Deliberative Automated Negotiators Using Fuzzy Similarities

advertisement

Deliberative Automated Negotiators Using Fuzzy Similarities

C. Sierra

IIIA (CSIC), Spain.

Sierra@iiia.csic.es

P. Faratin

N.R. Jennings

QMW

University of London

P.Faratin@qmw.ac.uk

Introduction

Automated agents are autonomous entities which decide for themselves what, when, and under what conditions their actions should be performed. Since agents

have no direct control over others, they must persuade

others to act in a particular manner. The type of persuasion we consider in this paper is negotiation which

we dene as a process by which a joint decision is made

by two or more parties. The parties rst verbalise contradictory demands and then move towards agreements

(Pruitt 1981).

For negotiation agents must be provided with the capability to represent and reason about, within their information and resource bounds, both their internal and

their external world and with the capacity to interact

according to a normative protocol. It is this individual

agent modelling which has been the central focus of the

work reported in this paper.

This paper extends our previous work, reported in

(Faratin, Sierra, & Jennings 1998), on negotiation models in the following way. The agent architecture has

been updated from a purely responsive mechanisms to

include new higher level deliberative mechanisms, involving the generation of trade os and the manipulation of the set of issues under negotiation by means

of a fuzzy similarity measure. Due to the complexity

of interactions and the nature and number of possible settlements, automated negotiators require problem

solving mechanisms which are more sophisticated than

simple response mechanisms. The negotiation protocol

has been updated to account for these new mechanisms.

More generally speaking, this paper advances the state

of the art in negotiation by designing components of

a negotiation architecture which allows agents to be

both responsive and deliberative and thus participate

in more varied types of negotiation processes.

The deliberative component of the individual agent

architecture is expanded on which describe evaluation

and oer generation mechanisms. An example real

world scenario is then introduced to clarify the concepts introduced in the model. Finally, we present the

conclusions reached and future avenues of research.

Agent Negotiation Architecture

The main contribution of the research reported here is

the use of fuzzy techniques for the specication of a

QMW

University of London

N.R.Jennings@qmw.ac.uk

negotiation architecture that structures the individual

agent's reasoning throughout the problem solving. Negotiation is often characterised by the diculty faced

by agents in establishing crisp decisions. For example, preferences, comparison of contracts or evaluation

of contracts may be vague. Thus, the use of fuzzy

techniques appears very natural to extend a classical

negotiation model. In this paper we'll see the use of

fuzzy techniques to compare contracts exchanged between agents. More concretely we'll generate trade-os

as contracts that are `similar' to contracts oered by opponents by means of a fuzzy similarity measure. Also,

we'll use this measure to compute which issue to include

in a negotiation process. Future work will include the

modelling of fuzzy preferences, and the fuzzy qualitative modelling of weights or issues' importance.

Rational behaviour is assumed to consist of maximisation of some value function (Raia 1982). Given this

rationality stance, the decisions faced by agents in negotiation are often a combination of: oer generation

decisions (what initial oer should be generated, what

counter oer should be given in situations where the

opponent's oer is unacceptable), and evaluatory decisions (when negotiation should be abandoned, and

when an agreement is reached). The solution to these

decision problems is captured in the agent architecture.

The mechanisms which assist an agent with evaluation

of oers is described rst, followed by two deliberative

mechanisms and an example.

Evaluation Mechanism

The evaluation process involves computing the

value/score of a proposal or a contract. When an agent

a receives an oer x from b at time t, xtb!a , over a set of

issues J , (x = (xj1 ] : : : xjn ]) where ji 2 J ), it rates

the overall contract value using the following weighted,

linear, additive scoring function:

V a (x) =

P

X wa V a(xji ])

in

1

ji ji

(1)

where wjai is the importance (or weight) of issue ji

such that 1in wjai = 1. Given that the set of negotiation issues can dynamically change, agents need

to dynamically change the values of the weights. The

score of value xj ] for agent a, given the domain of

acceptable values Dj , is modelled as a scoring function Vja : Dj ! 0 1]. For convenience, scores are

bounded to the interval 0 1] and the scoring functions

are monotonous for quantitative issues. Note that our

formulation assumes scores of issues are independent.

Given the score of the oered contract, the contract

evaluation function will determine whether to accept

or reject the contract or whether to generate a new

contract to propose back to the other agent.

Trade O Mechanism

A trade o is where one party lowers its score on some

issues and simultaneously demands more on other issues. Thus, a trade o is a search for a new contract to

propose that is equally valuable to the previous oered

contract, but which may benet the other party.

This decision making mechanism is costly since it involves searching all, or a subset of, possible contracts

with the same score as the previously oered contract

and the selecting the a new contract to propose that is

the \closest" to the opponent's last oer. The search

is initiated by rst generating new contracts that lie

on what is called the iso-value (or indierence) curves

(Raia 1982). Because all the potential contracts lie on

the same iso-value curve the agent is indierent between

them. More formally, an iso-curve is dened as:

Denition 1 Given a scoring value , the iso-curve set

at degree for agent a is dened as:

isoa () = fx j V a (x) = g

(2)

The selection of which contract to oer is then modelled as a \closeness function". The theory of fuzzy

similarity can be used to model \closeness". The best

trade o is the one that is the most similar contract on

the iso-curve to the opponent's last oer, since it may

be benecial to the other party. This evaluation is uncertain since other party's evaluation is not known by

the proposing agent. A trade o can now be dened as:

Denition 2 Given an oer, x, from agent a to b, and

a subsequent counter oer, y, from agent b to a,, with

= V a (x), a trade o for agent a with respect to y is

dened as:

tradeo a (x y) = arg max fSim(z y)g

z2isoa ()

(3)

where the similarity, Sim, between two contracts is

dened as a weighted combination of the similarity of

the issues:

Denition 3 The similarity between two contracts x

and y over the set of issues J is dened as:

Sim(x y) =

P

X waSimj (xj] yj])

j 2J

j

(4)

With, j2J wja = 1. Simj is the similarity function for

issue j .

Following the results from (Valverde 1985), a similarity function, that is, a function that satises the

axioms of reexivity, symmetry, and t-norm transitivity, can always be dened as a conjunction (modelled

as the inmum) of appropriate fuzzy equivalence relations induced by a set of criteria functions hi . A criteria

function is a function that maps from a given domain

into values in 0 1].

The similarity between two values for issue j ,

Simj (x y) is dened as:

Denition 4 Given a domain of values Dj , the similarity between two values x y 2 Dj is dened as:

Simj (x y) =

^

(hi (x) $ hi (y))

im

1

(5)

where fh1 : : : hm g is a set of comparison criteria with

hi : Dj ! 0 1], and $ is an equivalence operator.

Simple examples of the equivalence operator,$, are

h(x) $ h(y) = 1; j h(x) ; h(y) j or h(x) $ h(y) =

min(h(y)=h(x) h(x)=h(y)).

Issue Set Mechanisms

Our other deliberation mechanism is issue set manipulation. Negotiation processes are directed and centred around the resolution of conicts over a set of issues J . It is assumed that agents begin negotiation

with a prespecied set of \core" issues, J core J , and

possibly other mutually agreed non-core set members,

J :core J . Alterations to J core is not permitted. However, elements of J :core can be altered dynamically.

Agents can add or remove issues into J :core as they

search for new possible and up to now unconsidered

solutions.

If J t is the set of issues being used at time t (where

t

J = fj1 : : : jn g), J ; J t is the set of issues not being

used at time t, and xt = (xj1 ] : : : xjn ]) is a0 s current oer to b at time t, then issue set manipulation is

dened through two operators: add and remove.

The add operator assists the agent in selecting an

issue j 0 from J ; J t , and an associated value xj 0 ], that

gives the highest score to the agent.

Denition 5 The best issue to add to the set J t is dened as:

(6)

add(J t ) = arg j2max

f max V a (xt :xj ])g

J ;J t

xj ]2Dj

where : stands for concatenation.

An issue's score evaluation is also used to dene the

remove operator in a similar fashion. This operator

assists the agent in selecting the best issue to remove

from the current negotiation set J t .

Denition 6 The best issue to remove from the set J t

(from a0 s perspective), is dened as:

remove(J t ) = arg j 2Jmax

fV a (x)g

(7)

t ;J core

i

with x = (xt j1 ] : : : xt ji;1 ] xt ji+1 ] xt jn ])

The remove operator can also be dened in terms

of the aforementioned similarity function. This type

of similarity-based remove operator selects from two

given oers x, from agent a to b, and y, from agent b

to a, which issue to remove in order to maximise the

similarity between x and y. Therefore, this mechanism

can be considered as more cooperative. We dene this

similarity based remove operator as:

Denition 7 The best issue to remove from a0 s perspective from the set J t is dened as:

remove(J t ) = arg j 2Jmax

fsim(

i t ;J core

(xj1 ] : : : xji;1 ] xji+1 ] : : : xjn ])

(yj1 ] : : : yji;1 ] yji+1 ] : : : yjn ]))g

(8)

It is not possible to dene a similarity-based add operator since the introduction of an issue does not permit

an agent to make comparisons with the opponent's last

oer (simply because there is no value oered over that

issue).

Agents deliberate over how to combine these add and

remove operators in a manner that maximises some

measure | such as the contract score. However, a

search of the tree of possible operators to nd the optimum set of issues may be computationally expensive.

To overcome this problem we intend to implement anytime algorithms and use the negotiation time limits to

compute a, possibly sub-optimal, solution. Another

computational requirement of these mechanisms is the

need for an agent to dynamically recompute the issue

weights. We dene the re-computation of weights by

rst specifying the importance of the added issue, Ij ,

with respect to the average importance of other issues.

Then:

Denition 8 The weight of added issue j , wj , is dened as:

wj = (n ; I1)j + I

j

wi = (1 ; wj )wi 8i 2 fi1 : : : in g i 6= j (9)

where wj is the importance of the issue j , n is the new

number of issues, wi is the old weight for issue i and

wi is its new weight after the inclusion of issue j . Re0

0

computation of weights when an issue is removed in

turn is dened simply as re-normalising the remaining

weights:

Denition 9 The weight of the remaining issues i after an issue j has been removed is dened as:

(10)

wi = 1 ;1w wi

j

0

An Illustrative Example

The concepts and processes outlined above will be described using an example involving negotiation between

the European Union (EU) and Morocco over shing

Issue

Reservation

Weight

Zone

fAll Central Boundariesg

0.2

Quantity

20 2]

0.35

Ships

30 5]

0.2

Price

100 5]

0.25

Figure 1: Core Negotiation Parameters for EU

Issue

Reservation

Weight

Zone

fBoundaries Central Allg

0.3

Quantity

1 10]

0.2

Ships

1 10]

0.1

Price

50 200]

0.4

Figure 2: Core Negotiation Parameters for Morocco

rights o the coast of Morocco. Negotiation between

these parties involves reaching agreements over access

rights as well as shing conditions which Morocco affords EU shing boats o its coastline.

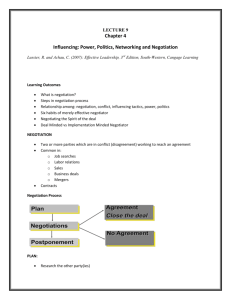

Negotiation Parameters

Figures 1 and 2 detail the \core" set of issues involved

in negotiation for EU and Morocco respectively. Reservation values specify the ranges of acceptable values for

an issue and the weight of the issue signies the level of

importance of that issue.

The issue Zone represents the sectors of the coastal

regions where shing is permitted by Morocco. The

values of this issue are qualitatively subdivided into regions, where shing eets can sh anywhere (all), or

the central regions of the area (central) or on the outskirts of the region (boundaries). Quantity, the most

important issue for EU, represents the total tonnage

of sh (in units of millions) the shipping eet is permitted to catch. Like Zone, Ships is a qualitative issue

which represents the number of the ships allowed to sh

within Zone. Finally, Price, the most important issue

for Morocco, is the amount of money the EU will pay

Morocco for the right to sh within Zone.

Non-core issue types, which EU or Morocco can include into negotiation respectively, and their respective

parameters, are given in gures 3 and 4. Trade represents the amount of discount (in percentage) Morocco

can obtain through the sale of sh caught by EU to

Morocco. Seasons, the least important non-core issue to Morocco, qualitatively represents the seasons

where Morocco can aord EU shing rights in its territorial waters |W A Sp Su, represent winter, autumn,

spring and summer respectively. Finally, Fish represents the type of sh Morocco will permit EU boats to

catch and ranges from Tuna to Octopus and Cuttlesh.

Finally, how agents value the contracts proposed to

them is given by the value function. For the purpose

of exposition, the value of the oer x for quantitative

Issue

Reservation

Weight

Trade

10 80]

0.2

Seasons

fSu Sp A W g

0.4

Fish fTuna Octopus Cuttlefishg 0.4

Figure 3: Non Core Negotiation Parameters for EU

Issue

Reservation

Weight

Trade

90 15]

0.4

Season

fW A Sp Sug

0.1

Fish fTuna Octopus Cuttlefishg 0.3

Figure 4: Non Core Negotiation Parameters for Morocco

issues i is modelled as a simple linear function, dened

as:

maxx ;;minmin

if increasing

(11)

if decreasing

Because the values of issues fQuantity Shipsg increase with increasing levels of the oer, these issues

are increasing in value for EU (and conversely decreasing for Morocco). Alternatively, the values of issues

fPrice Tradeg decrease with increasing levels of the offer and therefore decrease in value for EU (but increase

for Morocco). The value functions for qualitative issues

fZone Ships Season Fishg are discrete in nature and

is represented in gure 5 for both EU and Morocco.

V (xi ) =

i

i

i

xi ;min

i

1 ; max

;

i mini

i

Issue Trade-O Negotiation

Assume EU begins the negotiation, oering Morocco

a contract which allows EU to sh in all zones, for

15 tones, using 18 ships for a price of 55 units,

All 15 18 55]. Using equation (1), the qualitative

scores in gure 5, and equation (11), EU scores the

value for this contract to be 0:7705. Further assume

that Morocco evaluates this contract to be unacceptEU

Issue

Reservation

Score

Zone fAll Central Boundariesg

f1 0:6 0:1g

Ships

30 5]

0:04=ship

Season

fW A Sp Sug

0:2 0:6 0:8 1]

Fish fTuna Octopus Cuttlefishg 1 0:8 0:1]

Morocco

Issue

Reservation

Score

Zone fAll Central Boundariesg

f0:1 0:6 1g

Ships

30 5]

0:11=ship

Season

fW A Sp Sug

1 0:8 0:6 0:2]

Fish fTuna Octopus Cuttlefishg 0:1 0:8 1]

Figure 5: Qualitative Values for EU & Morocco

Issue

Criteria Function

Zone

1 0:5 0]

Quantity

0:4=Ship

Ships

Offer ; min=max ; min

Price 1 ; (Offer ; min=max ; min)

Figure 6: Comparison Criteria for EU

able and therefore counter-proposes with the contract

Boundaries 8 4 100].

EU decides to oer Morocco a contract which is a

trade-o over some issues and possibly more acceptable to Morocco. A contract trade-o for EU begins

by generating all/subset of contracts that lie on the indierence curve (using equation 3). Three such points

are:

Central 15 18 24:6] All 13 18 19:2] All 15 17 51:7]

where EU has traded-o Zone for Price in the rst contract (shing in central zone only but paying less to Morocco), Quantity for Price in the second (reduced tonnage for less payment) and Ships for Price in the third

(reduced number of ships and less payments). Note,

since these are indierence contract points the value of

each of these contracts is the same as EUs rst oer,

namely 0:7705.

Figure 6 shows the comparison criteria that EU uses

for computing the similarity (using equation 5) between

each iso-contract issue and the corresponding issue

in Morocco's last oer, namely Boundaries 8 4 100].

Offer, in gure 6, refers to the number of ships Morroco or EU make to one another. The equivalence operator for comparing two values of the criteria, used in

equation 5, is 1; j h(x) ; h(y) j.

Given the above iso-contracts and criteria functions, the most similar iso-contract to Morocco's

last oer is then computed, using equation 4,

to be 0:45 0:38 and 0:43 for the iso-contracts

Central 15 18 24:6] All 13 18 19:2] All 15 17 51:7]

respectively.

Therefore, EU oers Morocco

Central 15 18 24:6] since this is the closest EU

iso contract to Morocco's last oer.

Issue Inclusion Negotiation

Assume now that Morocco evaluates, using equation 1,

EUs rst oer (Central 15 18 24:6]) to be unacceptable, and decides to include an issue into the core negotiation set. Using equation 9, and the importance levels

of non-core issues in table 4, the new set of weights after individually adding Trade, Season and Fish into

the existing set of issues are, 0:27 0:18 0:09 0:36 0:09],

0:29 0:2 0:1 0:39 0:02] and 0:28 0:19 0:09 0:37 0:07]

respectively. The nal step in deciding which issue to

include into the core negotiation set is achieved by individually adding each non-core issue into the core set and

then, using the updated weights, computing the value

for the new contract (equation 6). The contract whose

overall value is the greatest is then selected. In this case

the inclusion of Trade, Season and Fish generates contracts with overall contract value of 0:56, 0:52, and 0:55

respectively. Therefore, Morocco begins a sub-dialogue

with EU to include the issue Trade into the original dialogue. If EU accepts the inclusion of this issue then Morocco will oer the contract Boundaries 8 4 100 90],

allowing EU to sh within the boundaries of the Morocco coastline, for 8 tonnage of sh, using 4 ships, and

a payment of 100 units. Finally, Morocco also demands

a trade agreement with EU for the EU sale of sh to

Morocco at a 90% discount rate.

Related Work

The central focus of the work reported here, has been

the use of fuzzy techniques for the design of a negotiation agent architecture for structured interactions in

real environments. Our work is closely related to the

Contract Net Protocol (Davis & Smith 1988), where a

protocol is used for modelling interactions. However,

unlike the CNP we do not assume agents are cooperative and negotiation is an iterative process involving

more than two interchanges of oers. Iterative negotiation, over multiple issues and agents, is modelled by

the PERSUADER system through the concepts of argumentation and mediation (Sycara 1989). However,

negotiation, as dened in this paper, is a mutual selection of outcome and precludes any intervention by

outside parties. Other systems such as KASBAH have

attempted to actually engineer a real world application

(Chavez & Maes 1996). However, negotiation in KASBAH is between semi-autonomous agents which negotiate over a single issue and agents are semi-autonomous

|the system models only a subset of the decision making which is involved in negotiation and the user makes

all the other decisions.

Conclusions

This paper has presented a distributed negotiation

model which coordinates agent interactions. Mechanisms have been proposed for nding solutions using

fuzzy logic and based on realistic assumptions that are

practical and model the complex nature of negotiation.

The direction for future research will be primarily

focused at empirical evaluation of the developed model

to determine its properties.

References

Chavez, A., and Maes, P. 1996. Kasbah: An agent marketplace for buying and selling goods. Proceedings of the

First International Conference on Practical Applications

of Intelligent Agents and Multi-Agent Technology.

Davis, R., and Smith, R. 1988. Negotiation as a metaphor

for distributed problem solving. In Bond, A., and Gasser,

L., eds., Readings in Distributed Articial Intelligence.

Morgan Kaufmann Publishers, Inc. 333{357.

Faratin, P. Sierra, C. and Jennings, N. 1998. Negotiation

decision functions for autonomous agents. Robotics and

Autonomous Systems 24(3{4):159{182.

Pruitt, D. G. 1981. Negotiation Behavior. Academic Press.

Raia, H. 1982. The Art and Science of Negotiation. Cambridge, USA: Harvard University Press.

Sycara, K. 1989. Multi-agent compromise via negotiation.

In Gasser, L., and Huhns, M., eds., Distributed Articial

Intelligence Volume II, 119{139. San Mateo, California:

Morgan Kaufmann.

Valverde, L.

1985.

On the structure of Findistinguishability. Fuzzy Sets and Systems 17:313{328.