Aba Ali Habib Research Friday June 20, 2014

advertisement

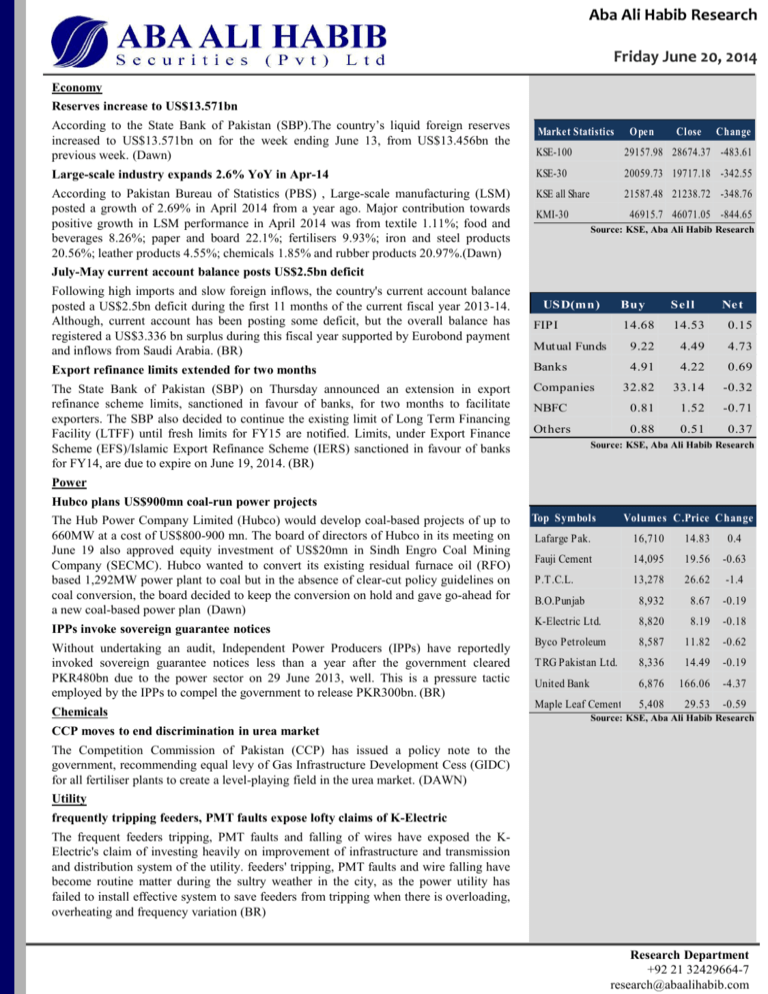

Aba Ali Habib Research Friday June 20, 2014 Economy Reserves increase to US$13.571bn According to the State Bank of Pakistan (SBP).The country’s liquid foreign reserves increased to US$13.571bn on for the week ending June 13, from US$13.456bn the previous week. (Dawn) KSE-100 29157.98 28674.37 -483.61 Large-scale industry expands 2.6% YoY in Apr-14 KSE-30 20059.73 19717.18 -342.55 According to Pakistan Bureau of Statistics (PBS) , Large-scale manufacturing (LSM) posted a growth of 2.69% in April 2014 from a year ago. Major contribution towards positive growth in LSM performance in April 2014 was from textile 1.11%; food and beverages 8.26%; paper and board 22.1%; fertilisers 9.93%; iron and steel products 20.56%; leather products 4.55%; chemicals 1.85% and rubber products 20.97%.(Dawn) KSE all Share 21587.48 21238.72 -348.76 Market Statistics O pen KMI-30 Close Change 46915.7 46071.05 -844.65 Source: KSE, Aba Ali Habib Research July-May current account balance posts US$2.5bn deficit Following high imports and slow foreign inflows, the country's current account balance posted a US$2.5bn deficit during the first 11 months of the current fiscal year 2013-14. Although, current account has been posting some deficit, but the overall balance has registered a US$3.336 bn surplus during this fiscal year supported by Eurobond payment and inflows from Saudi Arabia. (BR) FIPI Export refinance limits extended for two months Banks The State Bank of Pakistan (SBP) on Thursday announced an extension in export refinance scheme limits, sanctioned in favour of banks, for two months to facilitate exporters. The SBP also decided to continue the existing limit of Long Term Financing Facility (LTFF) until fresh limits for FY15 are notified. Limits, under Export Finance Scheme (EFS)/Islamic Export Refinance Scheme (IERS) sanctioned in favour of banks for FY14, are due to expire on June 19, 2014. (BR) Companies USD(mn) Buy Se ll 14.68 14.53 0.15 9.22 4.49 4.73 Mutual Funds NBFC Others Ne t 4.91 4.22 0.69 32.82 33.14 -0.32 0.81 1.52 -0.71 0.88 0.51 0.37 Source: KSE, Aba Ali Habib Research Power Hubco plans US$900mn coal-run power projects The Hub Power Company Limited (Hubco) would develop coal-based projects of up to 660MW at a cost of US$800-900 mn. The board of directors of Hubco in its meeting on June 19 also approved equity investment of US$20mn in Sindh Engro Coal Mining Company (SECMC). Hubco wanted to convert its existing residual furnace oil (RFO) based 1,292MW power plant to coal but in the absence of clear-cut policy guidelines on coal conversion, the board decided to keep the conversion on hold and gave go-ahead for a new coal-based power plan (Dawn) IPPs invoke sovereign guarantee notices Without undertaking an audit, Independent Power Producers (IPPs) have reportedly invoked sovereign guarantee notices less than a year after the government cleared PKR480bn due to the power sector on 29 June 2013, well. This is a pressure tactic employed by the IPPs to compel the government to release PKR300bn. (BR) Chemicals Top Symbols Volumes C.Price Change Lafarge Pak. 16,710 14.83 0.4 Fauji Cement 14,095 19.56 -0.63 P.T .C.L. 13,278 26.62 -1.4 B.O.Punjab 8,932 8.67 -0.19 K-Electric Ltd. 8,820 8.19 -0.18 Byco Petroleum 8,587 11.82 -0.62 T RG Pakistan Ltd. 8,336 14.49 -0.19 United Bank 6,876 166.06 -4.37 5,408 29.53 -0.59 Maple Leaf Cement Source: KSE, Aba Ali Habib Research CCP moves to end discrimination in urea market The Competition Commission of Pakistan (CCP) has issued a policy note to the government, recommending equal levy of Gas Infrastructure Development Cess (GIDC) for all fertiliser plants to create a level-playing field in the urea market. (DAWN) Utility frequently tripping feeders, PMT faults expose lofty claims of K-Electric The frequent feeders tripping, PMT faults and falling of wires have exposed the KElectric's claim of investing heavily on improvement of infrastructure and transmission and distribution system of the utility. feeders' tripping, PMT faults and wire falling have become routine matter during the sultry weather in the city, as the power utility has failed to install effective system to save feeders from tripping when there is overloading, overheating and frequency variation (BR) Research Department +92 21 32429664-7 research@abaalihabib.com