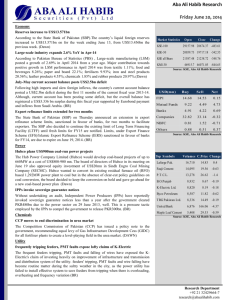

0955 1-Ismail-DBDP_Energy_Investment_Pakistan_US_2_final

advertisement

BOARD OF INVESTMENT PRIME MINISTER’S OFFICE GEO STRATEGIC LOCATION 2 Pakistan-Home to around 1000 multinational businesses Deutsche Bank Power Sector has attracted around $14 billion of FDI and 65 power projects were completed in the past two decades owing to lucrative policy incentives offered by GOP 3 3 ECONOMIC INDICATORS (2013-14) • • • • • • • Population 15-39y old youth population Net FDI Inflows Exports Imports Inward Remittances KSE 100 Index • (11th May, 2013) 19,916 • (17th Sep, 2014) 30,137 188 million 39% $3 billion $ 25.2 billion $ 41.7 billion $ 15.8 billion On road to progress: Expected to achieve annual economic growth of over 7% within the next few years (currently over 4%) Youth: One of the biggest youth population in the world. Educated, skilled and trained workforce available KSE: Stock Index was among world’s top 5 performers in 2013 – Over 4 100% growth in the past 18 months. INVESTMENT CLIMATE Investor Friendly Regime • • 100% foreign ownership allowed Investor Protection • Protection of Economic Reform Act, 1992, protects foreign capital entering in Pakistan • Legal cover through the Foreign Private Investment (Promotion and Protection) Act, 1976 • Signatory to the New York Convention; Recognition and Enforcement (Arbitration Agreements and Foreign Arbitral Awards) Act, 2011 • • Low corporate tax and income tax rates • • Industrial estates with fully developed infrastructure Lower Costs 5 Full repatriation of profits, capital gains and dividends allowed Special economic zones with exemptions on custom duty and taxes on import of capital goods and income tax for a period of ten years Efficient, skilled, and low-cost labor INCENTIVES FOR DEVELOPMENT OF POWER PROJECTS Exemption from Corporate Income Tax, Sales Tax and Import Tariff. GOP Guarantees obligations of power purchaser and provinces GOP provides protection against Political Force Majeure, change in law and Change in duties & taxes GOP allows 20% ROE for indigenous coal based Power Projects, and 17% ROE on all other Power Projects (IPPs) Tariff adjustments for variation in currency exchange rates and fuel prices Tariff indexation for inflation (US CPI & Pak WPI) Government ensures conversion of Pak Rupee & remittance of foreign exchange for project-related payments 6 PAKISTAN POWER SECTOR TOTAL INSTALLED CAPACITY Total Installed Capacity: 23,486 MW Public Sector Hydel Private Sector Public Sector Thermal Nuclear 7 Public Sector MW % Hydel 6,844 29 Private Sector MW Thermal 4,829 21 IPPs 8,630 37 Nuclear 802 3 KESC 2,381 10 Total 12,475 53 Total 11,011 47 % POWER SECTOR INVESTMENTS 8 Country Distressed/Cancelled Projects (% of investment) Malaysia 24% Indonesia 13% Vietnam 8% India 3% Pakistan 3% Source: World Bank PPI Database – 1990-2013 Expected International Investment Pipeline in Hydropower IPPs International Investment in Hydropower IPPs (Examples) New Bong Escape HPP – 84 MW Run of River Project • • First hydropower IPP commissioned in Mar 2013 • Financed by ADB, IDB, IFC, and Proparco (France) • Registered CDM project by UNFCCC for carbon credits • • • China International Water and Power Company (China) – 1,100 MW Kohala HPP Korea Water Resource Corporation (K-Water) and Daewoo E&C Co (Korea) – 665 MW Lower Palas Valley HPP China Three Gorges International Corporation (China) – 720 MW Karot HPP K-Water and Daewoo (Korea) – 147 MW Patrind HPP DIAMER BASHA DAM PROJECT • International Competitive Bidding will be carried out for the services and supplies with utmost transparency. • Procurement of equipment and services of around $8 billion is expected in the project. • Government is considering a Special Purpose Investment Vehicle for the development of the project. • SPV will also own Ghazi Barotha Hydropower Project, a 1,450MW ROR project commissioned in 2002 with a cost of $2.3 billion generating over 7,000 GWh/annum. 10 KEY TAKEAWAYS • There is a board based consensus in Pakistan for private sector to undertake all economic projects and government to limit its role to regulation. All small and large-scale power projects are supported by all political and other stakeholders. • Pakistan provides some of the highest dollar based rate of return on power projects of at least 17%. Compare this to our bond issue which paid 8.25% • Government of Pakistan is open to public-private partnerships for development of large infrastructure projects with international investors 11 KEY TAKEAWAYS • Pakistan will be among the fastest growing economies in the next few years • Power, telecom and manufacturing sectors have attracted significant investments in the past two decades despite the regional situation • Political stability, improved security and good governance are putting Pakistan on the track of rapid development and progress Board of Investment www.boi.gov.pk