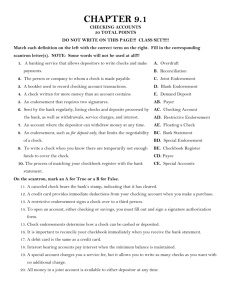

BANKING

advertisement

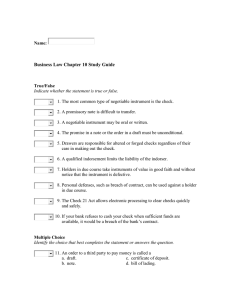

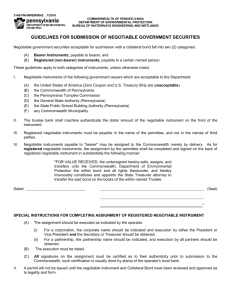

BANKING Chapter 5 Study Guide Negotiable Instruments True/False The most common form of negotiable instrument is a check. Under some circumstances, it is legal to write a postdated check. Check use in the United States is beginning to decline. Transit numbers are issued to financial institutions that hold accounts at a Federal Reserve Bank. A check does not have to be written on paper to be legal. You do not have to pay off your credit card at the end of every month. A check cannot be negotiated until it has been endorsed. It is legal for a bank to make different check-cashing rules for customers and non-customers. A restrictive endorsement limits both the transferability and the further negotiability of a check. Multiple Choices The payee is the feature of the check that indicates who is to receive the funds. The drawer is the person who signs a draft. The 9-digit number printed on a check that identifies the bank that holds the checking account is responsible for payment is called the transit number. A debit card directly transfers money from a person’s account to the account of a retailer. Three elements of negotiability are must be written, must state the amount to be paid, and must be signed. The term negotiation, as it applies to a negotiable instrument, applies to the ability of the holder to obtain its value. The Uniform Commercial Code of 1958 largely eliminated the wide variation of legal regulation from the country’s payments system. “For Deposit Only” is an example of a restrictive endorsement. Completion A written order or promise to pay a sum of money is called a negotiable instrument. A postdated check is a check that is dated later than the date on which it is actually written. A bearer instrument is payable to whoever holds it. Smart cards have embedded microchips use embedded logic to change and store values and record transactions. A bill of exchange is a negotiable and unconditional written order addressed by one party to another. A charge card allows a consumer to make purchases, but the account must be paid in full at the end of the month. A short-term note or draft issued by a corporation or government is called commercial paper. When the same funds are counted in two depository banks, the funds are called float. A full endorsement transfers a check to another specified party. Short Answer What three things are shown by a check’s identification numbers? Define the term elements of negotiability and list the six elements. What is a promissory note? Essay Name the four primary types of endorsement. Which is the most commonly used? What is a draft? When are they typically used? What is a float? What effect does float have on the money supply? What is EFT? (Name the acronym and define)