Conceptual Framework for Managerial Costing

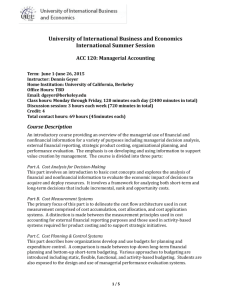

advertisement