Managerial Accounting - McCombs School of Business

advertisement

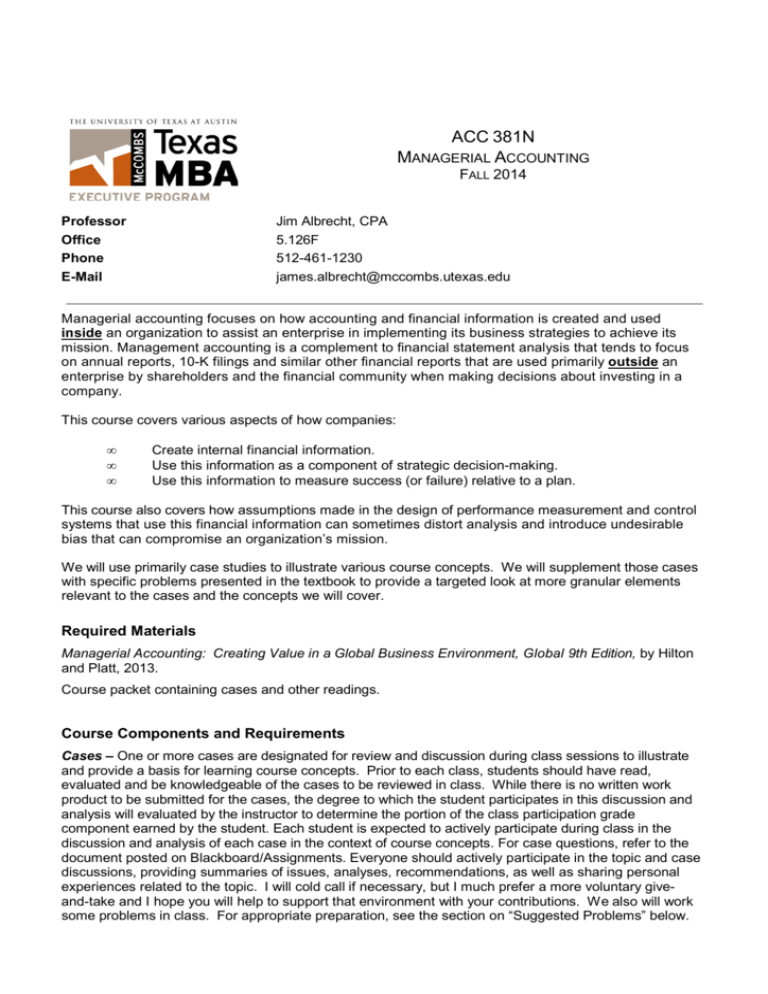

EVISED ACC 381N MANAGERIAL ACCOUNTING FALL 2014 Professor Office Phone E-Mail Jim Albrecht, CPA 5.126F 512-461-1230 james.albrecht@mccombs.utexas.edu Managerial accounting focuses on how accounting and financial information is created and used inside an organization to assist an enterprise in implementing its business strategies to achieve its mission. Management accounting is a complement to financial statement analysis that tends to focus on annual reports, 10-K filings and similar other financial reports that are used primarily outside an enterprise by shareholders and the financial community when making decisions about investing in a company. This course covers various aspects of how companies: • • • Create internal financial information. Use this information as a component of strategic decision-making. Use this information to measure success (or failure) relative to a plan. This course also covers how assumptions made in the design of performance measurement and control systems that use this financial information can sometimes distort analysis and introduce undesirable bias that can compromise an organization’s mission. We will use primarily case studies to illustrate various course concepts. We will supplement those cases with specific problems presented in the textbook to provide a targeted look at more granular elements relevant to the cases and the concepts we will cover. Required Materials Managerial Accounting: Creating Value in a Global Business Environment, Global 9th Edition, by Hilton and Platt, 2013. Course packet containing cases and other readings. Course Components and Requirements Cases – One or more cases are designated for review and discussion during class sessions to illustrate and provide a basis for learning course concepts. Prior to each class, students should have read, evaluated and be knowledgeable of the cases to be reviewed in class. While there is no written work product to be submitted for the cases, the degree to which the student participates in this discussion and analysis will evaluated by the instructor to determine the portion of the class participation grade component earned by the student. Each student is expected to actively participate during class in the discussion and analysis of each case in the context of course concepts. For case questions, refer to the document posted on Blackboard/Assignments. Everyone should actively participate in the topic and case discussions, providing summaries of issues, analyses, recommendations, as well as sharing personal experiences related to the topic. I will cold call if necessary, but I much prefer a more voluntary giveand-take and I hope you will help to support that environment with your contributions. We also will work some problems in class. For appropriate preparation, see the section on “Suggested Problems” below. After each class, I will make class participation notes, with particular attention to quality of comments, not quantity. Suggested Problems – As an adjunct to case facts and circumstances, problems in the textbook will be recommended to direct your attention to certain concepts and to provide practice related to certain accounting tools or techniques used in managerial accounting activities. While there may be a nonspecific, intuitive answer to the problems at a conceptual level, it is important for the student to “workthrough” the problem to a solution in order to gain experience with and develop an appreciation for the dynamics of management accounting. These problems are not collected or graded. The solutions will be reviewed in class or posted to Blackboard for your review. Examination – A comprehensive, course examination is administered during the final class session. It may include problems, essay questions, and/or short answer questions. The scope of the examination is all concepts and subjects covered in this management accounting curriculum. This examination is the only test for this course. Course Grade This curriculum is 50% of the total curriculum that, when combined with the financial statement analysis curriculum, comprises a full course of record. Your grade for the course as a whole is a result of an equally-weighted combination of your grades for each of managerial accounting and financial statement analysis. Your grade for this managerial accounting curriculum is comprised of the following components: Class Participation Final Exam 25% of total grade 75% of total grade Attendance Consistent class attendance by all students is important to the success of the learning experience and achieving the overall objectives of the course for all students both individually and collectively. Missing class can have an immediate effect on the class participation portion of your grade. If you miss three or more class sessions, your class participation grade will automatically default to zero. Academic Dishonesty Cheating is an insult to your fellow students and to this learning experience. I always report it, and I go for the maximum penalty possible. Always. Don’t do it. You’ll feel bad even if you get away with it, and really, this isn’t about the grade anyway, is it? Official policy: The McCombs School of Business has no tolerance for acts of scholastic dishonesty. The responsibilities of both students and faculty with regard to the Honor System have been described to you by the Texas EMBA staff. These standards are essential not only to the maintenance of the academic integrity of the program but also its brand equity, an important part of its value to all graduates. You must clarify any points of confusion or uncertainty with the professor in advance. For more information on scholastic dishonesty at the University of Texas at Austin, please contact the professor or program staff, or visit deanofstudents.utexas.edu/sjs. ACC 381N Managerial Accounting Class Schedule, Content and Assignments Fall 2014 Class #1 Concept #1 Text Reading Case Costs, Expenses and Margin Chapter 1 and 2 Caribbean Internet Cafe Class #2 Concept #2 Text Reading Cases Budgeting Chapter 9 Hanson Ski Codman & Shurtleff Concept #3 Text Reading Case Cost Assignment and Costing Models Chapters 3 and 4 Seligram PTO Class #3 Concept #4 Text Reading Case Activity Based Costing Chapter 5 Siemens EMW Concept #5 Text Reading Case Cost-Volume-Profit Analysis Chapter 7 Bill French, Accountant Class #4 Concept #6 Text Reading Case Decision Making: Relevant Costs and Benefits Chapter 14 Baldwin Bicycle Concept #7 Text Reading Case Investment Centers and Transfer Pricing Chapter 13 Compagnie du Froid Class #5 Concept #8 Text Reading Case Standard Costing and Operational Performance Measures Chapter 10 Citibank Performance Evaluation Concept #9 Text Reading Case Levers of Control Simons “Control in the Age of Empowerment” (separate from textbook) Automation Consulting