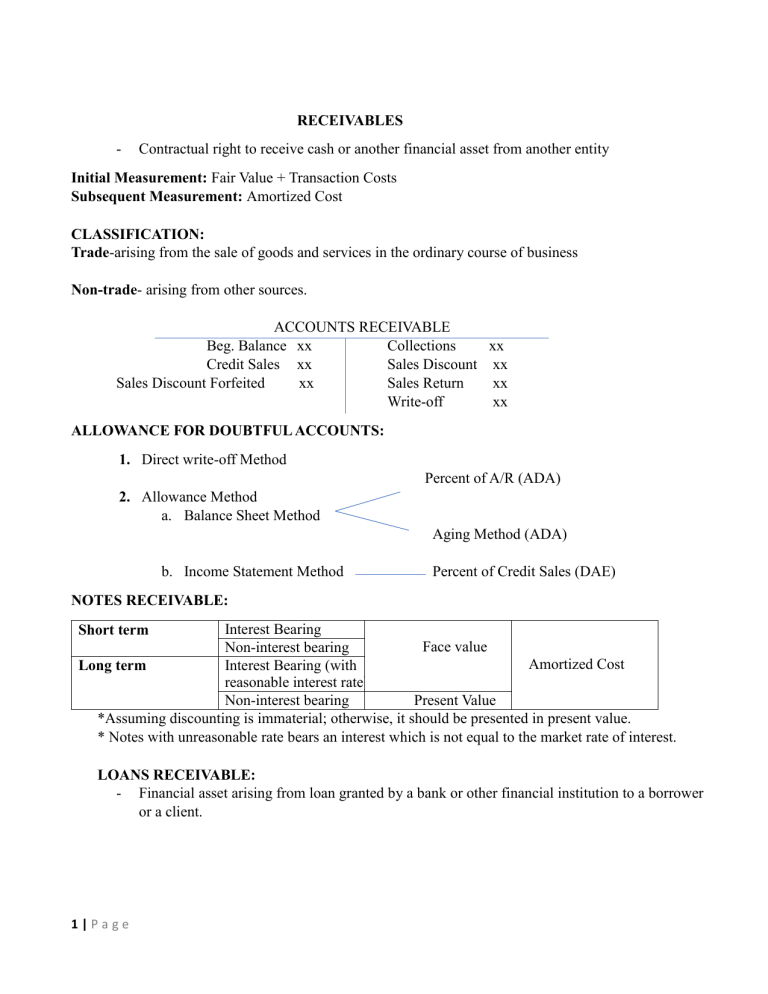

RECEIVABLES - Contractual right to receive cash or another financial asset from another entity Initial Measurement: Fair Value + Transaction Costs Subsequent Measurement: Amortized Cost CLASSIFICATION: Trade-arising from the sale of goods and services in the ordinary course of business Non-trade- arising from other sources. ACCOUNTS RECEIVABLE Beg. Balance xx Collections xx Credit Sales xx Sales Discount xx Sales Discount Forfeited xx Sales Return xx Write-off xx ALLOWANCE FOR DOUBTFUL ACCOUNTS: 1. Direct write-off Method Percent of A/R (ADA) 2. Allowance Method a. Balance Sheet Method Aging Method (ADA) b. Income Statement Method Percent of Credit Sales (DAE) NOTES RECEIVABLE: Interest Bearing Face value Non-interest bearing Amortized Cost Interest Bearing (with Long term reasonable interest rate) Non-interest bearing Present Value *Assuming discounting is immaterial; otherwise, it should be presented in present value. * Notes with unreasonable rate bears an interest which is not equal to the market rate of interest. Short term LOANS RECEIVABLE: - Financial asset arising from loan granted by a bank or other financial institution to a borrower or a client. 1|Page MEASUREMENT: Initial Measurement Face Value Add: Direct Origination Costs Less: Origination Fee Initial Carrying Value Subsequent Measurement: Amortized Cost xx xx (xx) xx Impairment of Loans: How to compute? Carrying amount of loan receivable PV of recoverable amount Impairment Loss xx xx xx RECEIVABLE FINANCING: Common forms of receivable financing Pledge/Hypothecation Assignment Factoring Discounting Formal? Transfer of rights? Transfer of ownership? AR serve as security Proceed from assignment: Face value of loan Less: Commission and other charges Net proceeds from assignment xx xx xx CA of AR Less: CA of loans payable Equity on assigned accounts xx xx xx Gain or loss from factoring: xx xx xx xx Selling Price Less: CA of AR Gain or loss on factoring Without Recourse Basis 2|Page Assignment √ √ x √ Specific Equity on assigned accounts: Proceed from factoring: Face value of AR Less: Commission and other charges Factor’s holdback Net proceeds from factoring Forms of Discounting: Pledge x x x √ General xx xx xx Conditional Sale TYPES OF NEGOTIATION With Recourse Basis Secured Borrowing Proceed from factoring: Maturity Value Less: Discount Net proceeds from discounting Gain or loss on discounting: xx xx xx Selling Price Less: CA of NR Gain or loss on discounting xx xx xx s NOTES: Notes Receivable discounted is presented as contra-asset account (deduction from notes receivable account) Gain or loss discounting is applicable only to without recourse basis and conditional sale basis. 3|Page