1 - JustAnswer

advertisement

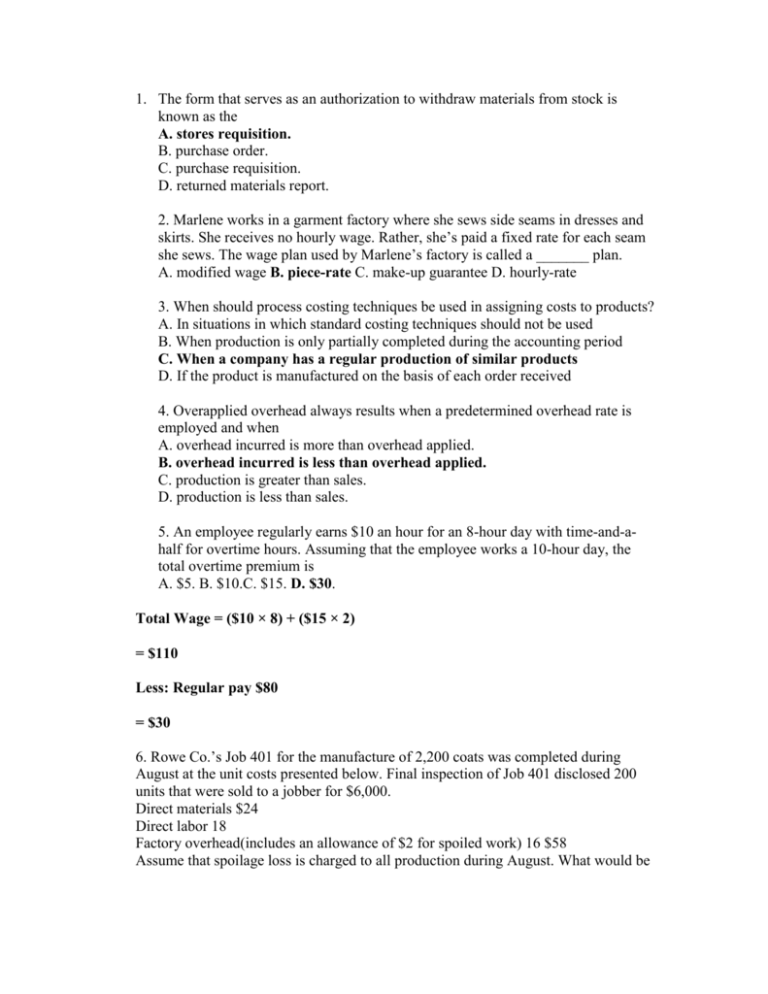

1. The form that serves as an authorization to withdraw materials from stock is known as the A. stores requisition. B. purchase order. C. purchase requisition. D. returned materials report. 2. Marlene works in a garment factory where she sews side seams in dresses and skirts. She receives no hourly wage. Rather, she’s paid a fixed rate for each seam she sews. The wage plan used by Marlene’s factory is called a _______ plan. A. modified wage B. piece-rate C. make-up guarantee D. hourly-rate 3. When should process costing techniques be used in assigning costs to products? A. In situations in which standard costing techniques should not be used B. When production is only partially completed during the accounting period C. When a company has a regular production of similar products D. If the product is manufactured on the basis of each order received 4. Overapplied overhead always results when a predetermined overhead rate is employed and when A. overhead incurred is more than overhead applied. B. overhead incurred is less than overhead applied. C. production is greater than sales. D. production is less than sales. 5. An employee regularly earns $10 an hour for an 8-hour day with time-and-ahalf for overtime hours. Assuming that the employee works a 10-hour day, the total overtime premium is A. $5. B. $10.C. $15. D. $30. Total Wage = ($10 × 8) + ($15 × 2) = $110 Less: Regular pay $80 = $30 6. Rowe Co.’s Job 401 for the manufacture of 2,200 coats was completed during August at the unit costs presented below. Final inspection of Job 401 disclosed 200 units that were sold to a jobber for $6,000. Direct materials $24 Direct labor 18 Factory overhead(includes an allowance of $2 for spoiled work) 16 $58 Assume that spoilage loss is charged to all production during August. What would be the unit cost of the good coats produced on Job 401? A. $56.00 B. $58.00 C. $60.80 D. $63.80 Cost of Goods produced; Direct material Direct Labor Factory overhead Less: Sold to jobber Total cost for 2000 coats Per unit cost 2200 * 24 2200*18 2200*16 52800 39600 35200 6000 121600 121600 / 2000 = 60.80 7. Which one of the following costs is considered a prime cost? A. Wages paid to production workers B. Wages paid to supervisory workers C. Amount paid for insurance D. Amount paid for rent 49 8. The Lucas Manufacturing Company has two production departments (fabrication and assembly) and three service departments (general factory administration, factory maintenance, and factory cafeteria). A summary of costs and other data for each department, prior to allocation of service department costs for the year ended June 30, appears below. The costs of the general factory administration department, factory maintenance department, and factory cafeteria are allocated on the basis of direct labor hours, square footage occupied, and number of employees, respectively. Fabrication Assembly General Factory Administration Factory Maintenance Factory Cafeteria Direct labor costs $1,950,000 $2,050,000 Direct material costs $3,130,000 $950,000 Factory overhead costs $1,650,000 $1,850,000 $80,000 $67,500 $58,000 Direct labor hours 237,690 ---387,810 Number of employees 160 128 20 42 25 Square footage occupied 20,000 30,000 2,400 2,000 4,800 Assuming that Lucas elects to distribute service department costs to production departments using the direct distribution method, calculate the amount of factory maintenance department costs that would be allocated to the fabrication department. (Round all final calculations to the nearest dollar.) A. $14,674 B. $15,000 C. $22,804 D. $27,000 Factory Maintenance Costs Square Footage of: Fabrication Assembly Total 20,000 30,000 50,000 Allocation to Fabrication Department: 20,000 / 50,000 $67,500 = $27,000 9. If the amount of overtime premium is to be charged to all jobs worked on during the period, the debit will be to the _______ account. A. Factory Overhead B. Payroll C. Work in Process D. Accrued Payroll By charging the overtime premium to factory overhead, all jobs worked on during the period share the cost. 10. Of the following industries, which one would most likely use process costing? A. Canned soup B. Home construction C. Printing D. Shipbuilding Canned soup production usually consists of manufacturing "long runs" of homogeneous products for which process costing is used. The other three industries would utilize job order costing. 50 Questions 11 and 12 are based on the following information. The Bisset Corporation uses Raw Material A in a manufacturing process. The balances on hand, purchases, and requisitions of Raw Material A are given in the following table. Raw Material A Quantities Dollars Date Received Issued Balance Unit Price Received Issued Balance 1/1 100 $1.40 $140 1/24 300 400 1.55 $465.00 2/8 80 320 3/16 140 180 6/11 150 330 1.62 243.00 8/18 130 200 9/6 110 90 10/15 150 240 1.70 255.00 12/29 140 100 11. If Bisset maintains a perpetual inventory record of Raw Material A on a FIFO basis, what will be the year-end inventory? A. $152 B. $159 C. $162 D. $170 12. Assume that no perpetual inventory is maintained for Raw Material A and that quantities are obtained by an annual physical count. The accounting records show information as to purchases but not as to issues. On this assumption, the closing inventory on a LIFO basis will be A. $140. B. $152C. $156. D. $160. Units in Ending Inventory = 100 units Cost of Units in Ending Inventory = 100 × $1.4 = $140 . 51 13. Selected data concerning the past fiscal year’s operations of the Stanley Manufacturing Company are presented below (000s omitted): Based on this information, the cost of raw materials purchased during the year amounted to A. $385. B. $390 C. $400. . D. $430. INVENTORIES Beginning Ending Raw materials $90 $85 Work in process 30 65 Finished goods 100 90 Other data: Raw materials used 395 Total manufacturing costs charged to production during the year (includes raw materials, direct labor, and factory overhead) 680 Cost of goods available for sale 745 Labor and overhead expenses 285 Beginning Inventory Add: Purchases Cost of Raw Materials Available Less: Materials Used in Production Ending Inventory $90 $390 $480 $395 $85 Use the following information to answer questions 14 and 15. Carlos Company reported the following data for a six-month period: Month Maintenance Cost for the Month Units Produced January $3,500 400 February 3,000 300 March 3,750 500 April 3,400 350 May 2,500 200 June 3,800 450 Plot this information onto the graph in Examination Figure 1, and then answer questions 14 and 15. 14. What is the estimate of the fixed cost portion of the semivariable cost? A. $1,000 B. $1,500 C. $2,000 D. $2,500 15. What is the variable cost per unit at a volume level of 400? A. $2.00 B. $3.75 C. $5.00 D. $8.75 16. The Eleanor Company payroll for the first week in January was $12,000. The amount of income tax withheld was 12 percent and the FICA, state unemployment, and federal unemployment taxes were 8 percent, 5 percent, and 1 percent, respectively. The amount of the employer’s payroll taxes are A. $720. B. $1,440. C. $1,680. D. $3,120 Employer's payroll taxes = (8% + 5% + 1%) $12,000 = $1,680. Income tax withheld is the responsibility of the employee, as is the employees’ portion of FICA. 17. When using a flexible budget, what will occur to fixed costs (on a per-unit basis) as production increases? A. Fixed costs per unit will increase. B. Fixed costs aren’t considered in flexible budgeting. C. Fixed costs per unit will remain unchanged. D. Fixed costs per unit will decrease. 18. How should a shipment of completed goods to the customer be debited and credited? A. Debited to Finished Goods and credited to Cost of Goods Sold B. Debited to Cost of Goods Sold and credited to Finished Goods C. Debited to Accounts Payable and credited to Cash D. Debited to Cash and credited to Accounts Payable 19. An accrued expense, such as accrued wages, is an amount that’s A. paid and not currently matched with earnings. B. not paid and not currently matched with earnings. C. not paid and currently matched with earnings. D. paid and currently matched with earnings. 20. Inventory levels for firms using JIT inventory systems will be A. higher both for work in process and finished goods. B. higher for work in process and finished goods but lower for raw materials. C. lower for raw materials, work in process, and finished goods. D. higher for finished goods but lower for raw materials and work in process Manufacturers using just-in-time inventory systems will maintain lower inventory levels for all three types of inventories.