CPA Australia

advertisement

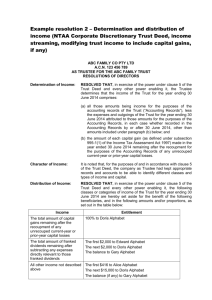

[Insert DD Month YYYY] [Insert Client Name] [Insert Client Position] [Insert Company Name] [Insert Company Address] [Suburb State Post Code] Dear [Insert Client Name] Re: Streaming and the taxation of trusts Recent years have seen significant developments in the taxation of trusts. Some of these developments are the result of legislative changes, while others are the result of developments in the Australian Taxation Office’s (ATO) interpretation of the law. We have highlighted some of the more significant issues below. Executive Summary We provide an explanation below of the following developments: 1. the streaming rules introduced by Tax Laws Amendment (2011 Measures No 5) Act 2011 2. TR 2012/D1, which explains the ATO’s initial view on trust income post Bamford 3. removal of the ATO’s previous administrative treatment regarding the timing of trustee resolutions 4. the trust income tax return form 5. Year end issues. Background – Bamford and the meaning of income Before turning to recent developments, it is helpful to briefly outline the relevant legislative provisions. Under Division 6 of the Income Tax Assessment Act 1936, beneficiaries of a trust are ordinarily liable for tax on the trust’s taxable income rather than the trustee1. Specifically, a beneficiary that is presently entitled to a share of the trust’s income will be subject to tax on that same share (i.e. proportion) of the trust’s taxable income. In Commissioner of Taxation v Bamford2 (“Bamford”) the High Court held that a trust’s ‘income’ was its income according to trust law 3. Under these trust law principles, any definition of ‘income’ contained in the trust deed will be relevant when determining the trust’s income. 1. Streaming issues In response to Bamford the ATO took the view that the proportionate approach adopted by the High Court would not permit the streaming of certain classes of income4. This view prompted legislative amendments contained in Tax Laws Amendment (2011 Measures No 5) Act 2011, which are designed to allow the streaming of capital gains and franked distributions 5. Key features of the new rules are explained below. 1 Provided that beneficiaries are presently entitled to all the income of the trust, all the taxable income of the trust will generally be assessed to the beneficiaries of the trust, with no amount falling for assessment in the trustee’s hands. 2 (2010) 240 CLR 481. 3 This will be its income calculated under general trust accounting concepts, as modified by any definitions in the trust deed. 4 Refer to Decision Impact Statement on Commissioner of Taxation v Phillip Bamford & Ors; Phillip Bamford & Anor v Commissioner of Taxation. 5 Note that the ATO considers the streaming of other types of income will not be effective. However, some practitioners dispute this view. A. Trust deed requirements There is doubt as to whether the streaming rules give a trustee power to stream capital gains or franking credits, where no such power exists in the trust deed. Consequently, taxpayers who wish to stream should review their trust deeds to ensure that streaming is permitted. Care should be taken to ensure that any changes to the Trust Deed do not give rise to a resettlement for stamp duty or tax purposes. Taxation Determination TD 2012/21 canvasses this issue. B. Specific entitlement to franked distributions or capital gains To effectively stream a capital gain or franked distributions the trustee must make a beneficiary ‘specifically entitled’ to a share of an amount equal to the net financial benefit referable to that capital gain or franked distribution. Under sections 115-228 and 207-58 of the Income Tax Assessment Act 1997, a beneficiary will be specifically entitled to an amount equal to a share of the net financial benefit where: they have received, or can reasonably expect to receive such an amount the amount is referrable to the capital gain/franked distribution (after applying any directly relevant losses or expenses) the amount is recorded, as referrable to the capital gain/franked distribution in the accounts or records of the trust no later than: o two months after the end of the income year for capital gains or o the end of the income year for franked distributions. C. Streamed capital gains and franked distributions excluded from trust income If the trustee makes a beneficiary specifically entitled to a capital gain or franked distribution that amount will be excluded from the income of the trust estate 6 and the trust’s net (taxable) income7 in working out the remaining beneficiaries’ share of the net income8. In other words, the trust is deemed to not have derived capital gains or franked dividend income for the purpose of working out a beneficiary’s assessable income under the normal tax rules for trusts. D. Streamed capital gains and franked distributions are taxed on a quantum basis The franked distribution and/or the capital gain will then be assessable to that specific beneficiary effectively on a quantum basis. E. Integrity measures There are also specific integrity measures that deal with the circumstances where a tax-exempt entity is entitled to some of the trust’s income. 2. TR 2012/D1: Income Tax: The meaning of ‘income of the trust estate” In April 2012, the ATO issued a draft ruling providing its initial views on the meaning of ‘trust income’ following Bamford’s case. Many aspects of the draft ruling have attracted criticism and controversy. However, while the draft ruling is yet to be finalised (and may not be finalised in its current form) it is the most comprehensive outline of the ATO’s views on trust income to date. Some of the key views outlined in the draft ruling are: notional amounts (e.g. franking credits) cannot form part of the trust’s income the trust’s income for a year will be capped at the ‘accretions’ to the trust (e.g. increases in the value of trust property) income which has been capitalised in prior years cannot be re-characterised as ‘income’ in the current income year. The trust estate’s income after excluding franked dividends and capital gains (to the extent they form part of the trust income) is known for the purpose of the Act as “the Division 6E income”. 7 The trust estate’s net income after excluding franked dividends and capital gains is known for the purpose of the Act as “the Division 6E net income”. 8 The Act will deem the income and the net income of the trust to be the Division 6E income for the purpose of applying Division 6 to assess the net income (excluding capital gains non-franked distributions) to beneficiaries. 6 When a trust deed defines trust income as net (taxable) income (i.e. income equalisation clauses), trustees must be very careful when making an analysis of the income of the trust. This is because net (taxable) income can often include notional amounts9 that, according to TR 2012/D1 cannot form part of the income of the trust. A common example of a notional amount is a franking credit which is included in assessable income (when a franked distribution is received). The ATO’s view in this regard is that franking credit is a tax fiction that cannot be considered to be an accretion to the trust and as such will not be taken into account when working out trust income. A trust with an income equalisation clause that does not exclude franking credits from its calculation of trust income will in almost all cases inflate its calculation of trust income. This can lead to the following problems: an unexpected allocations of taxable income between beneficiaries cause a wastage of franking credits give rise to a section 99A trustee assessment. Other examples of notional amounts that are included in net (taxable) income but may not be included in trust income are: 3. Division 7A deemed dividends liquidators deemed dividends trading stock revaluations (where the increase in value relates to a prior period) capital gains that have been inflated as a result of the market value substitution rule Assessable gains under the taxation of financial arrangement provisions Attributable amounts under the transferor trust provisions. Trustee resolutions In 2012, the ATO formally withdrew their administrative treatment that allowed trustees to make resolutions after 30 June (and still be effective for tax). Consequently the ATO now expects trustees to make the necessary resolution (e.g. to make beneficiaries presently entitled to income) by 30 June annually. As part of this administrative change the ATO undertook a project in regard to the 2012 year of income to review a sample of trust resolutions to ensure compliance with the 30 June deadline. The ATO are likely to review trustee resolutions as part of broader compliance activities. In this regard, trustees still need to review their deeds now to understand whether a resolution is needed and in what form this resolution should be made. For further information in relation to the 30 June deadline for trustee resolutions refer to the ATO factsheet at https://www.ato.gov.au/General/Trusts/In-detail/Trusttax-time-toolkit/Resolutions-checklist/ 4. Trust Tax Return Trustees are required to disclose the income of the trust at Item 53 of the 2015 Trust Tax Return Form and at item 54 the share of a beneficiaries’ income of the trust. Care must be taken when completing this disclosure so that it properly reflects the terms of the trust deed, and where relevant, takes into account the ATO’s views of the meaning of trust income per Draft taxation Ruling TR 2012/D1. 5. Year planning end issues Taxpayers wishing to stream capital gains and franked distributions should first review their trust deed to ensure it permits streaming. Broadly, if streaming is permitted, they must make a beneficiary specifically entitled to the capital gain/franked distribution within the required period (i.e. by year end for franked distributions and within two months of year end for capital gains). To ensure the amount is recorded, in its character as referrable to the capital gain/franked distribution in the accounts or records of the trust, taxpayers should pass trustee resolutions evidencing that the beneficiary is specifically entitled. These resolutions should reference the trust deed powers which allow streaming, and also specifically refer to the particular capital gain/franked distribution. 9 These notional amounts would otherwise increase or decrease the calculation of trust income In addition to the recording requirements for streaming, trustees that do not wish to rely on default clauses in their trust deeds (e.g. default beneficiary clauses) should review their deeds now and make and record the required resolutions by 30 June. We note that the practical application of these new rules can often be difficult, as such if you have further queries on any details contained within this letter or have any other tax planning issues, please contact me on [insert telephone number of partner]. Yours faithfully [Insert name of Partner]