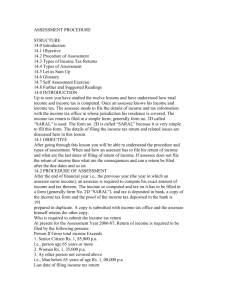

introduction to Income Tax

advertisement

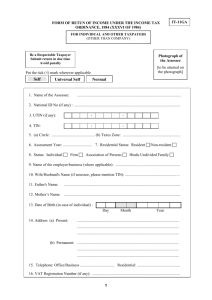

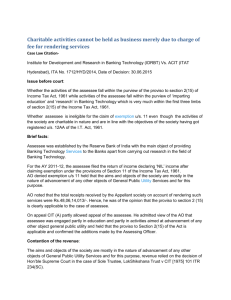

INCOME TAX ACT 1961 INTRODUCTION Brought into force from 1.4.1962 Applies to the whole of India including sikkim and Jammu &Kashmir The Act has been amended and reamended so drastically that it has become very complicated for the administering authorities as well as for the tax payers The Government has introduced a new Direct Taxes Code Bill 2010 in the Parliament on 30.08.2010. so far it has not been passed by the parliament BASIS OF CHARGEOF INCOME TAX Income tax is an annual tax on income Income of previous year is taxed in the next following assessment year at the rates applicable to that assessment year. Tax rates are fixed by the Annual Finance Act Tax is charged on every person defined in sec2(31) The tax is charged on the total income of every person computed in accordance with the provisions of this act Income tax is to be deducted at source or paid in advance as prescribed under the provisions of the act. IMPORTANT DEFINITIONS INCOME Income tax Act has not defined the term income. It is an inclusive definition Income generally includes the revenue receipts from outside There are some important rules regarding income which are discussed as follows RULES REGARDING INCOME z Definite source of income Income may be earned legally or illegally Not necessary that the income may be received regularly and periodically Income should be received from outside Income can be in monetary or non monetary form Income may be temporary or permanent Disputed income Application of income vs diversification of income Reimbursement of expenses is not income Accrued but not received income is to be treated as income Income may be in plus or minus GROSS TOTAL INCOME The aggregate of income under the following heads is known as gross total income: Income from salaries Income from House property Profits and gains of business or profession Income from capital gains Income from other sources the income from each head is computed after making deductions permissible under that head PERSON Person includes the following: An individual A hindu undivided family A company A firm An association of persons or body of individuals A local authority An artificial juridical person ASSESSEE ORDINARY ASSESSEE DEEMED ASSESSEE ASSESSEE IN DEFAULT ORDINARY ASSESSEE An ordinary assessee means a person: Who is liable to pay any tax or Who is liable to pay any other money under this act e.g. interest, penalty etc or In respect of whom any proceedings under the act have been taken for the assessment of his income or In respect of whom any proceeding under the act has been taken for the assessment of the loss sustained by him or In respect of whom any proceeding under the act has been taken for the refund due to him DEEMED ASSESSEE A person who is liable to pay tax on the income of some other person is called deemed or representative assessee. For example: After the death of a person his legal representative will be treated as his deemed assessee A person representing a foreigner, minor or person of unsound mind will be treated as an assessee for the income of such foreigner, minor or person of unsound mind ASSESSEE IN DEFAULT When a person is responsible for fulfilling an obligation under the income tax act and he fails to do so , he is called an assessee in default. For example: Every DDO has a legal obligation to deduct the tax at source from the income of the people working under him and to deposit the amount in the Government treasury. If he fails to deduct the tax or after deducting it fails to deposit it in Government treasury, he will be treated as assesee in default under the act and liable to prescribed punishment. ASSESSMENT YEAR Assessment year means a period of 12 months commencing on the first day of April every year and ending on 31st March of the next year. An assessee is liable to pay tax and file the return of income of the previous year in the following financial year( assessment year) For the purposes of the students the assessment year will be 2012-13. PREVIOUS YEAR Generally speaking previous year is the financial year preceding the assessment year. The financial year ending on 31st March will be the uniform previous year for all the assessees and for all sources of income For a newly set up business or for a newly created source of income the P.Y will begin from the date of starting of business or from the date of coming into existence of the new source of income to the end of the said financial year. In such situation the first PY may be less than 12 months. A financial year is both a previous year as well as an assessment year. EXAMPLES An assessee commences his business on: 1.07.2011, 1.10.2011, 1.01.2012 In each case what will be his AY and what period will be treated as the PY for the concerned assessment year? Taxation of PYs income in the AY: exceptions to the rule The Pys income is taxed in the same year in the following cases: Income of non resident assessee from shipping business Income of persons leaving india Transfer of property to avoid tax On discontinuance of a business or profession TAX AVOIDANCE TAX EVASION TAX PLANNING