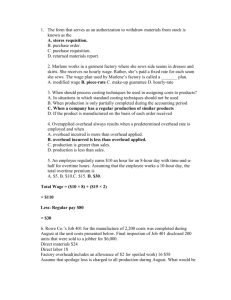

quick studies

advertisement