Chapter 13 Assessment

advertisement

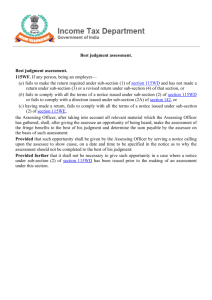

Chapter 13 Assessment When the service tax initially came into force on 01-07-1994, Section 70 of the Act provided for the regular assessment of service tax assessees. The Act incorporated the provisions for best judgment assessment and re-assessment also in Sections 72 and 73 respectively. The system of regular assessment as prescribed by Section 70 was replaced with the system of self-assessment with effect from 16-07-2001. The provision for re-assessment provided by Section 73 was done away with. And Section 72 providing for the best judgment assessment had been omitted with effect from 10-09-2004, which has now been re-introduced by the Finance Act, 2008 with effect from 10-05-2008. As on date, the principal procedure of assessment under service tax provisions is self-assessment where no provision of verification of return by the Superintendent of Central Excise exists. In addition to this, provisions for provisional assessment and best judgment assessment have been provided in Service Tax Rules, 1994. 1. Self-Assessment With effect from 16-07-2001, every assessee is required to himself assess the tax due on the services provided by him and to furnish a return to the Superintendent of the Central Excise in the prescribed manner. “Self-assessment” is complete with the filing of service tax return in Form ST-31 by the due date. When system of self-assessment was introduced on 16-07-2001, the self-assessed return filed by the assessee was to be verified by the Superintendent of Central Excise under Section 71. With effect from 10-09-2004, Section 71 relating to verification of the self-assessed return has been omitted. Prior to 10-09-2004, Section 71 empowered the Superintendent of Central Excise to verify the correctness of the service tax assessed by the assessee on the basis of information contained in Form ST-3. Again, for the purpose of such verification, the concerned officer could require the assessee to produce any accounts, documents or other evidence as and when required. It may be noted that there was no time-limit prescribed in Section 71 for completion of assessment. Section 71, further empowered the Superintendent of Central Excise to refer the matter to the Assistant Commissioner/Deputy Commissioner of Central Excise, if he noticed on verification that the service tax on any service provided by the assessee had escaped assessment or had been underassessed. In such a case AC/DC could pass such order of assessment as he thought fit. As per the clarification given, the assessment order was to be passed only by the AC/DC and not by the Superintendent who was required should simply to refer the matter to AC/DC.2 In this regard, CBEC Master Circular No. 97/8/2007-ST, dated 23-08-2007 states that normally, under self-assessment scheme, the service taxpayer assesses his tax liability himself and pays the 1. Provisions relating to filing of return have been explained in Part B — Chapter 11. 2. As per CBEC Instruction Letter No. B-11/1/2001-TRU, dated 09-07-2001. same. However, if a service taxpayer is not in a position to determine the service tax liability, say, for the reason that valuation or classification of taxable service or issue of admissibility of an exemption notification cannot be determined (or any such other reason) at the time of filing the return, he may opt for assessment of service tax on provisional basis after obtaining an order from the jurisdictional Deputy Commissioner/ Assistant Commissioner. The assessment shall be made in terms of the said order and would continue to be provisional till the issue is finalised. Upon finalisation, there may be additional tax liability or refund. In such cases, the taxpayer would have to either pay the differential amount of tax with interest or claim refund, as the case may be. 2. Provisional Assessment If the assessee is unable to correctly estimate the actual amount of service tax on the date of deposit, he may deposit the tax provisionally and later on the final tax may be assessed by the Central Excise Authority and adjustment can be made for any difference in the tax paid and the tax due. [Rule 6 of the Service Tax Rules, 1994] Procedure for provisional assessment: Sub-rules 4, 5 and 6 of Rule 6 of the Service Tax Rules, 1994, and provisions of Central Excise Rules, 2001, as they apply to provisional assessment have been summarised below: (i) Seeking permission for provisional assessment. For resorting to provisional assessment, the assessee needs to make a written request to the Assistant Commissioner/Deputy Commissioner of Central Excise giving reasons for payment of service tax on provisional basis. The AC/DC, on receipt of such request, may allow payment of service tax on provisional basis on such value of taxable service as may be specified by him. (ii) Filing of Memorandum in Form ST-3A along with the service tax return. The assessee who has sought permission for provisional assessment, and has made provisional payments of service tax, needs to file a memorandum in Form ST-3A along with the half-yearly return3 (Form ST-3). This memorandum is a statement which gives details of the difference between the service tax deposited and the service tax payable for each month. However, a discrepancy in filing Form ST-3A does not alter the character of provisional assessment. In Hari Shankar Almal v. CCE4, the appellant, a stock-broker, made provisional payment of service tax though inadvertently Form ST-3A was not filed with the return. It was held that simply because the appellant did not submit the statement in Form ST-3A, it could not be concluded that the assessments were not provisional, especially when the same had been finally assessed by the proper officer at the request of the appellant. (iii) Completion of Assessment under “Provisional Assessment”. Where the assessee submits Form ST-3A, the Assistant Commissioner or Deputy Commissioner of Central Excise may complete the assessment wherever he deems it necessary. For the purpose of final assessment he may call for such further documents or records which he considers necessary and proper. Though Rule 6(6) of the Service Tax Rules does not prescribe any time-limit for completion of assessment but according to Rule 7(3) of the Central Excise Rules, 2002, the AC/DC shall pass the final assessment order maximum within a period of six months from the communication of provisional assessment. The period of six months, however, may be extended by the Commissioner by another six months for reasons to be recorded in writing and by the Chief Commissioner for such further period as he may deem necessary. (iv) Service Tax Payable or Refund Due on Final Assessment. After the completion of final assessment, the assessee may be required to pay service tax in addition to the tax already paid under provisional assessment. Similarly, he may be entitled to refund in 3. The reference to quarterly return in Rule 6(5) is redundant, for w.e.f. 16-10-1998, only half-yearly return in Form ST-3 shall be filed by all types of assessees. 4. (2002) 145 ELT 578 (Trib.-Kolkata). case he had paid excess service tax earlier. (For details regarding filing of claim for refund, refer Chapter on “Refund of Service Tax”.) In case the assessee is required to pay differential tax after the final assessment, he shall be liable to pay interest on the amount so payable to the Central Government from the first day of the month succeeding the month for which such amount is determined, till the date of payment thereof. The rate of interest would be the rate specified by the Central Government by notification issued under Section 11AA or Section 11AB of the Central Excise Act. In case the assessee is entitled to a refund consequent to the order of final assessment, there shall be paid an interest on such refund from the first day of the month succeeding the month for which such refund is determined, till the date of refund. The rate of interest would be the rate specified by the Central Government by notification issued under Section 11BB5 of the Act. Section 72, before its deletion from 10-09-2004, empowered the Assistant Commissioner/Deputy Commissioner of Central Excise to make the best judgment assessment under the following circumstances: (i) When the assessee failed to make the return under Section 70, or (ii) When the return was furnished but the assessee failed to comply with the provisions of Section 71, i.e., did not produce the accounts, documents, or other evidence as demanded, or (iii) When the AC/DC was not satisfied with the correctness/completeness of the accounts of the assessee. Thereafter, the Assistant or Deputy Commissioner of Central Excise, after taking into account all relevant material which he might have gathered, was required to make a best judgment assessment and determine the sum payable by or refundable to the assessee. The best judgment assessment method was to be applied in accordance with the principles of natural justice i.e. the service provider was to be given opportunity to present his case, particularly if it was not favourable to the service provider. 3. Best Judgment Assessment Revived under Service Tax Section 72 has been reintroduced by the Finance Act, 2008 to authorise the Central Excise Officer for assessment on the basis of his best judgment after allowing assessee to represent his case where assessee fails to make service tax return as required under Section 70 or if the returns have been made out, fails to assess the tax appropriately. Prior to 10-09-2004 also, the provision of best judgment assessment was there under service tax. The Finance Act, 2004 had done away with the provision of best judgment assessment by omitting Section 72 with effect from 10-092004, which has now been again brought in force in the year 2008. The new provision reads as follows: If any person, liable to pay service tax,— (a) fails to furnish the return under Section 70; (b) having made a return, fails to assess the tax in accordance with the provisions of this Chapter or rules made thereunder, the Central Excise Officer, may require the person to produce such accounts, documents or other evidence as he may deem necessary and after taking into account all the relevant material which is available or which he has gathered, shall by an order in writing, after giving the person an opportunity of being heard, make the assessment of the value of taxable service to the best of his judgment and determine the sum payable by the assessee or refundable to the assessee on the basis of such assessment. It may be noted that the best judgment provision under service tax can be invoked only in the two specified circumstances mentioned above. 5. Prescribed rate of interest on delayed refunds is 6% p.a. vide Notification No. 67/2003-C.E. (N.T.), dated 12-09-2003. The concept of best judgment assessment has not been hitherto provided under the Central Excise Act, however, under Income Tax Act and Sales Tax Act, it is extensively used. In this regard, various judicial pronouncements uphold that the principle of natural justice should be followed by the Authorities in applying the best judgment assessment. ———