padini holdings

CONSUMER

PADINI HOLDINGS

(PAD MK, PDNI.KL)

PP 12247/06/2012 (030106)

11 May 2012

Expansion plan remains on track

Company report

BUY

AmResearch Sdn Bhd

www.amesecurities.com.my

+603 2036 2304

Price

Fair Value

52-week High/Low

Key Changes

RM1.75

RM2.15

RM1.79/RM0.83

Fair value

EPS

YE to June

Revenue (RMmil)

Core net profit (RMmil)

EPS (Sen)

EPS growth (%)

Consensus EPS (Sen)

DPS (Sen)

PE (x)

EV/EBITDA (x)

Div yield (%)

ROE (%)

Net Gearing (%)

Stock and Financial Data

Unchanged

FY11

568.5

74.7

11.3

24.7 n/a

FY12F

648.9

83.1

12.7

11.5

13.2

FY13F

732.1

98.8

15.1

19.2

15.2

FY14F

801.6

104.4

16.0

5.9

17.7

4.0

15.4

10.7

4.0

13.8

9.7

4.5

11.6

7.8

5.0

11.0

7.0

2.3

28.9

2.3

27.4

2.6

27.5

2.9

24.4

Net cash Net cash Net cash Net cash

Shares Outstanding (million) 657.9

Market Cap (RMmil) 1,151.3

Book value (RM/share)

P/BV (x)

ROE (%)

Net Gearing (%)

Major Shareholders

0.43

4.1

28.9

Net cash

Free Float (%)

Avg Daily Value (RMmil)

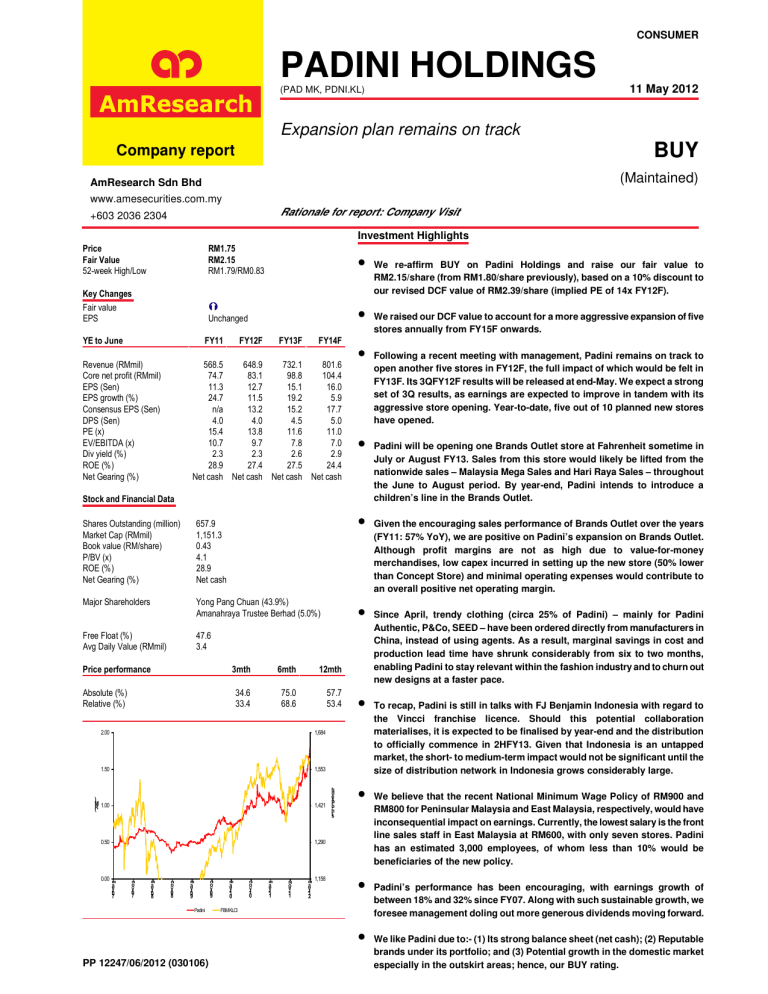

Price performance

Yong Pang Chuan (43.9%)

Amanahraya Trustee Berhad (5.0%)

47.6

3.4

3mth 6mth 12mth

Absolute (%)

Relative (%)

34.6

33.4

75.0

68.6

57.7

53.4

2.00

1.50

Rationale for report: Company Visit

1,684

1,553

Investment Highlights

• We re-affirm BUY on Padini Holdings and raise our fair value to

RM2.15/share (from RM1.80/share previously), based on a 10% discount to our revised DCF value of RM2.39/share (implied PE of 14x FY12F).

•

• Following a recent meeting with management, Padini remains on track to

• Padini will be opening one Brands Outlet store at Fahrenheit sometime in

July or August FY13. Sales from this store would likely be lifted from the

• Given the encouraging sales performance of Brands Outlet over the years

(FY11: 57% YoY), we are positive on Padini’s expansion on Brands Outlet.

• Since April, trendy clothing (circa 25% of Padini) – mainly for Padini

•

We raised our DCF value to account for a more aggressive expansion of five stores annually from FY15F onwards.

(Maintained)

open another five stores in FY12F, the full impact of which would be felt in

FY13F. Its 3QFY12F results will be released at end-May. We expect a strong set of 3Q results, as earnings are expected to improve in tandem with its aggressive store opening. Year-to-date, five out of 10 planned new stores have opened. nationwide sales – Malaysia Mega Sales and Hari Raya Sales – throughout the June to August period. By year-end, Padini intends to introduce a children’s line in the Brands Outlet.

Although profit margins are not as high due to value-for-money merchandises, low capex incurred in setting up the new store (50% lower than Concept Store) and minimal operating expenses would contribute to an overall positive net operating margin.

Authentic, P&Co, SEED – have been ordered directly from manufacturers in

China, instead of using agents. As a result, marginal savings in cost and production lead time have shrunk considerably from six to two months, enabling Padini to stay relevant within the fashion industry and to churn out new designs at a faster pace.

To recap, Padini is still in talks with FJ Benjamin Indonesia with regard to the Vincci franchise licence. Should this potential collaboration materialises, it is expected to be finalised by year-end and the distribution to officially commence in 2HFY13. Given that Indonesia is an untapped market, the short- to medium-term impact would not be significant until the size of distribution network in Indonesia grows considerably large.

In d

)

M

(R

1.00

0.50

1,421

1,290

• We believe that the recent National Minimum Wage Policy of RM900 and

RM800 for Peninsular Malaysia and East Malaysia, respectively, would have inconsequential impact on earnings. Currently, the lowest salary is the front line sales staff in East Malaysia at RM600, with only seven stores. Padini has an estimated 3,000 employees, of whom less than 10% would be beneficiaries of the new policy.

0.00

07 y-

M a

07 v-

N o

08 y-

M a

08 v-

N o

09 y-

M a

Padini

09 v-

N o

M y-

10

FBM KLCI

10 v-

N o

11 y-

M a

11 v-

12 y-

M a

1,158

• Padini’s performance has been encouraging, with earnings growth of between 18% and 32% since FY07. Along with such sustainable growth, we foresee management doling out more generous dividends moving forward.

• We like Padini due to:- (1) Its strong balance sheet (net cash); (2) Reputable brands under its portfolio; and (3) Potential growth in the domestic market especially in the outskirt areas; hence, our BUY rating.

Padini Holdings

4.0

3.2

)

(x

2.4

1.6

0.8

0.0

D ec

M a

CHART 1 : PB BAND CHART

S e

0

D ec

M a

D e

M a

+1s

Avg

-1s

16.0

13.0

10.0

)

(x

7.0

4.0

1.0

D ec

M a

CHART 2 : PE BAND CHART

D ec

M a

11 May 2012

M a

+1s

Avg

-1s

AmResearch Sdn Bhd 2

Padini Holdings

AmResearch Sdn Bhd

11 May 2012

Income Statement (RMmil, YE 30 June)

Revenue

EBITDA

Depreciation

Operating income (EBIT)

Other income & associates

Net interest

Exceptional items

Pretax profit

Taxation

Minorities/pref dividends

Net profit

Core net profit

Balance Sheet (RMmil, YE 30 June)

Fixed assets

Intangible assets

Other long-term assets

Total non-current assets

Cash & equivalent

Stock

Trade debtors

Other current assets

Total current assets

Trade creditors

Short-term borrowings

Other current liabilities

Total current liabilities

Long-term borrowings

Other long-term liabilities

Total long-term liabilities

Shareholders’ funds

Minority interests

BV/share (RM)

Cash Flow (RMmil, YE 30 June)

Pretax profit

Depreciation

Net change in working capital

Others

Cash flow from operations

Capital expenditure

Net investments & sale of fixed assets

Others

Cash flow from investing

Debt raised/(repaid)

Equity raised/(repaid)

Dividends paid

Others

Cash flow from financing

Net cash flow

Net cash/(debt) b/f

Net cash/(debt) c/f

Key Ratios (YE 30 June)

Revenue growth (%)

EBITDA growth (%)

Pretax margins (%)

Net profit margins (%)

Interest cover (x)

Effective tax rate (%)

Net dividend payout (%)

Debtors turnover (days)

Stock turnover (days)

Creditors turnover (days)

Source: Company, AmResearch estimates

TABLE 1 : FINANCIAL DATA

58.6

26.1

26.6

111.4

10.1

0.8

10.9

234.3

0.0

0.36

2010

80.8

7.0

4.5

92.3

135.0

76.6

32.6

20.2

264.3

(1.1)

4.7

0.0

85.2

(25.3)

0.0

59.9

59.9

2010

2010

518.8

81.6

0.0

81.6

0.0

(17.8)

(3.5)

(13.5)

69.2

61.4

98.8

2010

9.1

27.1

16.4

11.5

74.6

29.7

33.0

23

59 n/a

85.2

21.8

26.8

(23.6)

110.2

(25.7)

0.1

(2.0)

(27.6)

7.8

93.9

24.9

19.1

137.9

22.2

1.6

23.7

282.7

0.0

0.43

2011

83.6

6.5

4.4

94.6

138.6

171.0

39.4

0.7

349.8

(1.0)

6.0

0.0

104.0

(29.4)

0.0

74.7

74.7

2011

2011

568.5

99.1

0.0

99.1

0.0

(32.9)

(0.7)

(22.1)

3.4

(8.1)

91.5

2011

9.6

21.5

18.3

13.1

63.0

28.2

35.2

23

79

49

104.0

22.3

(69.0)

(27.6)

29.8

(24.7)

20.4

0.0

(4.3)

11.5

51.6

3.1

7.4

62.1

19.0

1.6

20.6

325.2

0.0

0.49

2012F

87.4

7.0

4.4

98.8

100.4

131.3

33.9

43.5

309.1

2012F

648.9

110.3

0.0

110.3

0.0

5.1

0.0

115.5

(32.3)

0.0

83.1

83.1

2012F

0.0

(26.3)

5.0

(24.6)

(36.1)

(32.8)

78.3

2012F

14.1

11.3

17.8

12.8

75.9

28.0

31.7

21

85

41

115.5

24.8

(87.4)

(34.6)

18.2

(30.0)

0.3

0.0

(29.7)

(3.3)

45.6

2.2

11.5

59.3

14.5

1.6

16.0

466.0

0.0

0.71

2014F

87.2

7.9

4.4

99.6

210.3

105.7

31.0

94.8

441.8

2014F

801.6

136.3

0.0

136.3

0.0

8.7

0.0

145.0

(40.6)

0.0

104.4

104.4

2014F

0.0

(29.6)

8.4

(23.7)

68.0

70.5

193.6

2014F

9.5

3.4

18.1

13.0

124.6

28.0

31.5

15

48

22

145.0

29.8

(6.8)

(46.5)

121.5

(30.0)

0.3

0.0

(29.7)

(2.5)

49.3

2.6

9.2

61.2

16.6

1.6

18.1

394.5

0.0

0.60

2013F

88.5

7.4

4.4

100.4

142.2

106.9

32.9

91.3

373.4

2013F

732.1

131.8

0.0

132

0.0

5.5

0.0

137.3

(38.4)

0.0

98.8

98.8

2013F

0.0

(26.3)

5.1

(24.1)

41.9

44.7

123.1

2013F

12.8

19.4

18.8

13.5

104.6

28.0

30.0

17

59

25

137.3

27.3

(27.8)

(41.1)

95.7

(30.0)

0.3

0.0

(29.7)

(2.9)

3

Padini Holdings

Anchor point for disclaimer text box

11 May 2012

Published by

AmResearch Sdn Bhd (335015-P)

(A member of the AmInvestment Bank Group)

1 5 t h F l o o r B a n g u n a n A m B a n k G r o u p

55 Jalan Raja Chulan

50200 Kuala Lumpur

Tel: ( 0 3 ) 2 0 7 0 - 2 4 4 4 ( r e s e a r c h )

F a x : ( 0 3 ) 2 0 7 8 - 3 1 6 2

Printed by

AmResearch Sdn Bhd (335015-P)

(A member of the AmInvestment Bank Group)

1 5 t h F l o o r B a n g u n a n A m B a n k G r o u p

55 Jalan Raja Chulan

50200 Kuala Lumpur

Tel: ( 0 3 ) 2 0 7 0 - 2 4 4 4 ( r e s e a r c h )

F a x : ( 0 3 ) 2 0 7 8 - 3 1 6 2

AmResearch Sdn Bhd

The information and opinions in this report were prepared by AmResearch Sdn Bhd. The investments discussed or recommended in this report may not be suitable for all investors. This report has been prepared for information purposes only and is not an offer to sell or a solicitation to buy any securities. The directors and employees of AmResearch Sdn Bhd may from time to time have a position in or with the securities mentioned herein. Members of the AmInvestment Group and their affiliates may provide services to any company and affiliates of such companies whose securities are mentioned herein. The information herein was obtained or derived from sources that we believe are reliable, but while all reasonable care has been taken to ensure that stated facts are accurate and opinions fair and reasonable, we do not represent that it is accurate or complete and it should not be relied upon as such. No liability can be accepted for any loss that may arise from the use of this report. All opinions and estimates included in this report constitute our judgement as of this date and are subject to change without notice.

For AmResearch Sdn Bhd

Benny Chew

Managing Director