Q u ic k T ake - Am Securities

advertisement

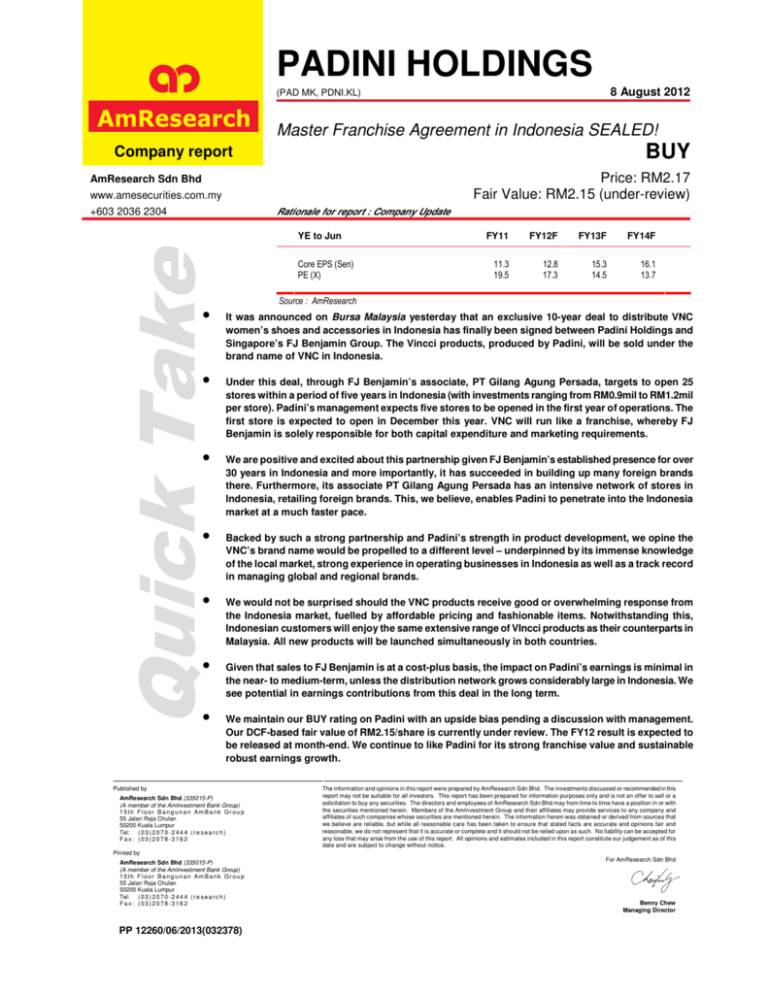

PADINI HOLDINGS 8 August 2012 (PAD MK, PDNI.KL) Master Franchise Agreement in Indonesia SEALED! BUY Company report Price: RM2.17 Fair Value: RM2.15 (under-review) AmResearch Sdn Bhd www.amesecurities.com.my +603 2036 2304 Rationale for report : Company Update Quick Take YE to Jun Core EPS (Sen) PE (X) FY11 FY12F FY13F FY14F 11.3 19.5 12.8 17.3 15.3 14.5 16.1 13.7 Source : AmResearch • It was announced on Bursa Malaysia yesterday that an exclusive 10-year deal to distribute VNC women’s shoes and accessories in Indonesia has finally been signed between Padini Holdings and Singapore’s FJ Benjamin Group. The Vincci products, produced by Padini, will be sold under the brand name of VNC in Indonesia. • Under this deal, through FJ Benjamin’s associate, PT Gilang Agung Persada, targets to open 25 stores within a period of five years in Indonesia (with investments ranging from RM0.9mil to RM1.2mil per store). Padini’s management expects five stores to be opened in the first year of operations. The first store is expected to open in December this year. VNC will run like a franchise, whereby FJ Benjamin is solely responsible for both capital expenditure and marketing requirements. • We are positive and excited about this partnership given FJ Benjamin’s established presence for over 30 years in Indonesia and more importantly, it has succeeded in building up many foreign brands there. Furthermore, its associate PT Gilang Agung Persada has an intensive network of stores in Indonesia, retailing foreign brands. This, we believe, enables Padini to penetrate into the Indonesia market at a much faster pace. • Backed by such a strong partnership and Padini’s strength in product development, we opine the VNC’s brand name would be propelled to a different level – underpinned by its immense knowledge of the local market, strong experience in operating businesses in Indonesia as well as a track record in managing global and regional brands. • We would not be surprised should the VNC products receive good or overwhelming response from the Indonesia market, fuelled by affordable pricing and fashionable items. Notwithstanding this, Indonesian customers will enjoy the same extensive range of VIncci products as their counterparts in Malaysia. All new products will be launched simultaneously in both countries. • Given that sales to FJ Benjamin is at a cost-plus basis, the impact on Padini’s earnings is minimal in the near- to medium-term, unless the distribution network grows considerably large in Indonesia. We see potential in earnings contributions from this deal in the long term. • We maintain our BUY rating on Padini with an upside bias pending a discussion with management. Our DCF-based fair value of RM2.15/share is currently under review. The FY12 result is expected to be released at month-end. We continue to like Padini for its strong franchise value and sustainable robust earnings growth. Published by AmResearch Sdn Bhd (335015-P) (A member of the AmInvestment Bank Group) 15 th F l oor B a ng un an Am B a nk Gr ou p 55 Jalan Raja Chulan 50200 Kuala Lumpur Tel: ( 0 3 ) 2 0 7 0 - 2 4 4 4 ( r e s e a r c h ) F a x: ( 03 ) 2 07 8- 3 16 2 The information and opinions in this report were prepared by AmResearch Sdn Bhd. The investments discussed or recommended in this report may not be suitable for all investors. This report has been prepared for information purposes only and is not an offer to sell or a solicitation to buy any securities. The directors and employees of AmResearch Sdn Bhd may from time to time have a position in or with the securities mentioned herein. Members of the AmInvestment Group and their affiliates may provide services to any company and affiliates of such companies whose securities are mentioned herein. The information herein was obtained or derived from sources that we believe are reliable, but while all reasonable care has been taken to ensure that stated facts are accurate and opinions fair and reasonable, we do not represent that it is accurate or complete and it should not be relied upon as such. No liability can be accepted for any loss that may arise from the use of this report. All opinions and estimates included in this report constitute our judgement as of this date and are subject to change without notice. Printed by AmResearch Sdn Bhd (335015-P) (A member of the AmInvestment Bank Group) 15 th F l oor B a ng un an Am B a nk Gr ou p 55 Jalan Raja Chulan 50200 Kuala Lumpur Tel: ( 0 3 ) 2 0 7 0 - 2 4 4 4 ( r e s e a r c h ) F a x: ( 03 ) 2 07 8- 3 16 2 PP 12260/06/2013(032378) For AmResearch Sdn Bhd Benny Chew Managing Director 8 August 2012 Padini Holdings TABLE 1 : VALUATION MATRIX YE to Jun Revenue (RMmil) Core net profit (RMmil) EPS (Sen) EPS growth (%) Consensus EPS (Sen) DPS (Sen) PE (x) EV/EBITDA (x) Div yield (%) ROE (%) Net Gearing (%) FY10 FY11 FY12F FY13F FY14F 518.8 59.9 9.1 3.0 24.3 16.6 1.4 27.3 Net cash 568.5 74.7 11.3 24.7 4.0 19.5 13.7 1.8 28.9 Net cash 656.1 84.2 12.8 12.8 14.5 6.0 17.3 12.2 2.7 28.3 Net cash 741.8 100.6 15.3 19.4 16.5 6.0 14.5 9.9 2.7 29.3 Net cash 811.6 106.2 16.1 5.6 18.0 6.0 13.7 9.0 2.7 26.1 Net cash Source : Company, AmResearch estimates AmResearch Sdn Bhd 2