Principles of accounting

advertisement

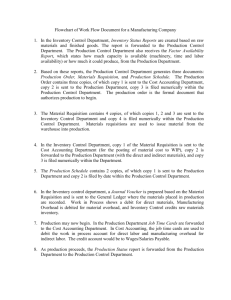

ter 18 Managerial Accounting Concepts and Principles 76S strategic initiatives mat each company put forward in its desire to better compete and in the marketplace. of these strategic initiatives for both companies, explain how it reflects (or does not reflect) satisfaction focus. ETHICS 18-3 Assume that you are the managerial accountant at Infostore, a manufacturer of hard , CDs, and diskettes. Its reporting year-end is December 31. The chief financial officer is CHALLENGE conC3 C4 C5 1 about having enough cash to pay the expected income tax bill because of poor cash flow 1 nent. On November IS, the purchasing department purchased excess inventory of CD raw ma; in anticipation of rapid growth of this product beginning in January. To decrease the company's (liability, the chief financial officer tells you torecordthe purchase of this inventory as part of sup! and expense it in the current year; this would decrease the company's tax liability by increasing . In which account should the purchase of CD raw materials be recorded? I How should yourespondto thisrequestby the chief financial officer? 18-4 Write a one-page memorandum to a prospective college student about salary expectaCOMMUNICATING I for graduates in business. Compare and contrast the expected salaries for accounting (including IN PRACTICE nt subfields such as public, corporate, tax, audit, and so forth), marketing, management, and ce majors. Prepare a graph showing average starting salaries (and those for experienced profesils in thosefieldsif available). To get this information, stop by your school's career services ofi libraries also have this information. The Website .IobStar.org (click on Salary Info) also can get t started. TN 18-$ Managerial accounting professionals follow a code of ethics. As a member of the TAKING IT TO istitute of Management Accountants, the managerial accountant must comply with Standards of THE NET ducal Conduct. Cl C3 Inquired I Identify, print, and read the Statement of Ethical Professional Practice posted at www.IMAnet.org. (Search using "ethical professional practice.") i What four overarching ethical principles underlie the IMA's statement? > Describe the courses of action the IMA recommends in resolving ethical conflicts. Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn 766 Chapter 18 Managerial Accounting Concepts and Principles TEAMWORK IN ACTION C7 P2 BTN 18-6 The following calendar-year information is taken from Ihe trial balance and other records of Dahlia Company. Advertising expense $ 19,125 Direct labor Depreciation expense—Office equipment 8,750 Indirect labor Depreciation expense—Seling equipment 10,000 Miscelaneous production costs Depreciation expense—Factory equipment 32,500 Office salaries expense Raw materials purchases 872300 Factory supervision 122,500 21,125 Factory supplies used 15,750 Rent expense—Office space Rent expense—Seling space 2&73I | Factory utilities 36,250 Rent expense—Factory building 7f,7J|^ Inventories 27,875 Raw materials, December 31, 2008 177,500 Maintenance expense—Factory equipment 3,275,000 Raw materials, December 31, 2009 168,125 Sales 57309 Goods in process, December 31, 2008 15,875 Sales discounts 28CU0 Goods in process, December 31, 2009 14,000 Sales salaries expense Finished goods, December 31, 2008 164,375 Finished goods, DecRequired ember 31, 2009 129,000 I . Each team member is to be responsible for computing one of the following to duplicate your teammates' work. Get any necessary amounts from teammates. Each explain the computation to the team in preparation for reporting to class a. Materials used. d. Total cost of goods in process. b. Factory overhead. e. Cost of goods manufactured. c. Total manufacturing costs. P«t(3 2. Check your cost of goods manufactured with the instructor. If it is correct, proceed to . You! 3. Each team member is to be responsible for computing one of the following amounts to duplicate your teammates' work. Get any necessary amounts from teammates. Each Point: Provide teams with transparen- explain the computation to the team in preparation for reporting to class. a. Net sales. d. Total operating expenses. cies and markers for presentation b. Cost of goods sold. e. Net income or loss before taxes. purposes. c. Gross profit. ENTREPRENEURIAL BTN 18-7 Brian Taylor of Kernel Season's must understand his manufacturing costs to DECISION operate and succeed as a profitable and efficient company. Cl C4 i Required I . What are the three main categories of manufacturing costs that Brian must monitor at Provide examples of each. 2. How can Brian make the Kemel Season's manufacturing process more cost-effective? examples of two useful managerial measures of time and efficiency. 3. What are four goals of a total quality management process? How can Kemel Season's • improve its business activities? HITTING THE ROAD Cl C5 * BTN 18-8 Visit your favorite fast-food restaurant. Observe its business operations. Required departs. I . Describe all business activities from the time a customer arrives to the tune Ihat ^ 1 2. List all costs you can identify with the separate activities described in part 1. 3. Classify each cost from part 2 as fixed or variable, and explain your classification. Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn xounting Concepts and Principles 76J 18-9 Accen DSG's annual report for the year ended April 28, 2007 (www.DSGiplc.com). GLOBAL DECISION section "Corporate Governance" dealing with the responsibilities of the board of directors. the responsibilities (see the "schedule of mattersreservedfor the board") of DSG's board of would management accountants be involved in assisting the board of directors in carrying out responsibilities? Explain. ISWERS TO MULTIPLE CHOICE Q U I Z t Beginning finished goods + Cost o onnHc • Ending finished goods = Cost of g< $6,000 + COGM - $3,200 = $7,500 COGM = $4,700 f Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn Chapter 18 introduced managerial accounting and explained basic cost concepts. We also described the lean business model and the reporting of manufacturing activities, including the manufacturing statement. We begin this chapter by describing a cost accounting system. We then explain the procedures used to determine costs using a job order costing system We conclude with a discussion of over- and underapplied overhead. J o b O C o s t r d e r A c c o u n t i n g Chapter Learning Objectives C A P Conceptual Analytical Procedural f> 1 Explain the cost accounting^1 Appf/ job order costing in pricing Describe and record the low of PI system, (p. 770) services, (p. 782) materials costs in job order cost ^2 Describe important features of job accounting, (p. 773) order production, (p. 770) P2 Describe and record the low of labor costs in job order cost Explain job cost sheets a n d h o w C3 accounting, (p. 775) they are used in job order cost accounting, (p. 772) P3 Describe and record the low of overhead costs in job order coat accounting, (p. 776) Determine adjustments for overapplied and underapplied bony LPI9 overhead, (p. 781) Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn W o r k i n g t h e F i e l d "Being successful is having a vision which you are excited to follow without the fear of failure" —Hank Julicher JmmL PHILADELPHIA. PA—One size fits all? Not Manufacturers when it of custom products, such as that from Sprinturf, use [[) comes to synthetic turf for athletic fields—this ac- state-of-the-art job order cost accounting to track costs. This includes j»T cording to Hank Julicher. founder of Sprinturf tracking the cost of materials, labor and overhead, and managing those (Sprinturf.com). "Not all fields are exactly alike, be- expenses. To help control costs and ensure product quality, Sprinturf cause no two owners have the same exact needs," insists Hank. "d M oaensy not outsource any part of the design or installation process. variables must be considered, including playing requirements, climate,Controlling all aspects of the process enables it to better isolate costs and financial considerations." Designing, installing, and servicing syn- and avoid the run-away costs often experienced by startups that fail to thetic turf systems are Sprinturf's mission. use costing techniques. Recruiting top-notch personnel and experi"There is much more to a playing field than just the surface," exenced supervisors also helps control labor costs. Refleaing the unique plains Hank. "Many would argue that the base is the most important— nature of each field, each installation is videotaped to ensure it is done it needs the strength to support athletes and vehicles, while still being exactly according to customer specifications. able to drain over 20" of rainfall per hour," For this, Sprinturf relies onHank Julicher stresses cost control as vital to Sprinturf 's success. "To its all-rubber infill system for its installations. Still, understanding cus-take on two 800 pound gorillas in our industry, we had to be more tomer needs is key. In extremely hot, arid climates, Sprinturf uses lightcreative, efficient, and cost-effective to win," explains Hank. "We just colored rubber infill to reduce the temperature of playing surfaces. Inhung in there until the public recognized our quality and value." This cold areas, Sprinturf offers solutions to reduce snow and ice buildup.winning formula has led to product growth that any team would envy. Hank has put in fields from Utah State University to University of [Sources: Sprinturf Website, January 2009: Entrepreneur, 2007; PanStadia, February Montana to Long Beach City College While a touchdown is worth and November 2005] v 6 points on every Sprinturf field, each field is otherwise unique. Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn Chapter Preview This chapter introduces a system for assigning costs to the products or providers of custom flow of goods through a production process. We then that use job order costing typically base h on a describe the details of a job order cost accounting system. Job system, which provides a inventory order costing is frequently used by manufacturers of custom materials, goods in process, and finished Job Order Cost Accounting • • • • Job Order Cost Flows and Reports Materials cost flows and documents Labor costflowsand documents Overhead cost flows and documents Summary of cost flows Job Order Cost Accounting This section describes a cost accounting system and job order production and costing. Cost Accounting System An ever-increasing number of companies use a cost accounting system to generate timely and P J Explain the cost accurate inventory information. A cost accounting system records manufacturing activities usaccounting system. ing a perpetual inventory system, which continuously updates records for costs of materials, goods in process, and finished goods inventories. A cost accounting system also provides timely information about inventories and manufacturing costs per unit of product. This is especially Point: Cost accounting systems helpful for managers" efforts to control costs and determine selling prices. (A general acaccumulate costs and then assign counting system records manufacturing activities using a periodic inventory system. Some them to products and services. companies still use a general accounting system, but its use is declining as competitive forces and customer demands have increased pressures on companies to better manage inventories.) The two basic types of cost accounting systems are job order cost accounting and process cost accounting. We describe job order cost accounting in this chapter. Process cost accounting is explained in the next chapter. Job Order Production ^ 2 Describe important Many companies produce products individually designed to meet the needs of a specific cusfeatures of job order tomer. Each customized product is manufactured separately and its production is called job production. order production, or job order manufacturing (also called customized production, which is the production of products in response to special orders). Examples of such products include synthetic footballfields,special-order machines, a factory building, custom jewelry, wedding invitations, and artwork. The production activities for a customized product represent a job. The principle of customization is equally applicable to both manufacturing and service companies. Most service companies meet customers" needs by performing a custom service for a specific customer. Examples of such serv ices include an accountant auditing a client'sfinancialstatements, an interior designer remodeling an office, a wedding consultant planning and superv ising a reception, and a lawyer defending a client. Whether the setting is manufacturing or serv ices, job order operations inv olve meeting the needs of customers by producing or performing custom jobs. Boeing's aerospace division is one example of a job order production system. Its primary business is twofold: (1) design, develop, and integrate space carriers and (2) provide systems Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn Chapter 19 Job Order Cost Accounting 771 I engineering and integration of Department of Defense (DoD) systems. Many of its orders are customized and produced through job order operations. When a job involves producing more than one unit of a custom product, it is often called a job lot Products produced as job lots could include benches for a church, imprinted T-shirts for a 10K race or company picnic, or advertising signs for a chain of stores. Although these Point: Many professional orders involve more than one unit, the volume of production is typically low, such as 50 benches, examinations Including the CPA and 200 T-shirts, or 100 signs. Another feature of job order production is the diversity, often called CMA exams require knowledge of job heterogeneity, of the products produced. Namely, each customer order is likely to differorfrom der and process cost accounting another in some important respect. These variations can be minor or major. Decision Insight ^^ Custom Design Managers once saw companies as the center of a solar system orbited by suppliers and customers. Now the customer has become the center of the business universe. Nike allows custom orders over the Internet, enabling customers to select materials, colors, and to personalize their shoes with letters and numbers. Soon consumers may be able to personalize almost any product, from cellular phones to appliances to furniture. Events in Job O r d e r C o s t i n g The initial event in a normal job order operation is the receipt of a customer order for a custom product. This causes the company to begin work on a job. A less common case occurs when management decides to begin work on a job before it has a signed contract. This is referred to as jobs produced on speculation. The first step in both cases is to predict the cost to complete the job. This cost depends on the product design prepared by either the customer or the producer. The second step is to negotiate a sales price and decide whether to pursue the job. Other than for government or other cost-plus contracts, the selling price is determined by market factors. Producers evaluate the market price, compare it to cost, and determine whether the profit on the job is reasonable. If the profit is not Point: Some |obs are priced on a reasonable, the producer would determine a desired target cost The third step is for the procost-plus basis: The customer pays the ducer to schedule production of the job to meet the customer's needs and to fit within its own manufacturer for costs incurred on the production constraints. Preparation of this work schedule should consider workplace facilities in|ob plus a negotiated amount or rate of cluding equipment, personnel, and supplies. Once this schedule is complete, the producer can profit place orders for raw materials. Production occurs as materials and labor are applied to the job. An overview of job order production activity is shown in Exhibit 19.1. This exhibit shows the March production activity of Road Warriors, which manufactures security-equipped cars and trucks. The company converts any vehicle by giving it a diversity of security items such as alarms, reinforced exterior, bulletproof glass, and bomb detectors. The company began by catering to high-profile celebrities, but it now caters to anyone who desires added security in a vehicle. Job order production for Road Warriors requires materials, labor, and overhead costs. Recall that direct materials are goods used in manufacturing that are clearly identified with a particular job. Similarly, direct labor is effort devoted to a particular job. Overhead costs support production of more than one job. Common overhead items are depreciation on factory buildings and equipment, factory supplies, supervision, maintenance, cleaning, and utilities. Exhibit 19.1 shows that materials, labor, and overhead are added to Jobs B15, B16, B17, B18. and B19, which were started during March. Road Warriors completed Jobs B15, B16, and B17 in March and delivered Jobs B15 and B16 to customers. At the end of March, Jobs B18 and B19 remain in goods in process inventory and Job B17 is infinishedgoods inventory. Both labor and materials costs are also separated into their direct and indirect components. Their indirect amounts are added to overhead. Total overhead cost is then allocated to the various jobs. Decision Insight WBammmmmmwWmmmmmmtmmmmmmmmmmmwmwmmmmmmmmmmimm Target Costing Many producers determine a target cost for their jobs. Target cost is determined as follows: Expected selling price - Desired profit = Target cost. If the projected target cost of the job as determined by job costing is too high, the producer can apply value engineering, which is a method of determining ways to reduce job cost until the target cost is met. mmmmammmmmmmm Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn 772 Chapter 19 Job Order Cost Accounting EXHIBIT 19.1 Job Order Production Activities Manufacturing Costs Goods in Process Finished Goods Job C o s t S h e e t P2 Explain job cost sheets General ledger accounts usually do not provide the accounting information that managers of ^ and how they are used job order cost operations need to plan and control production activities. This is so because the needed information often requires more detailed data. Such detailed data are usually stored in in job order cost subsidiary records controlled by general ledger accounts. Subsidiary records store information accounting. about raw materials, overhead costs, jobs in process, finished goods, and other items. This section describes the use of these records. A major aim of a job order cost accounting system is to determine the cost of producing each job or job lot. In the case of a job lot, the system also aims to compute the cost per unit The accounting system must include separate records for each job to accomplish this, and it must capture information about costs incurred and charge these costs to each job. A job cost sheet is a separate record maintained for each job. Exhibit 19.2 shows a job cost sheet for an alarm system that Road Warriors produced for a customer. This job cost sheet identifies the customer, the job number assigned, the product, and key dates. Costs incurred on the job are immediately recorded on this sheet. When each job is complete, the supervisor enters Point: Factory overhead consists of the date of completion, records any remarks, and signs the sheet. The job cost sheet in Exhibit costs (other than direct materials and 19.2 classifies costs as direct materials, direct labor, or overhead. It shows that a total of $600 direct labor) that ensure the productioiin direct materials is added to Job B15 on four different dates. It also shows seven entries for direct labor costs that total $1,000. Road Warriors allocates (also termed applies, assigns, or activities are carried out. charges) factory overhead costs of $1,600 to this job using an allocation rate of 160% of direct labor cost (160% X $1,000)—we discuss overhead allocation later in this chapter. While a job is being produced, its accumulated costs are kept in Goods in Process Inventory. Point: Documents (electronic and The collection of job cost sheets for all jobs in process makes up a subsidiary ledger controlled paper) are crucial in a |ob order systeby m. the Goods in Process Inventory account in the general ledger. Managers use job cost sheets and the |ob cost sheet is a cornerstoto ne. monitor costs incurred to date and to predict and control costs for each job. Understanding it aids in grasping con- When a job isfinished,its job cost sheet is completed and moved from the jobs in process cepts of capitalizing product costs and file to the finished jobsfile.This latterfileacts as a subsidiary ledger controlled by the Finished product cost flow Decision Maker i Goods Inventory account. When a finished job is delivered to a customer, the job cost sheet is moved to a Consultant permanentfileOsupporting cost of goods sold. file conManagement ne of your the taskstotal is to control and m anageThis costspermanent for a consulting and prior periods. ctains ompanrecords y. At thefrom end both of a current recent month, you find that three consulting jobs were completed and two are 60% complete. Each unfinished job is estimated to cost $10,000 and to earn a revenue of $12,000. You are unsure how to recognize goods in process inventory and record costs and revenues. Do you recognize any inventory? If so. how much? How much revenue is recorded for unfinished jobs this month? [Answo—p.78fc] Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn Chapter 19 Job Order Cost Accounting counting System: Exhibit 19-2 ad Warriors Los Angeles. California *^RB T^ 3/3/2009 R-4698 3/7/2009 R-4705 3/9/2009 R-4725 3/10/2009 R-4777 m COM 100.00 225.00 180 00 95.00 600.00 Data 3/3/2009 3/4/2009 3/5/2009 3/8/2009 3/9/2009 3/10/2009 3/11/2009 JOB COST SHEET L-3393 L-3422 L-3456 L-3479 L-3501 L-3535 L-3559 cost 120.00 150.00 180 00 60.00 90.00 240.00 160.00 1,000.00 773 EXHIBIT 19.2 Job Cost Sheet 160% of Direct Labor Cost Quick Check I. Which of these products is likely to involve job order production? (a) inexpensive watches, (b) racing bikes, (c) bottled soft drinks, or (d) athletic socks. 2. What is the difference between a job and a job lot? 3. Which of these statements is correct? (a) The colleaion of job cost sheets for unfinished jobs makes up a subsidiary ledger controlled by the Goods in Process Inventory account, (b) Job cost sheets are financial statements provided to investors, or (c) A separate job cost sheet is maintained in the general ledger for each job in process. 4. What three costs are normally accumulated on job cost sheets? IjNGost Flows and Reports Materials C o s t Flows a n d D o c u m e n t s This section focuses on the flow of materials costs and the related docuP I Describe and record ments in a job order cost accounting system. We begin analysis of the flow the flow of materials of materials costs by examining Exhibit 19.3. When materials are first recosts in job order cost ceivedfromsuppliers, the employees count and inspect them and record accounting. the items' quantity and cost on a receiving report. The receiving report Materials serves as the source document for recording materials received in both a Point: Some companies certify ccrcair materials ledger card and in the general ledger. In nearly all job order cost systems, materials suppliers based on the quality of their ledger cards (or files) are perpetual records that are updated each time units are purchased m and aterials Goods received from these each time units are issued for use in production. suppliers are not always inspected by To illustrate the purchase of materials, Road Warriors acquired $450 of wiring and relatedthe purchaser to save costs materials on March 4, 2009. This purchase is recorded as follows. Mar. 4 Raw Materials Inventory—M-347 450 Assets - Liabilities + ( quits 450 Accounts Payable + 450 +450 Torecordpurchase of materials for production. Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn Chapter 19 Job Order Cost Accounting 774 EXHIBIT 19.4 Materials Ledger Card Exhibit 19.3 shows that materials can be requisitioned for use either on a specific job (direct materials) or as overhead (indirect materials). Cost of direct materials flows from the materials ledger card to the job cost sheet. The cost of indirect materials flows from the materials ledger card to the Indirect Materials account in the factory overhead ledger, which is a subsidiary ledger controlled by the Factory Overhead account in the general ledger. Exhibit 19.4 shows a materials ledger card for material received and issued by Road Warriors. The card identifies the item as alarm system wiring and shows the item's stock number, its location in the storeroom, information about the maximum and minimum quantities that should be available, and the reorder quantity. For example, alarm system wiring is issued and recorded on March 7, 2009. The job cost sheet in Exhibit 19.2 showed thai Job B15 used this wiring. MATERIALS LEDGER CARD Alarm system wiring Stock No. M-347| Location in Storeroom Bin137| Minimum quantity | Quantity to reorder 2un»l | Received Issued ^Receiving RequiUnit Report Units Price Unit Price Total i Number sition Units U n Total Date | Number Price Price Units Price Price 225 00 225 00 3/ 4/2009 C-7117 225.00 450.00 225.00 675.00 R-4705 225.00 225.00 3/ 7/2009 225.00 450.00 When materials are needed in production, a production manager prepares a materials requisition and sends it to the materials manager. The requisition shows the job number, the type of material, the quantity needed, and the signature of the manager authorized to make the requisition. Exhibit 19.5 shows the materials requisition for alarm system wiring for Job B15. To see how this requisition ties to the flow of costs, compare the information on the requisition with the March 7. 2009. data in Exhibits 19.2 and 19.4. Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn