Commercial Paper - Villanova University

advertisement

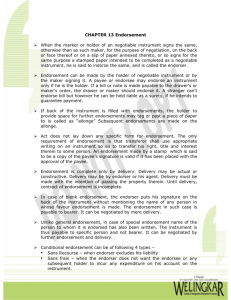

Commercial Paper The law of negotiable instruments UCC Article 3 Types of Negotiable Instruments • Promissory Note: A promise in writing to pay a sum of money. • Draft: An order addressed by one person to another, ordering the person to whom it is addressed to pay a sum of money to a third party Check – Drawee is a bank Parties • Note: Two party document – Maker – One who promises to pay – Payee - One to be paid • Draft Drawer – One giving the order to pay Drawee - One who is directed to pay Payee - One to be paid Negotiability • In writing • Signed • Payable at fixed or determinable time or on demand • Payable to order or bearer • Unconditional promise or order • To pay a sum certain • Payable in money Time for Payment • On demand: – If stated in Instrument – No time for payment is stated Acceleration clause is permitted Postdating does not affect negotiability Time for Payment • Determinable future time – “on or before a stated date” – Fixed period after date Payable to Order or Bearer • Exception : If a check meets all other requirements of negotiability it will remain negotiable even if the words “order of” or “bearer” are missing Unconditional • May make reference to another agreement • May limit payment to a particular fund or source. (Revised Article 3) Sum Certain (Fixed amount of Money) • Minimum amount to be paid to holder must be specified. • May call for the payment of interest Negotiation Order Paper Endorsement and Delivery Bearer Paper Delivery alone Imposter and Fictitious Payee Rules •Imposter Rule: Forged payee endorsement when maker/drawer has been induced by imposter to issue note/draft is effective for negotiation. Fictitious Payee Rule: A forged endorsement is effective for negotiation when maker/drawer has been induced by dishonest employee to issue note/draft. Types of Endorsements • Blank – Signature only – Names no endorsee Instrument becomes bearer paper Endorser guarantees payment Blank Indorsement Jane Doe Types of Endorsements • Special – Endorser specifically names the transferee to whom the instrument is payable. Only transferee can negotiate instrument further Instrument is order paper Payment guaranteed by endorser Special Indorsement Pay to the order of Bill Smith Jane Doe Types of Endorsements • Qualified – Blank endorsement – “Without Recourse added Endorser does not guarantee payment in event of default Warranty liability still applies Qualified Indorsement Without Recourse Without Warranty Jane Doe Types of Endorsements •Restrictive –Attempt to restrict further negotiation General Rule: Endorsement is Not effective / Once instrument is negotiable no endorsement can prevent further negotiation Exception: “For Deposit Only / “For Collection” Only bank can become holder Restrictive Indorsement For Deposit Only Jane Doe Holder in Due Course • Holder: Possession of Instrument with all necessary endorsements. • Holder in Due Course Must Take Instrument – In good faith – For value – Without notice of: • Overdue Defects Dishonor • Altered or unauthorized signatures Defenses Holder in Due Course • Holder in Due Course : • Takes instrument free of personal defenses • Subject to universal (real) defenses Personal Defenses • Ordinary contract defenses • Incapacity other than minority and adjudicated incompetents • Fraud in the inducement • Unauthorized completion • Theft, when instrument is bearer paper Real Defenses • • • • Fraud in the execution Forgery Material Alteration Incapacity of a minor or adjudicated incompetent • Illegality or Duress that renders instrument void • Bankruptcy Warranty Liability •Implied liability whenever instrument is negotiated for value Bearer Paper : Warranties extend only to immediate transferee Order paper : Endorser warrants to all subsequent holders Warranties • All signatures are genuine • Good title (transferor is entitled to enforce the instrument • Instrument has not been materially altered • Transferee has no knowledge of insolvency proceedings against any part to instrument • No defense of any party is good against transferee Shelter Rule • One who takes from a Holder in Due Course or traces possession back to a Holder in Due Course takes with the rights of a Holder in Due Course even if they do not qualify as a Holder in Due Course.