ENVIRONMENTAL AND SOCIAL RISK

advertisement

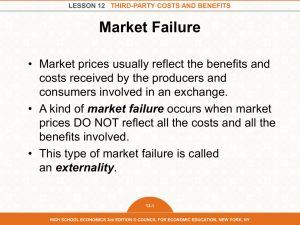

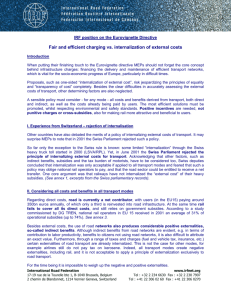

ENVIRONMENTAL AND SOCIAL RISK – From awareness to action Oman, January 2013 www.unepfi.org Introduction 2 f f Início de tour du monde The Story of a Steel Factory f f f f f f f f e 3 Business & the Environment 4 Externalities Externality: A (positive or negative) consequence of an economic activity that is experienced by unrelated third parties. Positive externalities: • Stable Climate • Water availability and water quality Negative externalities: • Poor air or water availability and quality and related health problems • Loss of biodiversity and/or cultural heritage Maintaining air quality Keeping rivers clean Externalities now have a price $$$ Keeping the climate stable 6 Preserving cultural heritage The soaring cost of “externalities” – – – – – – – – Cost of water Cost of water treatment Cost of waste disposal Cost of cleaning contaminated land Cost of reducing air polution Cost of emmitting CO2 Environmental fines Cost of paying indemnities / dammages What about the Middle East Region? 8 Drivers for Environmental & Social Risk Management 9 “A successful bank can no longer just look at the commercial performance of a customer. It has to consider its broader performance in environmental and social issues.” Roberto Dumas Damas Banco BBA Creditanstalt, Brazil 10 IFC Beyond Risk Survey: Risks for a FI’s clients 11 IFC Beyond Risk Survey: Risks for Lenders 12 Regulators • Green Banking / Green Credit policies • Central Banks in some countries are starting to take action • Basel III shifts focus to ‘material risk’, and the expectation for E&S risk to be specifically mentioned is rising 13 Investors & Capital Markets Investors: Collaborative engagements by PRI signatories Engagements with companies on Carbon Disclosure Project data * Investor statement calling for global arms trade agreement * Investor statement in support of Prof. John Ruggie’s Draft Guiding Principles * Pilot Project on Responsible Business in conflict affected and high risk areas * Sudan Engagement Group * Sustainable stock exchanges Capital Markets: • • Sustainability Indices > rewards those who do well. Growing drive for ‘sustainable stock exchanges’, including mandatory reporting for listed companies. 14 Multilateral / Development Banks • Have some of the most advanced/ sophisticated E&S Risk Management policies and procedures • Increasingly working through or with private sector Fis • Access to deals is dependant on E&S Risk Management capacity 15 NGOs: You are being watched From NGO campaigns to Bank Track to the Wall Street Movement... 16 New York Times Ad by Rainforest Action Network (RAN) 2002 Início de tour du monde 18 New York, 2003 Peer Pressure Carbon Equator UN Global UNEP FI Disclosure Principles Compact Project Global Reporting Initiative Bank of America √ √ √ Barclays √ √ √ √ Citi Group √ √ √ √ Self Declared Credit Suise √ √ √ √ Self Declared Deutsche Bank √ √ √ GRI checked HSBC √ √ √ √ √ Standard Chartered √ √ √ √ √ 19 Conclusions 20 Launched in 2003, the Equator Principles provide an environmental and social management methodology for project finance. Over 70 financial institutions have currently adopted them. The Principles are a voluntary but widely recognised standard. It’s not all about Risk! “Risk Management can help you seize opportunity, not just avoid danger” • Dan Borge, former MD of Bankers Trust 23 A Great Opportunity for Smart FI’s– the Green Economy Going forward will banks be more critically judged for their: investment in old polluting technology? commitment of funds that cause the loss of biodiversity and ecosystems? UNEP’s “Toward a Green Economy” estimates that the investment required will be USD1.3 trillion per year from 2010 to 2050.1 The WEF and Bloomberg calculate that clean energy investment must rise to USD500bn by 2020 to restrict global warming to 2 deg.1 HSBC estimates a USD10 trillion growth in cumulative capital investments between 2010 and 2020.2 It is estimated that more than 80% of this financing needs to come from the private sector. 1. Towards a Green Economy, UNEP (2011) 2. Sizing the Climate Economy, HSB Global Research 2010 24 25 Will the Middle East become home to Tomorrow’s Sustainability Leader? IFC/FT Awards designate the Sustainable Bank of the Year since 2006 • 2012: Standard Chartered Bank • 2011: Banco Itau, Brazil (Regional winner for Europe: Co-operative Financial Services . CrossRegional Winner: Bank Sarasin, Switzerland) • 2010: Co-Operative Financial Services, U.K. , Runner-up: HSBC, U.K. • 2009: Triodos Bank, Netherlands. Runner-up: Standard Chartered, UK 26 Changing Finance to Finance Change Business Business as as usual usual Unsustainable economic activity BANK BANK LENDING LENDING Environmental Environmental and and Social Social Risk Risk Management, Management, Engagement, Engagement, and and Financing Financing Gradual shift to sustainable economic activity 27 Contact Robert Tacon Robert.tacon@btinternet.com UNEP Finance Initiative www.unepfi.org 28