Global Absolute Return Strategies Fund

advertisement

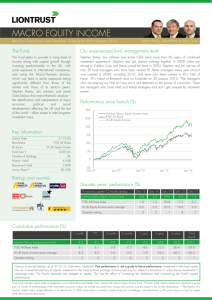

Jan 2016 Global Absolute Return Strategies Fund 31 January 2016 Unit Trust The Standard Life Investments Global Absolute Return Strategies Fund aims to provide positive investment returns in all market conditions over the medium to long term. The fund is actively managed, with a wide investment remit to target a level of return over rolling three-year periods equivalent to cash plus five percent a year, gross of fees. It exploits market inefficiencies through active allocation to a diverse range of market positions. The fund uses a combination of traditional assets (such as equities and bonds) and investment strategies based on advanced derivative techniques, resulting in a highly diversified portfolio. The fund can take long and short positions in markets, securities and groups of securities through derivative contracts. Absolute Return Fund Past performance is not a guide to future returns and future returns are not guaranteed. The price of assets and the income from them may go down as well as up and cannot be guaranteed; an investor may receive back less than their original investment. The fund will use derivatives extensively to reduce risk or cost, or to generate additional capital or income at low risk, or to meet its investment objective. Usage of derivatives is monitored to ensure that the fund is not exposed to excessive or unintended risks. The value of assets held within the fund may rise and fall as a result of exchange rate fluctuations. Fund Manager Fund Manager Start Launch Date Current Fund Size Base Currency IA Sector Multi Asset Investing Team 29 Jan 2008 29 Jan 2008 £26540.0m GBP Targeted Absolute Return Benchmark Monthly 6 Month GBP LIBOR This document is intended for use by individuals who are familiar with investment terminology. Please contact your financial adviser if you need an explanation of the terms used. Please note that the Portfolio Risk and Return Analysis table is only updated on a quarterly basis. For a full explanation of specific risks and the overall risk profile of this fund and the shareclasses within it, please refer to the Key Investor Information Documents and Prospectus which are available on our website – www.standardlifeinvestments.com Fund Information * Quarterly Portfolio Risk and Return Analysis Strategy Market Returns European equity Strategies Japanese equity High yield credit US investment grade credit UK equity EU corporate bonds UK corporate bonds Pacific Basin ex Japanese equity US equity Chinese equity Global equity miners Directional Short US duration Strategies Long MXN v AUD Long GBP v CHF Long USD v EUR Long INR v EUR Australian forward-start interest rates Mexican rates v EUR Australian duration Long USD v KRW Long USD v SGD Long European payer swaptions Stand-alone Risk Exposure % 1.2 0.6 0.3 0.3 0.2 0.1 0.1 0.1 0.0 Closed Closed 1.1 0.7 0.7 0.6 0.6 0.5 0.5 0.4 0.4 0.4 0.1 Weighting (risk based %) Contribution to Returns % Q4 8.3 5.2 5.2 4.7 4.6 3.8 3.5 3.5 2.9 2.8 0.8 0.6 0.3 0.1 0.0 0.1 0.0 0.0 0.0 0.0 0.0 0.1 0.1 -0.4 0.0 0.2 0.2 -0.1 0.1 0.0 -0.1 -0.1 0.0 1 Yr 0.8 -0.1 0.0 0.0 0.1 0.0 0.0 0.0 0.0 0.0 -1.0 -0.3 -0.3 -0.1 1.1 0.5 0.3 0.0 0.0 0.2 0.0 -0.1 9.1 4.7 2.0 2.0 1.8 0.8 0.8 0.6 0.1 Relative Value Strategies US equity tech v small cap US butterfly US and Europe v UK duration US equity banks v consumer staples US equity large cap v small cap European equity banks v insurers European v UK duration HSCEI v FTSE variance Asian v S&P variance EuroStoxx50 v S&P variance 1.0 0.8 0.7 0.4 0.3 0.3 0.1 0.1 0.1 0.0 7.4 6.1 5.2 3.0 2.6 2.1 0.8 0.8 0.7 0.1 0.8 0.2 0.1 0.0 0.2 -0.5 0.0 -0.2 0.0 0.0 1.2 0.0 0.1 -0.2 0.2 -0.7 -0.4 0.0 0.0 0.0 FX Hedging FX hedging 0.1 0.7 0.0 -0.3 Cash Cash Residual Stock selection Total Diversification Expected Volatility 0.0 3.3 0.1 0.0 0.0 1.9 0.2 0.0 0.5 0.0 0.4 12.9 8.8 4.2 Should you require more information regarding the Physical Allocation please use contact numbers shown. Individual strategy contributions are based on gross returns. Fund Performance * Price Indexed 135 The performance of the fund has been calculated over the stated period using bid to bid basis for a UK basic rate tax payer. The performance shown is based on an Annual Management Charge (AMC) of 0.75%. You may be investing in another shareclass with a higher AMC. The charges for different share classes are shown later. For details of your actual charges please contact your financial adviser or refer to the product documentation. 130 125 120 115 110 Source: Standard Life Investments (Fund) and Thomson Datastream (Benchmark) 105 100 Global Absolute Return Strategies Jan-16 Jul-15 Jan-15 Jul-14 Jan-14 Jul-13 Jan-13 Jul-12 Jan-12 Jul-11 Jan-11 95 6 Month GBP LIBOR Year on Year Performance Source: Standard Life Investments (Fund) and Thomson Datastream (Benchmark) Year to 31/12/2015 (%) Year to 31/12/2014 (%) Year to 31/12/2013 (%) Year to 31/12/2012 (%) Year to 31/12/2011 (%) Retail Fund Performance 2.2 4.8 6.2 6.9 2.1 Institutional Fund Performance 2.8 5.5 6.8 7.6 2.8 Platform One 2.8 5.5 6.8 n/a n/a 6 Month GBP LIBOR 0.7 0.7 0.6 1.1 1.2 Cumulative Performance Source: Standard Life Investments (Fund) and Thomson Datastream (Benchmark) 6 Months (%) 1 Year (%) 3 Years (%) 5 Years (%) Retail Fund Performance -3.5 -2.0 10.0 22.1 Institutional Fund Performance -3.2 -1.4 12.1 25.9 Platform One -3.2 -1.4 12.1 n/a 0.4 0.7 2.0 4.3 6 Month GBP LIBOR Note: Past Performance is not a guide to future performance. The price of shares and the income from them may go down as well as up and cannot be guaranteed; an investor may receive back less than their original investment. For full details of the fund's objective, policy, investment and borrowing powers and details of the risks investors need to be aware of, please refer to the prospectus. For a full description of those eligible to invest in each share class please refer to the relevant prospectus. Monthly Investment Review and Outlook Market review Concerns about Chinese economic growth, tumbling commodity prices and the possibility of rising stress in credit markets continued to dent sentiment. In a month of volatile trading, global equities ended steeply lower as investors sought safe havens. In Europe, the mood was further soured by disappointing economic data. US equities also slumped, posting their worst losses since August 2015. China led the drop in Asian markets, compelling the Chinese authorities to extend the share-sale restrictions placed on major shareholders. Along with other risk assets, corporate bonds fell. The decline was intensified by mounting worries that persistent weakness in commodity prices would likely exacerbate the pressure on credit markets. By contrast, those assets and currencies perceived as more defensive performed well, benefiting from waning investor risk appetite and the turbulence disrupting stock and commodity markets. In addition, Japan’s surprising decision to implement negative interest rates helped support core sovereign bonds including US Treasuries, UK gilts and Australian government bonds. Economic newsflow from the US was mixed: robust labour market data was offset by poor retail sales and industrial production numbers. In Europe, new figures showed a largerthan-expected decline in economic confidence, which in January reached its lowest level in five months. Meanwhile, citing global macroeconomic uncertainty, Bank of England governor Mark Carney gave a cautious appraisal of the UK economy. Expectations of an interest rate rise moved out as a consequence. Activity We closed our European equity banks versus insurers strategy. We believe the challenging earnings and capital outlook confronting banks will persist for longer than we previously thought. Regulatory pressures are constraining return-on-equity, while negative deposit rates have depressed bank revenues. Meanwhile, although low European interest rates are a negative driver for the capital position of European life insurance companies, we no longer believe this is a significant enough impediment to cause these stocks to underperform. Continued earnings and dividend growth, absent from many other sectors, will likely continue to support the insurers. We closed our long British sterling versus Swiss franc strategy. In our view, sterling’s upside potential now appears more limited than we had previously thought. Specifically, the likelihood of an EU referendum taking place in 2016 has increased, creating uncertainty. Additionally, the lack of strong economic data will force the Bank of England to push back monetary tightening. These factors are likely to negatively impact the upside potential of the currency. Finally, in light of other changes to the portfolio, we changed the short leg of our long Indian Rupee versus euro currency pair. Instead, we prefer to express our negative currency view through the Swiss franc. Switzerland is struggling to prevent the economy from slipping into deflation since it moved away from a linked exchange rate in January 2015. By contrast, India’s macroeconomic fundamentals are stable if not modestly improving. The rupee remains fairly valued and attractive from a cost of carry perspective. Performance The Global Absolute Return Strategies Fund returned -2.15% (net of retail fees) during the month, compared to the benchmark 6-month LIBOR return of 0.06% (gross of fees). Amid the rout in global equity markets, our European and Japanese equity exposures detracted from performance. In the US, small-caps bore the brunt of the selling, benefiting both our US equity large-cap versus small-cap and US equity technology versus small-cap positions. These strategies generally offer protection during equity market downturns, as small-cap stocks tend to suffer most during such periods. However, our US equity banks versus consumer staples position posted a loss as the banks sector exhibited more sensitivity to the fall in global equities. Heavy selling across credit markets hurt our US investment grade credit strategy. Elsewhere, the rally in US Treasuries hurt our short US duration strategy. However, the strong performance of Australian government bonds worked to the advantage of our Australian forward-start interest rates strategy. Our Mexican rates versus euro position dragged on returns. The euro strengthened, helped by increased demand from investors in pursuit of safer assets and new data indicating a slowdown in the Eurozone’s unemployment rate. The Korean won weakened after new figures showed the economy had slowed. In addition to heavy selling of local shares by foreigners, the central bank revised down its 2016 growth forecast on concerns over the state of China’s economy, further undermining the currency. This was favourable for our long US dollar versus Korean won pair. Outlook Our central expectation is still for modest global growth, albeit with regional variations. A growing divergence in central bank monetary policy will remain an important driver of asset returns. The US has finally embarked on monetary tightening, whereas economies in Europe and Asia maintain a looser monetary path. Geopolitical tensions remain high and on many metrics asset prices appear expensive. We seek to exploit the opportunities that these conditions present by implementing a diversified range of strategies using multiple asset classes. Other Fund Information Retail Acc 65111167 SLIGARA LN GB00B28S0093 B28S009 Retail Inc n/a n/a n/a n/a Lipper Bloomberg ISIN SEDOL Platform One Acc 68165478 U222GAR LN GB00B7K3T226 B7K3T22 Platform One Inc n/a n/a n/a n/a Reporting Dates XD Dates Payment Dates (Income) Interim 30 Sep n/a n/a Initial Charge AMC Ongoing Charges Figure Retail 4.00% 1.50% 1.59% Lipper Bloomberg ISIN SEDOL Fund Launch Date Institutional Acc 65111168 SLIGARS LN GB00B28S0218 B28S021 Institutional Inc n/a n/a n/a n/a Annual 31 Mar 31 Mar 31 Jul Valuation Point Type of Share ISA Option 7:30 am Accumulation Yes Institutional 0.00% 0.75% 0.84% Platform One 0.00% 0.75% 0.89% The Ongoing Charge Figure (OCF) is the overall cost shown as a percentage of the value of the assets of the Fund. It is made up of the Annual Management Charge (AMC) shown above and the other expenses taken from the Fund over the last annual reporting period. It does not include any initial charges or the cost of buying and selling stocks for the Fund. The OCF can help you compare the costs and expenses of different funds. *Any data contained herein which is attributed to a third party ("Third Party Data") is the property of (a) third party supplier(s) (the “Owner”) and is licensed for use by Standard Life**. Third Party Data may not be copied or distributed. Third Party Data is provided “as is” and is not warranted to be accurate, complete or timely. To the extent permitted by applicable law, none of the Owner, Standard Life** or any other third party (including any third party involved in providing and/or compiling Third Party Data) shall have any liability for Third Party Data or for any use made of Third Party Data. Past performance is no guarantee of future results. Neither the Owner nor any other third party sponsors, endorses or promotes the fund or product to which Third Party Data relates. **Standard Life means the relevant member of the Standard Life group, being Standard Life plc together with its subsidiaries, subsidiary undertakings and associated companies (whether direct or indirect) from time to time. “FTSE®”, "FT-SE®", "Footsie®", [“FTSE4Good®” and “techMARK] are trade marks jointly owned by the London Stock Exchange Plc and The Financial Times Limited and are used by FTSE International Limited (“FTSE”) under licence. [“All-World®”, “All- Share®” and “All-Small®” are trade marks of FTSE.] The Fund is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited (“FTSE”), by the London Stock Exchange Plc (the “Exchange”), Euronext N.V. (“Euronext”), The Financial Times Limited (“FT”), European Public Real Estate Association (“EPRA”) or the National Association of Real Estate Investment Trusts (“NAREIT”) (together the “Licensor Parties”) and none of the Licensor Parties make any warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the FTSE EPRA NAREIT Developed Index (the “Index”) and/or the figure at which the said Index stands at any particular time on any particular day or otherwise. The Index is compiled and calculated by FTSE. However, none of the Licensor Parties shall be liable (whether in negligence or otherwise) to any person for any error in the Index and none of the Licensor Parties shall be under any obligation to advise any person of any error therein. “FTSE®” is a trade mark of the Exchange and the FT, “NAREIT®” is a trade mark of the National Association of Real Estate Investment Trusts and “EPRA®” is a trade mark of EPRA and all are used by FTSE under licence.” Useful numbers Investor Services 0345 113 69 66. Market and Fund Specific Information www.standardlifeinvestments.co.uk Standard Life Investments Limited is registered in Scotland (SC123321) at 1 George Street, Edinburgh EH2 2LL. Standard Life Investments Limited is authorised and regulated by the Financial Conduct Authority. Calls may be monitored and/or recorded to protect both you and us and help with our training. www.standardlifeinvestments.com © 2016 Standard Life 0345 60 60 062. Call charges will vary. 201602171021 INVRT661 0116 U222