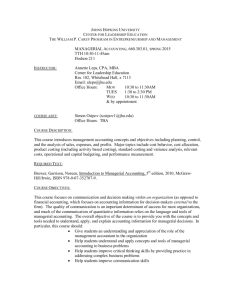

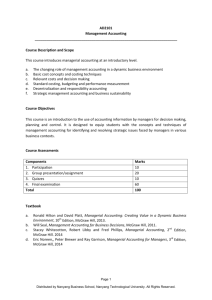

MANAGERIAL ACCOUNTING (Syllabus) Faculty of Business and

advertisement

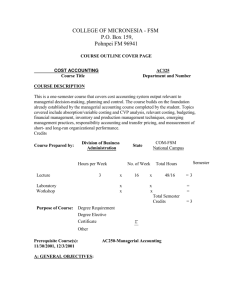

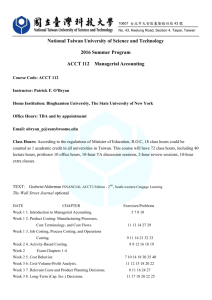

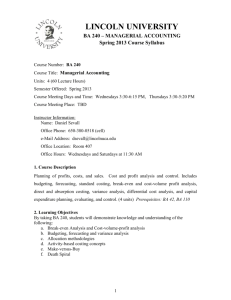

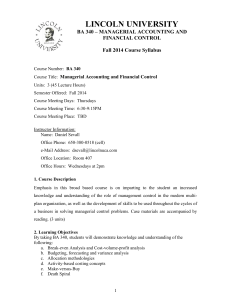

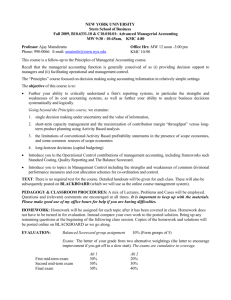

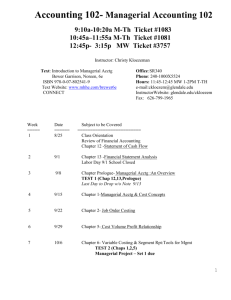

MANAGERIAL ACCOUNTING (Syllabus) Faculty of Business and Economics Department of Economics and Finance Fall Semester 2012 Lecturer: Alqi Bllako (MBA, Msc.) Office Hours: Monday – Friday 10:00 a.m. – 1:00 p.m. E-mail: alqibllako@unyt.edu.al; alqi.bllako@esc.edu Classes: Managerial Accounting – Thursdays 14-17:00, Class 2C Managerial Accounting: 3 Credit Hours Examination of accounting processes for manufacturing concerns Differences between external and internal reporting Use of accounting information as a tool for: o Managerial decision-making o Measurement and control of costs o Cost-volume-profit-analysis o Budgeting and performance analysis. Prerequisites: Financial Accounting (C- or better grade) Course Rationale Managerial Accounting focuses on: the development, interpretation, and application of accounting information for managerial decision making. The course stresses the use of financial information within organizations for the purposes of understanding and analyzing activities and operations. Students learn the linkages between accounting information and management planning through cost analysis (including activity based costing and the cost of quality), operational and capital budgeting, and performance measurement. Course Objectives: The Course Objectives for Managerial Accounting are: A. Given a trial balance of a manufacturing entity, prepare a schedule of cost of goods manufactured and an income statement. B. Given various costs (for products or segments), a target net income, and a what-if analysis, compute the sales figures in dollars and units. C. Given a static budget, prepare a flexible budget for various activity levels by cost center and create a performance report using the actual results to analyze and explain variances. D. Given segment information, discuss the allocation of fixed costs and identify and use the appropriate relevant costs to make decisions related to special orders, add/drop a segment, sell or process further, or make or buy. E. Given appropriate financial data, prepare a set of income statements, one based on direct costing and another based of absorption costing, including a discussion of the uses of each. F. Given a project or choice of projects, compare and contrast the capital budgeting methods (including tax effect) to evaluate the project or projects and provide your recommendation. In addition, be able to conduct an analysis of a lease or purchase situation and propose appropriate action. Attendance Attendance at every class is essential – If you are going to miss class please notify the instructor. Classes will begin on time and you are expected to attend and participate. Students missing more than 20% of the class meetings (9 hours in total), without my approval, will receive an "F" grade for the semester. Withdrawal by students must be in accordance with UNYT withdrawal policies. Course Outline: Week # 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Chapter 1 Topic Course Introduction: The Changing Role of Managerial Accounting in a Dynamic Business Environment 2 Basic Cost Management Concepts and Accounting for Mass Customization Operations 8 9 Product Costing and Cost Accumulation in a Batch Production Environment Process Costing & Hybrid Product Costing Systems Quiz # 1 Chapters 1-4 (Beginning of Class) Activity Based Costing and Management Activity Analysis, Cost Behavior and Cost Estimation Cost-Volume Profit Analysis Midterm Exam Chapters 1-7 Absorption and Variable Costing Profit Planning and Activity-Based Budgeting 10 Standard Costing, Operational Performance Measures and the Balanced Scorecard 3 4 5 6 7 11 13 14 15 16 17 Flexible Budgeting and the Management of Overhead and Support Activity Costs Investment Centers and Transfer Pricing Quiz # 2 Chapters 8-13 (Beginning of Class) Decision Making: Relevant Costs and Benefits Target Costing and Cost Analysis for Pricing Decisions Capital Expenditure Decisions Allocation of Support Activity Costs and Joint Costs Final Exam Review FINAL EXAM during normal class hours Textbooks: Main Course-book*: Ronald W. Hilton (2009), Managerial Accounting –Creating Value in a Dynamic Business Environment, 8th edition, McGraw-Hill Irvin Supplementary Course-book: Colin Drury (2008), Management and Cost Accounting, 7 th edition, South –Western Cengage Learning, (copies available in the library). Only for the last lectures the book of Brealey/Myers/Allen, Corporate Finance, 8 th or 9th edition, McGraw-Hill International Edition, is strongly suggested as a very helpful supplementary reading. * Students are required to study the main course-book. Additional Readings and Other Materials: Additional readings shall be assigned from other books, articles, or in-class handouts on a case-by-case basis. Various audio-visual materials shall be included in class presentations. Basis for Student Evaluation: 1. Quiz # 1: 10 % 2. Midterm Exam: 25 % 3. Quiz # 2: 10 % 4. Final Exam: 35 % 5. Attendance and Participation 10 % 6. Assignments 10% Grading Scale: Letter Percent Grade (%) A 96-100 A90-95 B+ 87-89 B 83-86 B80-82 C+ 77-79 C 73-76 C70-72 D+ 67-69 D 63-66 D60-62 F 0-59 Generally Accepted Meaning Outstanding work Good work, distinctly above average Acceptable work Work that is significantly below average Work that does not meet minimum standards for passing the course Individual Tutorials: Students are welcome to arrange a tutorial session with the instructor on an individual basis, provided that will be arranged on a mutual basis convenience. Students may reach the instructor during office hours or through email and cell phone. General Policies: 1. Regular attendance is expected. If there is an urgent reason to be absent, please email the instructor in advance. A student may not enter an examination without having justified all of his/her absences. 2. Assignments will be collected at the beginning of the class session. There will be a 10% daily deduction for late assignments (up to 2 days only, thereafter no grade will be given) unless you make special arrangements with the instructor in advance via email communications. 3. Any violation of academic honesty principles, e. g. plagiarism, will result in an automatic F on the course, in line with UNYT’s Honour Code policies. 4. Make-up exams will be given only in the case of a confirmed medical excuse. If possible, please advise the instructor in advance by email. Please Note: STUDENTS: If you feel that you have special learning difficulties, please, make an appointment with Ms. A. Gramo. Ms. Anxhela Gramo is trained to help students with learning difficulties. She has offered to provide this service to our students, just as it is offered in all American universities. Tirana, 04/10/2012 Prepared by: Alqi Bllako BSc, MBA, MSc, CFA Candidate