Snapshot PDF

advertisement

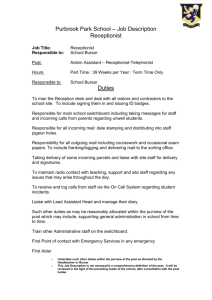

SNAPSHOT This document and its associated content are provided for personal training purposes only and are subject to the Copyright & Disclaimer Statement on page 5. Two-Tier Company Tax Rate from 1 July 2015 (May 2015 Final Legislation) On 27 May 2015, the Tax Laws Amendment (Small Business Measures No. 1) Bill 2015 was introduced into Federal Parliament (refer ParlInfo - Tax Laws Amendment (Small Business Measures No. 1) Bill 2015) to implement a new twotier company tax system for income years commencing from 1 July 2015 (usually the 2015/16 year) such that: Small Business Entities (SBE) companies with < $2 Million aggregated turnover (i.e. business tax turnover under existing Div 328 ITAA 1997 of the company and its ‘connected entities’ and ‘affiliates’) will pay tax at a 28.5% tax rate; and all other companies will continue to pay tax at a 30% tax rate. Importantly, this Tax Astute Snapshot provides only a brief overview of the new company tax rate provisions. Tax Astute clients should access their Tax Astute Federal Budget Guide and their next training session to review more detailed issues and examples regarding the new concessions. See below for two brief examples which broadly explain: how to identify which companies will be subject to a 28.5% or 30% tax rate; and likely effects for franked dividends paid by SBE companies subject to the new 28.5% tax rate from 2015/16. TIP Tax Astute Clients can access further detail and examples in relation to numerous further important issues arising from this new legislation including: Effects for the NON-PROFIT CORPORATE TAX RATE from 2015/16; The EXCESS FRANKING OFFSET calculation; Other franking calculation issues such as SHARE CAPITAL TAINTING and BENCHMARK FRANKING PERCENTAGE penalties; Issues for CONSOLIDATED GROUPS, LISTED INVESTMENT COMPANIES and NON-SHARE EQUITY distributions; and Potential SBE COMPANY issues regarding the R&D offset and DIVISION 7A. ©Tax Astute Pty Ltd (as Trustee for the Tax Astute Trust) 2015 Page | 1 SNAPSHOT This document and its associated content are provided for personal training purposes only and are subject to the Copyright & Disclaimer Statement on page 5. Two-Tier Company Tax Rate from 1 July 2015 (May 2015 Final Legislation) Proposed Two-Tiered Company Tax Rate from 2015/16 Which companies are subject to a 28.5% or 30% tax rate from 2015/16? The following diagram illustrates how the new 2 tier company tax rate system will apply such that: only an SBE company (with < $2 Million aggregated business turnover) will be subject to a 28.5% tax rate (see B); a non-business company (e.g. an investment entity) will remain subject to a 30% tax rate, regardless of how large or small its turnover may be (because it is not a business and therefore cannot be a SBE) (see A); and business companies with > $2 Million aggregated turnover will also remain subject to a 30% tax rate (see C). Importantly, a SBE in 2015/16 may grow its aggregated turnover over time such that in later years it may again become subject to a 30% company tax rate (i.e. in a year when it later ceases to be eligible for SBE status). Conversely a larger company with falling aggregated turnover may become subject to a 28.5% rate if it later becomes a SBE. What is the Company Tax Rate from 2015/16? A B NonBusiness Company (any size) SBE COMPANY 30% Tax Rate 28.5% Tax Rate C Business Company (> $2 million Aggregated Turnover) 30% Tax Rate Likely effect for franked dividends paid by an SBE company from 2015/16 The legislation introduces the following new defined terms into s 995-1 ITAA 1997 which will be relevant for a wide variety of corporate tax purposes (including the franking of dividends): ‘standard corporate tax rate’ - the 30% tax rate applying to all companies except SBE companies; and ‘corporate tax gross-up rate’ – used for a variety of corporate tax calculations including franking and calculated as (100% - 30% standard rate)/30% standard rate = 70%/30%). The corporate tax gross-up rate broadly: confirms that the 30% standard corporate tax rate will be used for franking calculation purposes for all companies and their shareholders; provides that the maximum franking credit for a dividend will be based upon the tax that the company could have paid on the distribution at the 30% standard corporate tax rate (regardless of whether the company actually pays tax at this rate); and replaces existing instances of this formula in numerous franking/imputation and other corporate tax provisions throughout the ITAA 1997 with the words ‘corporate tax gross-up rate’. Importantly, the majority of existing franking/imputation requirements remain effectively unchanged such that: there will be no change to how franking credits or debits are calculated and allocated to a company’s franking account (under Div 205 ITAA 1997) because the amount of tax paid (whether at 28.5% or 30%) will generate franking credits in a company’s franking account; all companies may still choose to what extent they frank any dividend (but subject to the important existing restrictions imposed by the company’s franking account balance and the s 203-5 ITAA 1997 benchmark franking percentage); the franked part of any dividend will continue to be calculated under s 976-1 ITAA 1997 using the same formula as in previous years (i.e. the corporate tax gross-up rate noted above x the franking credit allocated = the net franked dividend amount); the shareholder effect from receiving a franked dividend will continue to be calculated under existing rules in Subdivs 207-A and 207-B ITAA 1997; and if the company’s franking account is in debit at 30 June, franking deficit tax (FDT) will apply under existing s 205-45 ITAA 1997. ©Tax Astute Pty Ltd (as Trustee for the Tax Astute Trust) 2015 Page | 2 SNAPSHOT This document and its associated content are provided for personal training purposes only and are subject to the Copyright & Disclaimer Statement on page 5. Two-Tier Company Tax Rate from 1 July 2015 (May 2015 Final Legislation) Proposed Two-Tiered Company Tax Rate from 2015/16 The likely practical effect of the new legislation is therefore that: all dividends can be franked up to a maximum 30% rate by any company; but any company (including an SBE company) will remain effectively restricted by their franking account balance when franking distributions, with SBE companies paying a lower amount of tax and therefore likely to generate a smaller amount of franking credits under existing s 205-15 ITAA 1997. It is noted that the legislation’s EM has provided no examples as to the franking of dividends by SBE companies. The following example is intentionally simplified and assumes that the only franking credit in the SBE company’s franking account arises from the $28,500 tax paid for the 2015/16 year. In this context, the example illustrates the likely effect of the new 28.5% company tax rate for an SBE company seeking to frank its $71,500 net profit (after tax at 28.5%) as follows: Under s 976-1 ITAA 1997 (which is effectively unchanged by the new legislation), the maximum net franked dividend which can be paid (based on only $28,500 available franking credits) will be $66,500 (as calculated at A). The remaining $5,000 in after-tax profits would presumably either be: o retained by the company and not distributed; or o distributed by the company as an unfranked dividend (resulting in no franking offset or franking credit to the recipient shareholder on this part of the distribution). If instead the SBE company (with only $28,500 franking credits available) fully franked a $71,500 dividend at a 30% maximum franking credit of $30,642, it would be subject to franking deficit tax (FDT)of $2,142 (i.e. $28,500 balance less $30,642 = $2,142 as shown at B). While FDT may be subject to a later FDT offset of $2,142 (under existing s 205-70) there are various FDT disadvantages for the company (apart from timing) such as: o the possibility that any FDT offset may be reduced by 30% under existing s 205-70 ITAA 1997; and o the requirement to lodge a franking account tax return and pay the $2,142 FDT, generally by 31 July 2016 (i.e. 1 month after the 2015/16 year end in this example) with penalties likely where this does not occur. From the shareholder’s perspective in this example (see C): o they would still receive franking credits/offset on the franked dividend received (e.g. the $66,500 shown at A); but o they would also potentially receive either an unfranked dividend or no distribution at all regarding the $5,000 shown at A). ©Tax Astute Pty Ltd (as Trustee for the Tax Astute Trust) 2015 Page | 3 SNAPSHOT This document and its associated content are provided for personal training purposes only and are subject to the Copyright & Disclaimer Statement on page 5. Two-Tier Company Tax Rate from 1 July 2015 (May 2015 Final Legislation) Proposed Two-Tiered Company Tax Rate from 2015/16 Proposed SBE Company Tax Rate Cut From 2015/16 Imputation/ Franking Effects $28,500 Credit Franking Account Balance $100K Taxable Income @ 28.5% tax rate A Current S 976-1 Franked Amount = $28,500 Available Franking Credit x Corporate Tax Gross-Up Rate (70%/30%) = $66,500 Net FRANKED Distribution (+ $28,500 Franking Credit) & Remaining $5,000 either retained or distributed UNFRANKED SBE COMPANY $71,500 after-tax profit available for dividends SHAREHOLDER Credits Franking Account (if C) T OR C Assessed @ MARGINAL TAX RATE (often > 28.5%) ON Grossed Up Franked Dividend P PLUS Any Unfranked Dividend LESS Franking Offset B OR... $71,500 Franked Dividend + $30,642 Maximum Franking Credit = Franking Deficit Tax $2,142 C NOTE C = Company P = Partnership T = Trust NOTE It is recognised that, in practice, the above SBE company may have additional franking credits (e.g. from prior year tax paid at 30% and/or other sources such as franked distributions from other companies). This may reduce or defer the above effect beyond the 2015/16 year (and may in some cases be a consideration when determining 2014/15 dividends). It is important to note, however, that that above effect appears likely at some point (albeit over time in some cases) if a SBE company continually pays tax and generates franking credits at a lower rate than the franking calculation rate under existing s 976-1 ITAA 1997 (i.e. 28.5% vs 30%). While no examples were provided in the Bill’s EM to illustrate the ongoing franking effect for SBE companies, the effect shown in the above example appears to be supported by: o the Bill’s failure to change how an SBE company generates franking credits and incurs franking debits (i.e. credits remain limited to the actual tax paid and the debit arising from a franked dividend payment is unchanged); and o the following comments (emphasis added) in the Bill’s EM (see ParlInfo - Tax Laws Amendment (Small Business Measures No. 1) Bill 2015): ‘Keeping the maximum amount of franking credits a small incorporated business can attach to its dividends in a year the same as large companies while the tax rate decreases means shareholders in dividend paying incorporated businesses would be better off. Shareholders could receive franking credits in excess of the tax rate applicable to these companies, providing there are enough franking credits in these companies’ accounts’ (recognising that companies may not fully distribute their taxable income in any year)’ (EM para 2.29); and ’Reduced tax payable by small businesses will allow them to retain more earnings for reinvestment.’ (EM para 2.27). ©Tax Astute Pty Ltd (as Trustee for the Tax Astute Trust) 2015 Page | 4 SNAPSHOT This document and its associated content are provided for personal training purposes only and are subject to the Copyright & Disclaimer Statement on page 5. Two-Tier Company Tax Rate from 1 July 2015 (May 2015 Final Legislation) Proposed Two-Tiered Company Tax Rate from 2015/16 Review the online recording of this summary through your choice of only 2 technical slides at this RECORDING LINK. WANT MORE DETAILS? In addition to details available at www.taxastute.com.au, Tax Astute clients receive more information and specific details, questions and answers underlying the brief snapshot summary above as a part of: their Tax Astute training session; their Tax Astute Federal Budget Guide; and their detailed Tax Astute Federal Budget multimedia recording. COPYRIGHT & DISCLAIMER STATEMENT ©Tax Astute Pty Ltd (as Trustee for the Tax Astute Trust) 2015 This training material snapshot summary is subject to copyright and may not be reproduced, reused or adapted in any manner, except in accordance with the Copyright Act 1968 (Cth) for bona fide study purposes, other than with the express written consent of Tax Astute Pty Ltd (as Trustee for the Tax Astute Trust). This material has been prepared with the objective of maximising accuracy and currency, but is provided for personal educational purposes only and must not be relied on as legal, financial or any other type of advice. Tax Astute Pty Ltd (as Trustee for the Tax Astute Trust) hereby excludes any and all liability arising, whether directly or indirectly, from the use of this training material snapshot summary and any information contained herein. ©Tax Astute Pty Ltd (as Trustee for the Tax Astute Trust) 2015 Page | 5