4June2013

advertisement

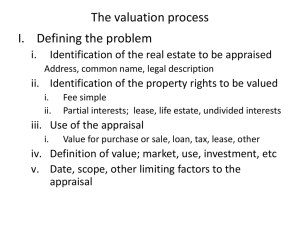

VALUATION UNDER EXCISE & SERVICE TAX CHANGING TRENDS & BUSINESS IMPACT “Your values become your destiny” - Mahatma Gandhi Speaker Siddharth Srivastava – Advocate SKS Associates- Indirect Tax Consultants & Solicitors Address: 431/D-22, II Floor, Chattarpur Hills, New Delhi ,110074 Contact: 011-647-111-00 ; 9560111577 E- Mail: siddharth.srivastava@sksassociates.in mail@sksassociates.in Valuation Concepts __________________________________________ Historical Background under Central Excise Pre 1975 Price of goods sold / capable of being sold 1.10.1975 to 30.6.2000 Normal price in wholesale trade 1.7.2000 onwards Transaction value Historical Background under Service tax Till 15.07.2001 Section 67 contained different provisions for different taxable services 16.07.2001 to 17.04.2006 Gross amount charged From 18.04.2006 - Gross amount charged - Ascertainable consideration in monetary & non-monetary form - As per Valuation Rules where consideration not ascertainable CHANGING CONCEPT UNDER CENTRAL EXCISE NORMAL PRICE (Till 01.07.2000) TRANSACTION VALUE (FROM 01.07.200) 4. Valuation of excisable goods for purposes of charging of duty of excise: 4. Valuation of excisable goods for purposes of charging of duty of excise. – (1) Where under this Act, the duty of excise is chargeable on any excisable goods with reference to value, such value shall, subject to the other provisions of this section be deemed to be - (1) Where under this Act, the duty of excise is chargeable on any excisable goods with reference to their value, then, on each removal of the goods, such value shall - (a) the normal price thereof, that is to say, the price at which such goods are ordinarily sold by the assessee to a buyer in the course of wholesale trade for delivery at the time and place of removal, where the buyer is not a related person and the price is the sole consideration for the sale (a) in a case where the goods are sold by the assessee, for delivery at the time and place of the removal, the assessee and the buyer of the goods are not related and the price is the sole consideration for the sale, be the transaction value Section 4(3)(d) defines “Transaction Value” as follows: “(d) “transaction value” means the price actually paid or payable for the goods, when sold, and includes in addition to the amount charged as price, any amount that the buyer is liable to pay to, or on behalf of, the assessee, by reason of, or in connection with the sale, whether payable at the time of the sale or at any other time, including, but not limited to, any amount charged for, or to make provision for, advertising or publicity, marketing and selling organization expenses, storage, outward handling, servicing, warranty, commission or any other matter; but does not include the amount of duty of excise, sales tax and other taxes, if any, actually paid or actually payable on such goods.” CONTROVERSIAL DECISIONS JUDGMENT RATIO Tribunal Larger Bench Order In Case Of MARUTI SUZUKI INDIA LTD. Rendered In 2010 Any indirect benefit resulting from the payment made by the buyer to the dealer in connection with or by reason of the sale transaction between dealer and manufacturer will have to be included in the assessable value of manufacturer. The concept of transaction value relates to the manufacturing cost inclusive of any other amount received or receivable directly or indirectly to make the product marketable. Bombay High Court Order In Case Of TATA MOTORS Rendered In 2012 Supreme Court Decision In Case Of FIAT INDIA PRIVATE Rendered In 2012 LIMITED “In our view, it is not necessary for us to record our views on the correctness of the judgment delivered by the Larger Bench in the case of Maruti Suzuki (supra).” “Loss making price” continuously for more than five years while selling more than 29,000 cars is not “normal price” or the price at which the goods are “ordinarily sold” by the assessee to a buyer in the course of wholesale trade Fiat’s strategy to penetrate the market by selling below cost was resulting in an extra commercial consideration and price is not the sole consideration. Since price is not the sole consideration, the ruling will equally apply even under TV regime. The Court held that in such cases, the residuary or bestjudgment method under Central Excise Valuation Rules can be applied. CHANGING CONCEPT UNDER SERVICE TAX OLD VALUATION (Till 17.04.2006) NEW VALUATION (From 18.04.2006) Section 67 of Finance Act Section 67 of Finance Act “For the purposes of this Chapter, the value of any taxable service shall be the gross amount charged by the service provider of such service provided or to be provided by him.” (1) Subject to the provisions of this Chapter, where service tax is chargeable on any taxable service with reference to its value, then such value shall,i. in case where the provision of service is for a consideration in money, be the gross amount charged by the service provider or to be provided by him; ii. in case where the provision of service is for a consideration not wholly or partly consisting of money, be such amount in money as , with the addition of service tax charged is equivalent to the consideration; iii. in a case where the provision of service is for a consideration which is not ascertainable be the amount as may be determined in the prescribed manner. VALUATION RULE 3 – Where value is not ascertainable (a) Value equivalent to the gross amount charged for providing similar service to any other person in the ordinary course of trade and the gross amount charged is the sole consideration; (b) where the value cannot be determined in accordance with clause (a), the equivalent money value which is not less than the cost of provision of such taxable service. CONTROVERSIAL DECISIONS RATIO JUDGMENT Delhi High Court INTERCONTINENTAL In Case CONSULTANTS Of It held that Rule 5(1) of the Rules runs counter and is repugnant to Sections 66 and 67 of the Act and to that extent it is ultra vires. & TECHNOCRATS PVT. LTD. Rendered In 2012 Bombay High Court Order In Case Of INOX AIR PRODUCTS LTD. Rendered in 2012 Punjab & Haryana High Court Decision In Case Of PUNJAB EX-SERVICEMEN CORPORATION Rendered in 2012 It held that the fact that cost of electricity used in manufacture of oxygen was includible in valuation thereof does not mean it has to be included in value of taxable services Profit motive is not necessary for imposition of Service tax. Neither charging section nor provision for valuation prescribe it. BUSINESS IMPACT Understanding the ever developing concept of extra commercial consideration Whether consideration can flow from a person other than from buyer to seller UNDER CENTRAL EXCISE What happens to introductory prices and discount / incentive schemes Whether one time transactions also open to scrutiny under best judgment assessment . What is the criteria for prolonged use? BUSINESS IMPACT Whether all reimbursable expenditure can be excluded. Is service tax on profit only? UNDER SERVICE TAX Difference between reimbursement and Pure Agent transactions Whether will be the true extent and meaning of ‘similar services’ in cases of pure intellectual services like consultants, lawyers, etc Whether it is possible to provide a free service to anyone in light of extra commercial considerations like market share, goodwill and introductory phase of business? PRESENTED BY IN ASSOCIATION WITH For any details & inquiries: SKS Associates- Indirect Tax Consultants & Solicitors Address: 431/D-22, II Floor, Chattarpur Hills, New Delhi ,110074 Contact: 9560111577 E- Mail: siddharth.srivastava@sksassociates.in