Methodology overview

FTSE Diversification Based Investing

Index Series

Objective

Features

The FTSE Diversification Based Investing Index Series,

launched in association with QS Investors, LLC, seeks

higher absolute and risk-adjusted returns compared to

cap-weighted indexes with less downside risk.

• Helps investors to avoid concentration

risk – or bubbles – in global and

international equity markets that tend to

build and collapse

Philosophy

Three key beliefs form the foundation of Diversification Based Investing (DBI):

1. G

eography and industry are the primary drivers of global/international

equity risk and return

2. M

arket sentiment can produce momentum effects that cause

concentration risk in equity indexes that tend to build and collapse

• Has historically outperformed market cap

weighted benchmark equivalents over

extended periods

• Has a transparent, intuitive and

straightforward index construction process

• Is highly diversified and easily

implementable with a high level of liquidity

3. A

diversified portfolio helps reduce concentration risk and downside risk

Supporting rationale

The DBI investment philosophy and process reflect the following

observations about the global equity markets:

Geography and industry drive risk and return: Where a company does

business and its type of business explains the majority of risk and return for

global equities over the past several decades.

Market sentiment leads to concentration risk: Broad equity indexes

are often considered highly diversified investments. And yet market

sentiment or, put another way, investors’ collective enthusiasms, can cause

concentrations in indexes that build up and subsequently collapse. For

example, in the 1980s, overly optimistic investors drove Japanese equity

prices up much faster than stock prices in the rest of the world. Japanese

stocks accounted for over 30% of Global Market Capitalization by weight

in 1989. The eventual peak led to a decline that continued over the next

decade. Similar “boom and bust” examples occurred in the late 1990s with

technology stocks and, more recently, with financial and cyclical stocks.

These concentrations resulted from repeated patterns of investor behavior.

The FTSE DBI Index Series is designed to avoid the concentration risk seen in

market cap-weighted indexes.

ftserussell.com

1

FTSE Russell

FTSE Diversification Based Investing Index Series

Index methodology

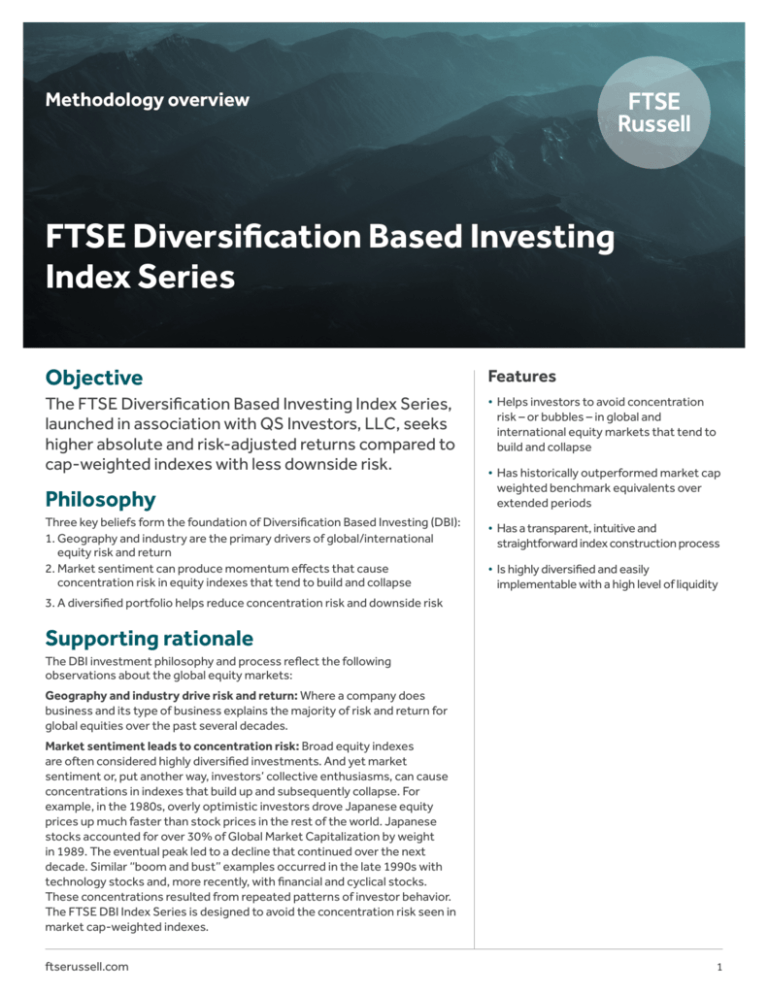

Underpinnings:

To achieve the goal of maximum diversification across countries and

industries, DBI groups stocks into risk themes or “clusters” according to their

correlations and then equal-weights the clusters. The result is a diversified

portfolio structured according to risk themes in the market based on

correlations rather than market cap weights. This is achieved through a four

step process:

Macro and Behavioral Inefficiency DBI

seeks to take advantage of macro and

behavioral inefficiencies in global and

international equity markets by developing

a diversified exposure to macro risk factors.

DBI uses analysis of country and industry

correlations to create an index that is highly

diversified across major risk exposures in

the market. It does not engage in stock

selection. Behavioral inefficiencies, such

as the inclination towards herding, can

arise when investors face uncertainty over

the likely impact of traditional drivers of

country and industry allocation decisions.

These drivers include:

Step 1:

Step 2:

Step 3:

Step 4:

Partition the

universe into key

risk exposures

Cluster highly

correlated risk

exposures

Weight for

optimal

diversification

Implement to

dynamically capture

market shifts

Methodology

Step 1: Partition the investment universe

The objective of this step is to identify stocks with common risk drivers. We

do this by dividing the investment universe from each relevant FTSE Index

by country and industry into “risk units.”

Step 2: Cluster highly correlated risk units

The objective of this step is to identify the key risk themes or drivers in

equity markets. We use correlation analysis to group highly correlated risk

units into “clusters” which represent risk themes or exposures in equity

markets. Risk Units are clustered such that the correlation of risk units

within clusters is high and the correlation between clusters is low, thereby

seeking a high level of diversification across risk themes.

Step 3: Weight for optimal diversification

The objective of this step is to develop a diversified exposure to key drivers

of risk in equity markets. Our approach is to equally weight all clusters

and then equally weight the risk units within each cluster. This allows us to

systematically give greater weight to good diversifiers and relatively less

weight to poor diversifiers.

Step 4: Implementation

The objective of this step is to capture structural changes in correlations

with low turnover. To do this, the risk clusters are updated annually to

ensure the portfolio reflects shifts in correlations among risk units, and the

indexes are rebalanced quarterly to maintain diversification. Turnover is

therefore minimized to keep transaction and market impact costs low.

Methodology overview

Monetary policy: The future level of interest

rates, potential and implemented asset

purchases as well as other actions by central

banks is uncertain as is their impact over the

near- and medium-term. Investors struggle

with these issues when evaluating the value

of different parts of the market and the

impact on economic growth as well as the

effectiveness of policy actions.

Fiscal policy: Similar to monetary policy,

fiscal stimulus or austerity is debated,

enacted and modified over the mediumterm

and subject to disagreement by policy

makers as well as investors. It takes years to

assess the impact of fiscal policy often with

uneven and contradictory economic data

that is released on an infrequent basis.

Regulatory policy: Legislative agendas

and reaction to market events can have

a large impact on perceived and actual

country competitiveness as well as

industry profitability and business strategy.

These changes are often debated over a

multi-year time frame and the impact of

legislation is uncertain.

Data definitions available from ftserussell.com.

2

FTSE Diversification Based Investing Index Series

FTSE Russell

For more information about our indexes, please visit ftserussell.com.

© 2015 London Stock Exchange Group companies.

London Stock Exchange Group companies includes FTSE International Limited (“FTSE”), Frank Russell Company (“Russell”),

MTS Next Limited (“MTS”), and FTSE TMX Global Debt Capital Markets Inc (“FTSE TMX”). All rights reserved.

“FTSE®”, “Russell®”, “MTS®”, “FTSE TMX®” and “FTSE Russell” and other service marks and trademarks related to the FTSE or

Russell indexes are trademarks of the London Stock Exchange Group companies and are used by FTSE, MTS, FTSE TMX and

Russell under licence.

All information is provided for information purposes only. Every effort is made to ensure that all information given in this

publication is accurate, but no responsibility or liability can be accepted by the London Stock Exchange Group companies nor

its licensors for any errors or for any loss from use of this publication.

Neither the London Stock Exchange Group companies nor any of their licensors make any claim, prediction, warranty or

representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the FTSE Russell

Indexes or the fitness or suitability of the Indexes for any particular purpose to which they might be put.

The London Stock Exchange Group companies do not provide investment advice and nothing in this document should be

taken as constituting financial or investment advice. The London Stock Exchange Group companies make no representation

regarding the advisability of investing in any asset. A decision to invest in any such asset should not be made in reliance on any

information herein. Indexes cannot be invested in directly. Inclusion of an asset in an index is not a recommendation to buy, sell

or hold that asset. The general information contained in this publication should not be acted upon without obtaining specific

legal, tax, and investment advice from a licensed professional.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means,

electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the London Stock Exchange

Group companies. Distribution of the London Stock Exchange Group companies’ index values and the use of their indexes to

create financial products require a licence with FTSE, FTSE TMX, MTS and/or Russell and/or its licensors.

The Industry Classification Benchmark (“ICB”) is owned by FTSE. FTSE does not accept any liability to any person for any loss

or damage arising out of any error or omission in the ICB.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns

shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect backtested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested

performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology

that was in effect when the index was officially launched. However, back-tested data may reflect the application of the index

methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based

on revisions to the underlying economic data used in the calculation of the index.

Methodology overview

3

FTSE Russell

FTSE Diversification Based Investing Index Series

About FTSE Russell

FTSE Russell is a leading global provider of benchmarking, analytics and data

solutions for investors, giving them a precise view of the market relevant to

their investment process. A comprehensive range of reliable and accurate

indexes provides investors worldwide with the tools they require to measure

and benchmark markets across asset classes, styles or strategies.

FTSE Russell index expertise and products are used extensively by

institutional and retail investors globally. For over 30 years, leading asset

owners, asset managers, ETF providers and investment banks have chosen

FTSE Russell indexes to benchmark their investment performance and create

ETFs, structured products and index-based derivatives.

FTSE Russell is focused on applying the highest industry standards in index

design and governance, employing transparent rules-based methodology

informed by independent committees of leading market participants. FTSE

Russell fully embraces the IOSCO Principles and its Statement of Compliance

has received independent assurance. Index innovation is driven by client

needs and customer partnerships, allowing FTSE Russell to continually

enhance the breadth, depth and reach of its offering.

FTSE Russell is wholly owned by London Stock Exchange Group.

For more information, visit www.ftserussell.com.

About QS Investors, LLC

QS Investors, LLC is an independent investment firm providing asset

management and advisory services to a diverse array of institutional clients.

QS Investors has focused over the last 10 years on pioneering approaches to

integrating quantitative and qualitative investment insights and dynamically

weighting key market drivers a cross a diverse spectrum of strategies

including global tactical asset allocation, global and US equities.

For more information please visit: www.qsinvestors.com.

To learn more, visit www.ftserussell.com; email index@russell.com, info@ftse.com;

or call your regional Client Service Team office:

EMEA

North America

Asia-Pacific

+44 (0) 20 7866 1810

+1 877 503 6437

Hong Kong +852 2164 3333

Tokyo +81 3 3581 2764

Sydney +61 (0) 2 8823 3521

Methodology overview

4