hawala_purchases_-_ca_devendra_jain

advertisement

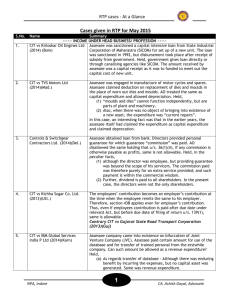

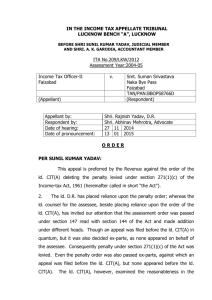

Recent Controversy on alleged Hawala Purchases 05.09.14 CA Devendra Jain Analysis of DCIT v. Rajeev D. Kalathil (ITA No. 6727/Mum/2012) Assessee relied upon: ‒ ‒ ‒ ‒ ‒ copies of bills suppliers carrying proper VAT registration ledger accounts of the parties in assessee's books payment was made by cheques a certificate from the banker giving details of cheque payment to the suupliers ‒ copies of the consignment note ‒ some material purchased from the said parties lying as part of closing stock Analysis of DCIT v. Rajeev D. Kalathil (ITA No. 6727/Mum/2012) Department relied upon: ‒ suppliers were not produced before the Assessing Officer ‒ declared hawala dealer by VAT department, ‒ because of cheque payment made to the supplier transaction cannot be taken as genuine. Analysis of DCIT v. Rajeev D. Kalathil (ITA No. 6727/Mum/2012) ITAT was guided by the following factors: ‒ proof of transportation of goods ‒ fact that part of the goods received by the assessee was forming part of closing stock, ‒ payment through banking channels ‒ No proof of immediate cash withdrawals by suppliers • However, these factors need to be evaluated cumulatively along with the other facts of the case. Mere absence of one of these factors should not lead to a conclusion that the transaction is not genuine. E.g. many a times, the nature of goods is such that it is delivered personally and there can not be a separate proof of transportation. • Other Rulings: • The Honorable Gujarat High Court has in the case of CIT v. M.K Brothers [1987] 30 TAXMANN 547 (GUJ.) held that when the payments for purchases are made by cheques and there is nothing to indicate that any part of the fund given by the assessee to these parties came back to the assessee in any form, the purchases can not be held to be bogus. • Similar view was taken by ITAT Jodhpur Bench in the case of Jagdamba Trading Co. v ITO (2007) 16 SOT 66 (Jodh) and ITO v. Permanand (2008) 25 SOT 11 (Jodh )(URO). • Other Rulings: • Babula Borana vs. Third ITO [(2005) 144 Taxman 674(Bom.)] • Nikunj Eximp Enterprises (P) Ltd. [(2013) 216 Taxman 171(Bom.)]. • Other Rulings: • ITO v. Arora Alloys Ltd. [2012] 25 taxmann.com 134 (Chandigarh - Trib.) • The statement made before the Central excise authorities in the context of levy of excise duty on unaccounted production can not form the sole basis for making additions by the Assessing Officer under the Income Tax Act. • YFC Projects (P) Ltd. v. DCIT (2010) 37 SOT 130 (Delhi) • Merely for non-filing of confirmation from suppliers, it cannot be held that assessee has not received the goods from these persons and the credit balance in the shape of sundry credit appearing in the books of account is unaccounted money of the assessee. • Other Rulings: • ITO v. Arora Alloys Ltd. [2012] 25 taxmann.com 134 (Chandigarh - Trib.) • The statement made before the Central excise authorities in the context of levy of excise duty on unaccounted production can not form the sole basis for making additions by the Assessing Officer under the Income Tax Act. • YFC Projects (P) Ltd. v. DCIT (2010) 37 SOT 130 (Delhi) • Merely for non-filing of confirmation from suppliers, it cannot be held that assessee has not received the goods from these persons and the credit balance in the shape of sundry credit appearing in the books of account is unaccounted money of the assessee. • Other Rulings: • Khandelwal gems Trading Corpn. Ltd. v. ACIT (1995) 83 Taxman 41 (Jaipur)(Mag.) • Non-production of parties was not sufficient ground to draw an adverse inference, particularly when the addresses given by the assessee tallied with those available with the bankers of those parties and with the sales tax authorities. • J.H. Metals v. ITO (2001)77 ITD 71 (Asr.) (TM ) • In case of purchases which are not adequately documented, if the gross profit declared is in line with the past gross profit rates, no addition should be made. Thank You dhjainassociates@gmail.com 11