Final Accounts - Midlands State University

advertisement

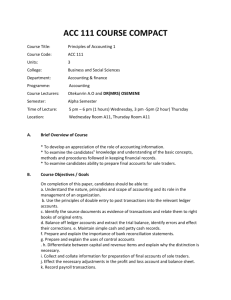

MIDLANDS STATE UNIVERSITY FACULTY OF COMMERCE DEPARTMENT OF ACCOUNTING COURSE TITLE: FINANCIAL ACCOUNTING FOR BUSINESS 1B (ACC 101) 1.0 Preamble . This course is a comprehensive module, which requires careful and dedicated study. This module serves as an introduction to more advanced accounting studies in Financial Accounting 2A and 2B. 2.0 Prerequisite Module Financial Accounting 1A 3.0 Aim To develop knowledge and understanding of the underlying principles and concepts relating to financial accounting and achieving technical proficiency in the use of doubleentry accounting techniques including the preparation of basic financial statements. 4.0 Module Objectives By the end of the module the students should be able to; . Explain the context and purpose of financial reporting . Define qualitative characteristics of financial information and the fundamental bases of accounting . Explain the accounting concepts and conventions present in generally accepted accounting principles . Journalise transactions and events and post to the general ledger and close the books of various enterprises . Prepare financial statements for manufacturing enterprises, partnerships and limited companies to comply with generally accepted practice . Record the transactions of a business that has one or more branches and prepare its financial statements. 5.0 Module Outline A. Accounting Theory . The objective of financial reporting . Users and stakeholders’ needs . The qualitative characteristics of financial reporting . The main elements of financial reports . The regulatory framework . Accounting concepts and principles . Capital and revenue expenditure. B. Specialised Accounting Procedures Departmental Accounts . Preparation of departmental accounts using the net profit approach and the contribution approach for enterprises involved in trading operations. Manufacturing Accounts . Preparation of a manufacturing account and trading account when goods are transferred at cost or market price. . The elimination of unrealised profit when closing stock exists for manufactured goods transferred to trading account at market price . General ledger accounts for: raw material control a/c, wages control a/c, manufacturing overhead control a/c, Work in Progress Control a/c, Finished Goods Control a/c and Cost of Sales a/c . A balance sheet extract Branch Accounts . Accounting for branches which are independent and dependent . Elimination of unrealised profit . Making journal and ledger entries . Final accounts C. Preparing Basic Financial Statements . Income Statement . Statement of changes in equity . Balance Sheet . Notes to the financial statements Partnerships . Changes in a partnership, dissolution, insolvent partner and piece meal distribution . Making journal and ledger entries . Final Accounts Limited Companies . Record shares and debentures issued at par, at a premium and at a discount( n.b. compliance with Companies Act Chapter ) . Forfeiture of shares . Recording capital and revenue reserves . Making journal, ledger and extracting a trial balance . Final accounts Cash flow statement . Both the direct and indirect method should be understood for the different enterprises. 6.0 Approach to Examining the Syllabus This module will be examined by way of course work which will be in the form of two in class tests and an end of semester examination. All questions are compulsory. . Coursework: Weight Test 1 15% Test 2 15% . End of semester examination 70% 100% End of Semester Examination Part Remarks Number of Marks A B C 10 multiple choice questions each carrying 2 marks covering the whole module.5 short theory questions each carrying 2 marks 1 question either on: departmental accounts, manufacturing accounts or branch accounts The following topics will be tested: partnership, limited companies and cash flow statement 30 20 50 100 Recommended Textbooks 1. Frank wood’s Business Accounting Volume 1& 2 by Frank wood and Alan Sangster 2. Fundamental Accounting (4 th Edition) by Flynn et.al. 3. A Practical Foundation in Accounting (2 nd Edition) by Harry Johnson and Austin Whittam 4. Business Accounts for bookkeeping and financial Accounting courses ( 3 rd Edition) by David Cox 5. Preparing Financial Statements (International Edition) Paper 1.1- ACCA 6. Basic Financial Exercises (Intermediate Accounting) by Morris Pelkowitz 7. Accounting-an Introduction (6th Edition) by Faul et.al 8. Accounting 1- Accounting Concepts ACN 102- Unisa