a geometric series is used to calculate the Future Value of a simple, ordinary annuity which can also be expressed in a more simplified form: Where FV is Future Value R is regular payment i is interest rate per conversion period n is the number of conversion periods This leads to the general formula that represents the future value of an ordinary annuity: FV =