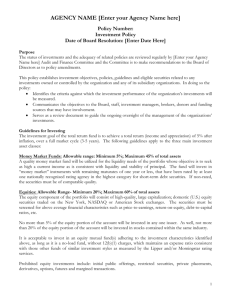

1Intercorporate Investments: An Overview

advertisement