Business Lending Fundamentals

advertisement

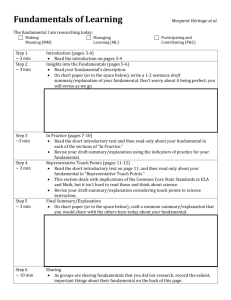

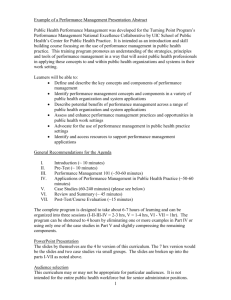

Business Lending Fundamentals SELF-PACED E-LEARNING 10-12 HOURS Build credit acumen by understanding borrowing needs OVE RVIEW The small business market offers the opportunity to invest in the communities you serve while building This course helps organizations tap into this lucrative market by providing the skills needed to successfully W H O S HOU L D ENR OL L Anyone who needs to understand businesses and their borrowing needs, including branch managers, RE S ULT S AND B US I NES S BE N E FI T S Upon completion, participants will be able to: Conduct meaningful conversations with business owners about operations and borrowing needs Assess the industry position, business growth stage, management, and business model Evaluate business loan requests to determine whether they represent bankable opportunities Improve communication with business owners and managers, as well as with internal management L E A RNING M O D ULES 1 2 3 4 5 Learning about the Business Understanding Business Needs Assessing the Business and Management Fundamentals of Financial Statements and Tax Returns Understanding Needs and Communicating Credit Solutions E-LEARNING By OMEGA PERFORMANCE Omega Performance E-Learning courses, accessible online at any time, are developed to be highly interactive—maintaining high learner interest that Learning Module Descriptions 1 LEARNING ABOUT THE BUSINESS 4 FUNDAMENTALS OF FINANCIAL STATEMENTS AND TAx RETURNS Addresses the components of a preliminary assessment situations 2 income statements UNDERSTANDING BUSINESS NEEDS determine the strength of a guarantee Compares and contrasts cash and accrual accounting Conveys the importance of the operating cycle as a foundation for planning and conducting borrower conversations and risk analysis through a business Demonstrates how timing differences in the operating cycle create 5 UNDERSTANDING NEEDS AND 3 COMMUNICATING CREDIT SOLUTIONS ASSESSING THE BUSINESS AND MANAGEMENT company’s loan request as part of the credit approval process Provides a process to determine the effectiveness of a borrower’s competitive strategy guarantees, and subordination Demonstrates the key issues to address when assessing a business Reviews the components of pricing Reviews the characteristics of strong general management analysis, including breadth, depth, leadership, and reputation Demonstrates how to communicate the credit solution including approvals, counter-offers, and declines Conveys the importance of product-market management regulatory issues information systems that support the business likelihood of business debt repayment FIND OUT MORE ABOUT OMEGA PERFORMANCE TRAINING For detailed course descriptions and to speak with an Omega training consultant, please contact us at: North America: +1 703-558-4440 // solutions@omega-performance.com // omega-performance.com +65 6505-2060 // apacsolutions@omega-performance.com // omega-performanceapac.com Training Effectiveness Benchmarking Report Business Lending Fundamentals Average Percentage Increase in Knowledge LEARNING MODULES 28% PRE-TEST SCORES POST-TEST SCORES 1. Learning About the Business 65 91 2. Understanding Business Needs 60 90 3. Assessing the Business & Management 58 86 4. Fundamentals of Financial Statements & Tax Returns 49 85 5. Understanding Needs & Communicating Credit 69 88 Key Takeaways 30% Pre-Training Participants were lacking critical Business Lending Fundamental skills, such as the ability to identify borrowing needs or understand the effects of different growth stages of business. Further, participants were not able to identify all parts of a business tax return or financial statement. 28% 36% 60 90 Unders sta andin ng Understanding Business Needs usiness Need ds Pre-Test 58 86 49 Assesssin A ng th he Assessing the Business Busine ess & Management Post-Test 85 F Fundam am men e ta alss Fundamentals of Financial Fina ancial Statements & Tax Returns Increase in Knowledge The graph above displays the score data for the learning modules of Business Lending Fundamentals in which participants display the greatest skill improvement, as demonstrated in the Pre-Test and Post-Test differential. OMEGA PERFORMANCE BENCHMARKING REPORT Post-Training Post-Test results highlighted an average 28% improvement in key skills. Participants were able to demonstrate the impact of sales growth on financing needs, and outline financial issues to address when evaluating a business. Additionally, participants were able to identify all parts of a business tax return and financial statement, and recognize how basic financial statement ratios are used in making credit decisions.