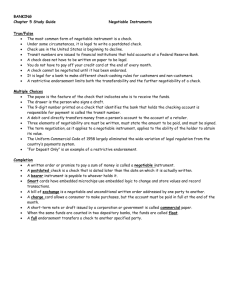

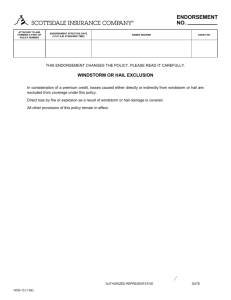

CHAPTER 13 Endorsement

advertisement

CHAPTER 13 Endorsement ¾ When the marker or holder of an negotiable instrument signs the same, otherwise than as such maker, for the purpose of negotiation, on the back or face thereof or on a slip of paper annexed thereto, or so signs for the same purpose a stamped paper intended to be completed as a negotiable instrument, he is said to indorse the same, and is called the endorser. ¾ Endorsement can be made by the holder of negotiable instrument or by the maker signing it. A payee or endorsee may endorse an instrument only if he is the holder. If a bill or note is made payable to the drawer’s or maker’s order, the drawer or maker should endorse it. A stranger can’t endorse bill but however he can be held liable as a surety, if he intends to guarantee payment. ¾ If back of the instrument is filled with endorsements, the holder to provide space for further endorsements may tag or past a piece of paper to is called as “allonge” Subsequent endorsements are made on the allonge. ¾ Act does not lay down any specific form for endorsement. The only requirement of endorsement is that transferor shall use appropriate writing on an instrument so as to transfer his right, title and interest therein to some person. An endorsement made by a stamp which is said to be a copy of the payee’s signature is valid if it has been placed with the approval of the payee. ¾ Endorsement is complete only by delivery. Delivery may be actual or constructive. Delivery may be by endorser or his agent. Delivery must be made with the intention of passing the property therein. Until delivery, contract of endorsement is incomplete. ¾ In case of blank endorsement, the endorser puts his signature on the back of the instrument without mentioning the name of any person in whose favour endorsement is made. The endorsement in such case is payable to bearer. It can be negotiated by mere delivery. ¾ Unlike general endorsement, in case of special endorsement name of the person to whom it is endorsed has also been written. The instrument is thus payable to specific person and not bearer. It can be negotiated by further endorsement and delivery. ¾ Conditional endorsement can be of following 4 types – • Sans Recourse – when endorser excludes his liability • Sans frais – when the endorser does not want the endorsee or any subsequent holder to incur any expenditure on his account on the instrument. • • Facultative – endorsee must give notice of dishonour of the instrument to the endorser, but later may waive his duty of endorsee. Contingent – making endorsee entitled to receive amount on happening or non-happening of an event ¾ In the absence of a contract to the contrary, whoever indorses and delivers a negotiable instrument before maturity without in such endorsement, expressly excluding or making conditional his own liability, is bound thereby to every subsequent holder, in case of dishonour by the drawee, acceptor or maker, to compensate such holder for any loss or damage caused to him by such dishonor, provided due notice of dishonour has been given to, or received by, such endorser as hereinafter provided. Every endorser after dishonour is liable as upon an instrument payable on demand. ¾ The endorsement of an instrument followed by a delivery transfers to the endorsee the property in the instrument with right of further negotiation. A holder of an instrument deriving title from a holder in due course has rights thereon of the holder in due course.